As we enter 2024, the investment scene presents many evolving trends and opportunities. The year promises a transformative shift in how investors approach the market, with several key sectors emerging as areas for potential growth. This is a response to technological advancements, global economic shifts, and changing consumer behaviors, all reshaping investment strategies.

2024 market trends are not just on traditional sectors but also on those areas that have shown resilience and innovation in recent times. From technology’s continuous march towards digitisation and Artificial Intelligence (AI) to the massive fields of renewable energy and healthcare, the mix of investment opportunities is as diverse as it is dynamic. Understanding these key sectors and their potential impact on the market will be crucial as investors seek to navigate this complex terrain. The year 2024 promises new investment avenues, with a blend of challenges and opportunities in an increasingly interconnected global economy.

Review of 2023 Market Trends

2023 was marked by a remarkable resurgence in technology investments, defying apprehensions and showcasing the sector’s resilience and innovation. Tech stocks, which had previously faced skepticism, had a comeback, surging to massive gains. This rally was not confined to a few names but was broad-based, indicating renewed investor confidence. The gains were partly fueled by groundbreaking advancements in AI, which opened new frontiers for growth and applications across almost every industry.

Simultaneously, consumer spending demonstrated resilience despite the challenges posed by persistent high inflation and higher interest rates. This consumer spending contributed to significant gains in consumer discretionary stocks, underlining the strength of the American consumer in the face of economic headwinds.

However, 2023 also brought its share of surprises in terms of sector performance. While defensive sectors like consumer staples were anticipated to provide shelter against market volatility, they exhibited unexpected weakness. On the other hand, cyclical sectors, which were expected to lag amid economic uncertainties, performed better than anticipated. This divergence in performance across sectors underscored the unpredictability of market trends and the importance of a diversified investment approach.

Growth Sectors to Watch for Investments 2024

For 2024, certain sectors stand out for their growth potential, for both macroeconomic factors and sector-specific drivers. Technology, healthcare, and renewable energy emerge as the potential frontrunners.

The technology sector continues to ride the wave of innovation, with AI at the forefront. Investments in technology are about the companies creating AI and those leveraging it to transform businesses and consumer experiences. The ripple effect of AI is expected to influence various sub-sectors, including cloud computing, cybersecurity, and semiconductors, making technology investments a key area of focus in 2024.

Healthcare sector investments are poised for a transformative year, driven by groundbreaking advancements in drug development and medical technologies. The aging global population and increasing healthcare needs magnify the sector’s potential. Moreover, healthcare is often considered a defensive play, offering stability in times of economic uncertainty making it an attractive sector for 2024.

Renewable energy investments reflect a global shift towards sustainability and environmental consciousness. With the world increasingly moving away from fossil fuels, renewable energy sources like solar, wind, and hydro are expected to gain traction. This shift is driven by consumer preference, governmental policies, and incentives, making renewable energy a sector with potentially significant growth prospects.

Technology Sector: AI and Digitisation

The technology sector in 2024 is poised for a significant leap forward, predominantly driven by advancements in Artificial Intelligence and continued digitisation. Once a futuristic concept, AI has become a cornerstone of technological innovation, reshaping industries and creating whole new areas of innovation. This year, AI’s application is expected to expand beyond traditional tech boundaries, influencing everything from healthcare to finance and creative industries.

For 2024, investment opportunities within the tech sector range from established giants to growing startups. Companies specialising in AI algorithms and machine learning models are desirable, as they are at the forefront of this technological revolution. Similarly, businesses that provide the infrastructure for AI, such as cloud computing services and data centers, have substantial growth potential.

Digitisation, another key trend, continues to accelerate, offering many investment opportunities. This includes companies involved in digital transformation services, cybersecurity solutions, and e-commerce platforms, which are fundamental to the digital economy’s expansion.

Healthcare and Renewable Energy: Long-term Potential

The healthcare sector in 2024 is full of potential, driven by remarkable innovations and a burgeoning demand for advanced medical technologies. One of the most notable developments is in the field of weight-loss drugs, where breakthroughs have opened new avenues for treating obesity and related health conditions. This progress is expected to drive significant growth in biotech and pharmaceutical companies specialising in these treatments. Additionally, advancements in areas like gene therapy, personalised medicine, and telehealth are attracting investor attention, offering promising healthcare sector investments.

