In investing, venturing into high-risk, high-reward opportunities can be a good strategy, but it also has downsides to consider. High-risk investments, characterised by their significant volatility and potential for substantial returns, appeal to investors seeking to amplify their earnings with a readiness to face more downside. While the draw of substantial gains is undeniable, there is a demand for astute risk management and strategic foresight to balance the downside possibilities.

This is where Diversiview steps in, serving as a tool for investors on this high-stakes journey. By offering advanced analytics and tailored risk assessment capabilities, Diversiview helps investors to make informed decisions, allowing them to balance the scales between risk and potential rewards.

Understanding High-Risk Investments

High-risk investments are financial assets that carry a greater probability of loss coupled with the possibility of higher returns compared to average market investments. These assets typically exhibit high volatility – significant and rapid fluctuations in value over short periods. This volatility comes from various factors, including market speculation, economic uncertainties, or the evolving nature of the underlying asset.

Characteristically, high-risk assets are often found in markets or sectors that are either emerging or experiencing rapid changes, such as technology startups, cryptocurrency, or speculative stocks. These investments can promise high potential returns, significantly outperforming standard market indices when they perform well. This potential is often due to the asset’s capacity for exponential growth, tapping into new or rapidly expanding markets and technologies.

However, the elevated risk is the flip side of this high reward potential. The value of high-risk investments can plummet just as quickly as it can soar, making them suitable primarily for investors with a high-risk tolerance and a well-considered strategy for dealing with market volatility. Understanding the nature of these assets – balancing their potential for high returns against the inherent risks – is important for anyone considering adding high-risk investments to their portfolio.

Pros of High-Risk Investments

High-risk investments can offer significant rewards, making them an attractive proposition for certain investors. One of the primary advantages is the potential for significant returns. These investments often involve emerging technologies, innovative business models, or new markets, where growth can far exceed more established sectors. For instance, early investments in tech startups or breakthrough industries have historically yielded substantial returns for investors who entered these markets at their early stages.

Another key advantage is their role in long-term wealth building. For investors with a long investment horizon and a higher risk tolerance, allocating a portion of their portfolio to high-risk investments can substantially increase overall portfolio growth. Over time, even a small allocation to these high-growth assets can make a notable difference in the total value of an investment portfolio.

These investments can also hedge against inflation, particularly when traditional investments offer lower returns. High-risk assets often have the potential to outpace inflation significantly, preserving the purchasing power of an investor’s capital.

Cons of High-Risk Investments

While high-risk investments can offer enticing returns, they come with significant drawbacks, chief among them being increased volatility. These assets are prone to rapid and unpredictable price fluctuations, making them a rollercoaster ride for investors. Such volatility can lead to substantial gains, but equally, it poses a high risk of severe losses, especially in the short term. This unpredictability demands a strong stomach and a readiness to face potential steep declines in asset value.

Another challenge with high-risk investments is the difficulty in predicting market conditions. A wide array of unpredictable factors, including technological advancements, regulatory changes, and consumer behavior shifts, often influence these assets. For instance, emerging industries or new tech stocks fluctuate wildly based on market sentiment, news, and speculation, making them hard to predict and manage.

Managing riskier assets requires financial knowledge and a deep understanding of the specific markets and the factors driving them. It involves continuous monitoring and a readiness to respond quickly to market changes. The complexity of these investments might be overwhelming for some investors, particularly those who lack the time or expertise to manage their portfolios actively.

Table: Pros and Cons of High-Risk Investments

| Pros of High-Risk Investments | Cons of High-Risk Investments |

|---|---|

| High Potential Returns: High-risk investments often offer the potential for significant returns, especially in emerging technologies or markets. | Increased Volatility: These investments are prone to rapid and unpredictable price fluctuations, leading to a higher risk of loss. |

| Long-term Wealth Building: For investors with a long-term horizon, high-risk investments can substantially increase the overall growth of a portfolio. | Predicting Market Conditions: The unpredictability of factors influencing high-risk assets makes market predictions challenging. |

| Inflation Hedge: High-risk assets can outpace inflation, preserving the purchasing power of capital. | Managing Riskier Assets: Requires continuous monitoring and a deep understanding of market dynamics, which can be complex and time-consuming. |

Balancing Risk and Reward: Strategies for Diversification

Diversification is a fundamental strategy for investors dealing with high-risk portfolios, crucial for balancing risk and potential reward scales. By spreading investments across various asset classes, geographical regions, and industry sectors, investors can mitigate the risks inherent in high-risk investments while capitalising on their potential for high returns.

One effective technique for diversification in high-risk portfolios is including a mix of asset types. This means combining riskier investments like emerging market stocks, high-yield bonds, or innovative tech startups with more stable assets like blue-chip stocks, government bonds, or index funds. This blend allows the stability of lower-risk investments to buffer against the volatility of high-risk assets.

