In Australia, retirement planning is witnessing a shift towards Self-Managed Super Funds (SMSFs). These funds have become popular, offering individuals greater control over their retirement savings and investment choices. Unlike traditional superannuation funds, SMSFs allow for a personalized approach to retirement planning, enabling trustees to tailor their investment strategies to their specific financial goals and risk appetites.

However, managing an SMSF involves complexities regarding investment decisions and compliance regulations. This is where Diversiview integrates technology and fintech innovations to streamline SMSF management. Diversiview offers a comprehensive solution for trustees, simplifying portfolio management, compliance monitoring, and investment strategy optimisation. As more Australians gravitate towards SMSFs for their retirement planning, Diversiview is an excellent tool that empowers SMSF trustees to navigate the intricacies of SMSF management confidently and efficiently.

What is a Self-Managed Super Fund?

A Self-Managed Super Fund (SMSF) is a private superannuation fund, regulated by the Australian Taxation Office (ATO), that you may manage yourself as a trustee. Unlike public super funds, where investment decisions are made by a committee on behalf of members, an SMSF often gives trustees (often also the SMSF members) the autonomy to tailor investment strategy to suit their individual retirement goals and financial circumstances.

Essentially, an SMSF is a legal tax structure with the sole purpose of providing for your retirement. Members of an SMSF are typically also its trustees, meaning they hold the legal responsibility for the fund’s compliance with superannuation and tax laws. This setup allows for greater control over your retirement savings, enabling you to invest in a broader range of assets, including direct property, shares, and fixed-income products.

The appeal of SMSFs in personal finance lies in this personalised control and flexibility. It empowers individuals to manage their retirement savings actively, aligning their investment choices with long-term financial planning goals. For many, an SMSF offers a pathway to a more engaged and hands-on approach to building their retirement nest egg.

The Importance of SMSF Compliance

Compliance is essential in managing Self-Managed Super Funds (SMSFs) to ensure the fund’s legitimacy and effectiveness in serving its retirement purpose. SMSFs in Australia are subject to stringent regulatory requirements from the ATO. These include the fund’s sole purpose test, investment restrictions, regular auditing, accurate record-keeping, and timely reporting. The sole purpose test ensures that the fund is maintained to provide members with retirement benefits.

However, navigating the complexities of SMSF compliance can be challenging. The constantly evolving superannuation laws require trustees to stay updated to avoid penalties and ensure the fund remains compliant. This task can be complex, especially for those without extensive financial or legal expertise. Technology and fintech solutions have emerged as companions in this aspect.

Technology and fintech solutions have emerged as companions in this aspect, providing real-time insights and updates on regulatory changes, helping trustees make informed decisions and maintain compliance. Additionally, tech-driven solutions can automate many of the fund’s administrative processes, reducing the likelihood of errors and non-compliance.

Investment Strategies for SMSFs

The flexibility in investment choices is one of the key attractions of Self-Managed Super Funds (SMSFs). This freedom allows trustees to employ investment strategies that align with their retirement objectives, risk tolerance, and financial goals. Common investment choices include common shares, property, fixed income, cash, and even alternative assets like artwork or cryptocurrencies. However, the choice of investments must always comply with the legal requirements and the fund’s stated investment strategy.

An essential principle in SMSF investment is diversification. Diversification involves spreading investments across different asset classes to reduce risk. It’s important because it helps mitigate the impact of poor performance in any single asset or market on the overall fund balance. A well-diversified SMSF might include a mix of local and international shares, property, bonds, and cash, tailored to the trustees’ long-term investment horizon and risk appetite.

Risk management is another important aspect. SMSF trustees must continually assess and manage the risks associated with their investment choices. This includes understanding market trends, economic factors, and how these influence different asset classes. Regular reviews and adjustments to the fund’s investment strategy are needed to ensure it remains aligned with the members’ changing needs and market conditions.