In addition, the renewable energy sector is emerging as a key growth area, driven in part by global decarbonisation efforts and a collective shift towards sustainable energy sources. Investments in renewable energy are diversifying, spanning solar, wind, hydro, and emerging technologies like green hydrogen. This shift is a response to environmental concerns and a strategic move by nations and corporations to achieve energy independence and security. Government policies, subsidies, and incentives further support the sector’s growth, making renewable energy investments not just environmentally responsible but also economically viable.

In 2024, the healthcare and renewable energy sectors will present substantial long-term investment potential. Their growth is underpinned by continuous innovation, societal needs, and global trends towards health and sustainability, making them suitable sectors for investors seeking opportunities with a forward-looking approach.

Emerging Markets: Opportunities in 2024

In 2024, emerging markets may be a good investment in the new year, presenting a blend of risk and reward that can be appealing for diversified portfolios. These markets are anticipated to benefit from accelerated economic growth, fueled by increased industrialisation, a growing middle class, and technological adoption. Key factors contributing to emerging market growth include favorable demographics with younger populations, improving governance, and increased consumption. There is a potential tailwind for emerging markets if the US dollar depreciates alongside the 2024 expectations of lower interest rates.

Countries in Asia, Latin America, and Africa are increasingly becoming hubs for innovation and manufacturing, attracting foreign investments. The tech sector in these regions shows significant promise, driven by increasing digital connectivity and a large and growing tech-savvy population. Additionally, the renewable energy sector in emerging markets is expected to grow, supported by global initiatives to tackle climate change.

Investing in emerging markets in 2024 requires a strategic approach, considering the geopolitical risks and market volatility. However, the potential for higher returns, especially in sectors boosted by domestic growth and global trends, makes emerging market investments compelling for investors looking for diversification and growth.

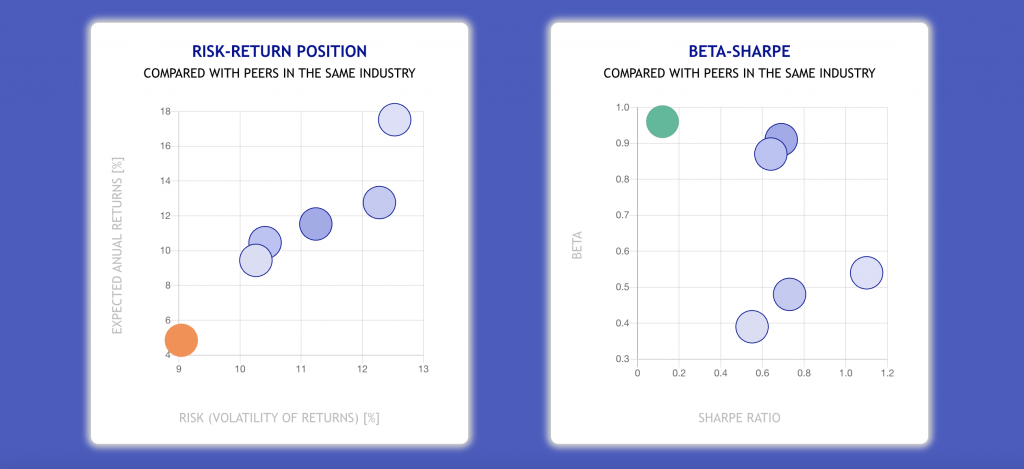

Portfolio Optimisation with Diversiview

In 2024, Diversiview will be a pivotal tool for portfolio optimisation. By harnessing advanced analytics and mathematical algorithms, Diversiview empowers retail investors to have the freedom and confidence to reach their financial goals. This insight is crucial for investors aiming to diversify their portfolios effectively.

Diversiview’s user-friendly interface and tailored analytics also assist in navigating market fluctuations, helping investors make informed decisions. With the addition of India’s National Stock Exchange (NSE), Diversiview is continiuing to expand to become a global portfolio optimisation tool and giving investors more diverse markets to analyse and invest in.

Whether rebalancing a portfolio to include high-growth sectors or mitigating risks through strategic diversification, Diversiview is a great tool for investors seeking to optimise their investments in 2024.

Conclusion: Preparing for Investment in 2024

As we approach 2024, investors must stay knowledgeable about key growth sectors like technology, healthcare, renewable energy, and emerging markets. These sectors are potentially the new growth investment trends, offering growth potential and innovation. Utilising Diversiview, investors can strategically align their portfolios with these trends, ensuring a strong investment strategy for the new year. Diversiview’s analytical prowess provides valuable insights, aiding in identifying promising opportunities and optimising investment portfolios. Diversiview is an indispensable ally in navigating the ever-evolving investment landscape as we embark on a new year of investing.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.