Another strategy is sector and geographic diversification. Investing across sectors (such as technology, healthcare, and energy) and geographies (like emerging markets versus developed economies) reduces the impact of sector-specific or region-specific downturns. For instance, while tech stocks may be experiencing high volatility and returns, other sectors like utilities or consumer staples might be more stable, thus balancing the overall risk in the portfolio.

It’s also essential to periodically reassess and rebalance the portfolio. As market conditions fluctuate, rebalancing helps maintain the desired risk-reward balance by returning the portfolio to its target allocation. This may involve selling some high-performing assets and buying more of the underperforming ones to keep the portfolio in line with the investor’s risk tolerance and investment goals.

Using Diversiview to Manage High-Risk Portfolios

The key to success in high-risk investments lies in monitoring riskier investments and timely adjustments. Diversiview, a sophisticated fintech tool, assists investors in navigating these challenges. Its platform is designed to provide a comprehensive overview of an investor’s portfolio, focusing on high-risk assets and enabling users to make informed decisions based on real-time data and advanced analytics.

Diversiview’s strength lies in its ability to analyse market conditions and riskier investments’ performance continuously. Its algorithms can detect shifts in market trends, alerting investors to potential risks and opportunities. This feature is important for high-risk portfolios, where the impact of market volatility can be more pronounced, and rapid response is often necessary.

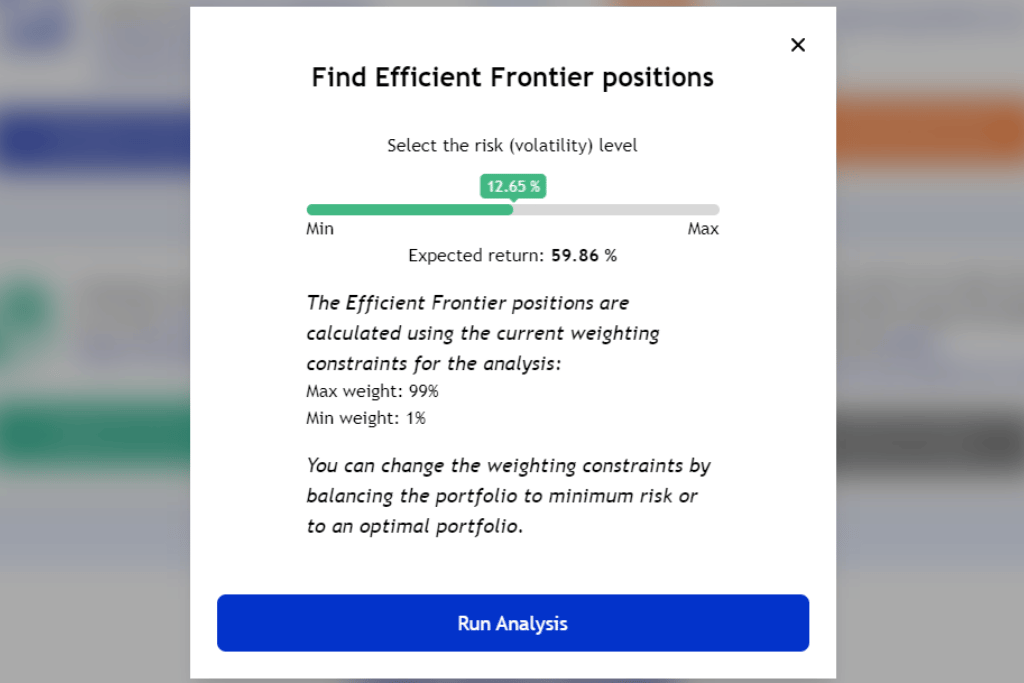

Furthermore, Diversiview offers robust risk management tools. It allows investors to set specific risk thresholds for their portfolios and receive alerts if these thresholds are breached using the “Efficient Frontier” positions. This proactive approach to risk management enables users to adjust their investment strategies before minor market fluctuations turn into significant losses.

Additionally, Diversiview provides scenario analysis features, allowing investors to forecast how their high-risk investments might perform under different market conditions. This foresight can help plan strategic responses to market uncertainties, ensuring that investors are prepared for market changes, not just reacting to them. In essence, Diversiview equips investors with the tools necessary to manage high-risk portfolios effectively, balancing the pursuit of high returns with the imperative of risk control.

Conclusion: Making Informed Decisions with Diversiview

Understanding and effectively managing high-risk investments is needed for those seeking to maximise returns without falling prey to heightened volatility. With its advanced analytical capabilities and real-time market insights, Diversiview emerges as an essential tool. It empowers investors to navigate the complexities of high-risk portfolios with greater confidence and control. By leveraging Diversiview’s comprehensive risk management and investment monitoring features, investors can make more informed decisions, ensuring that their high-risk investment strategies are bold and based on sound financial principles.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.