Utilising Diversiview for Portfolio Management in SMSFs

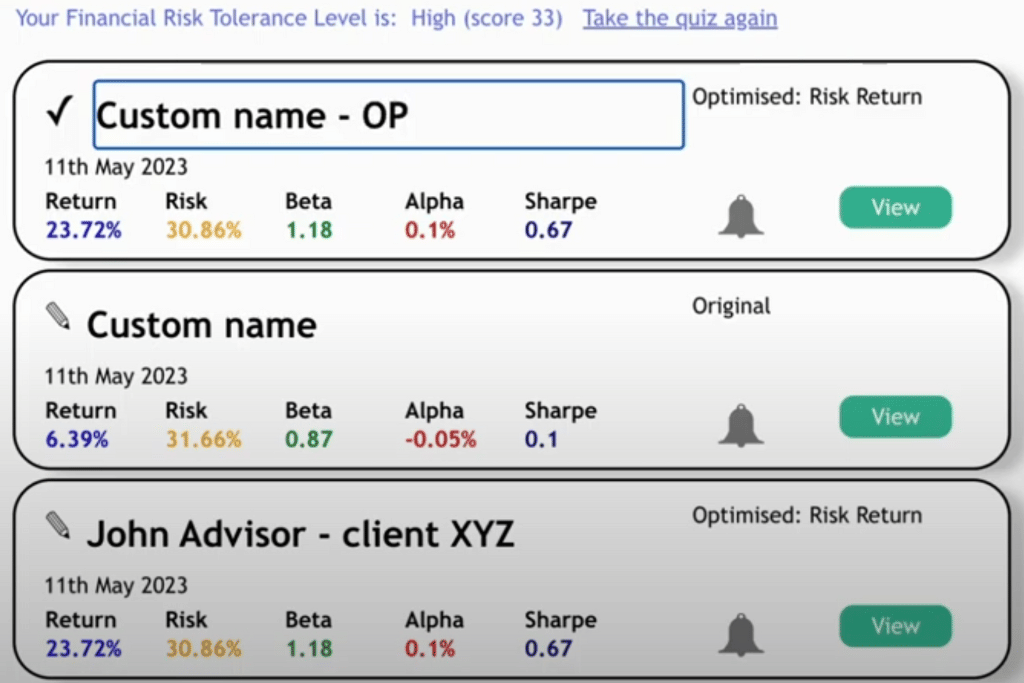

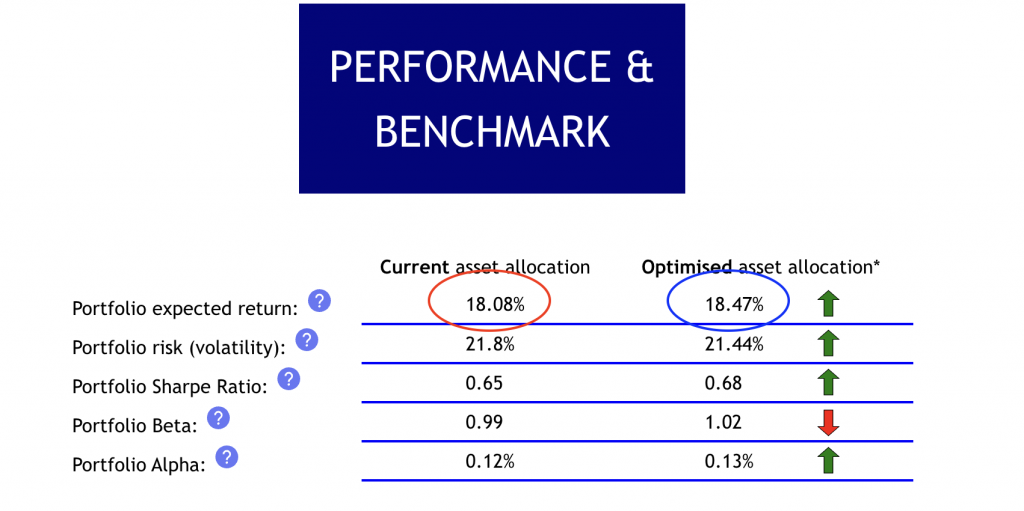

Diversiview is a great tool in Self-Managed Super Funds (SMSFs), particularly in portfolio management, and wealth building. This fintech platform blends advanced analytics with user-friendly interfaces to assist SMSF trustees in making informed investment decisions and maintaining regulatory adherence.

Diversiview offers a comprehensive suite of tools for investment selection that analyses various asset classes, providing insights into their performance, risks, and potential returns. This feature is needed for SMSFs, allowing trustees to make educated decisions based on data-driven analytics rather than speculation. The platform’s ability to crunch large datasets helps identify investment opportunities that align with the fund’s specific objectives and risk tolerance.

In terms of diversification, Diversiview can help as well. The platform’s algorithms can assess an SMSF’s current asset allocation and calculate adjustments to ensure a well-balanced and diversified portfolio. This function is key to risk management, as it helps spread investments across different asset classes to mitigate potential losses and stabilise returns.

Tax Planning and SMSFs

Effective tax planning is connected to successfully managing a Self-Managed Super Fund (SMSF), which is fundamental in maximising financial efficiency. SMSFs offer certain tax advantages, such as a concessional tax rate on investment earnings and the potential for tax-free pensions in retirement. Navigating these tax benefits while ensuring compliance with Australia’s tax laws requires careful planning and understanding of investment decisions’ tax implications.

Technological advancements have significantly streamlined the tax management process in SMSFs. Many fintech platforms utilise advanced software to help trustees track the tax impact of their investment choices, calculate potential tax liabilities, and plan for tax-effective investment strategies. This simplifies the complex task of tax planning and ensures that SMSF trustees can make decisions that optimise their fund’s tax position. Integrating technology in managing the tax aspects of SMSFs thus enhances the overall efficiency and effectiveness of the fund’s financial planning and management.

Conclusion

Diversiview is an excellent tool in the landscape of SMSFs, offering a blend of technological innovation and financial expertise. Its portfolio management capabilities make it an invaluable asset for SMSF trustees aiming to maximise their retirement savings. By leveraging the fintech solutions provided by Diversiview, SMSF management becomes more efficient and more aligned with strategic financial planning goals. For individuals navigating the complexities of SMSFs, Diversiview offers the necessary tools to ensure that their retirement journey is compliant and prosperous.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.