Your preferred calculation method for expected return will be used when Diversiview calculates your portfolio’s performance. Changing the calculation method for expected return will apply for calculations for new analyses only. Old analyses will not be affected.

In Diversiview, we use two methods to calculate the expected return of an investment:

- Expected Return (Historical):

- Expected Return (CAPM):

To learn the differences in the calculation methods, click here.

You can easily select your preferred calculation method for expected return in Diversiview in a few quick steps.

1. Locate the Settings:

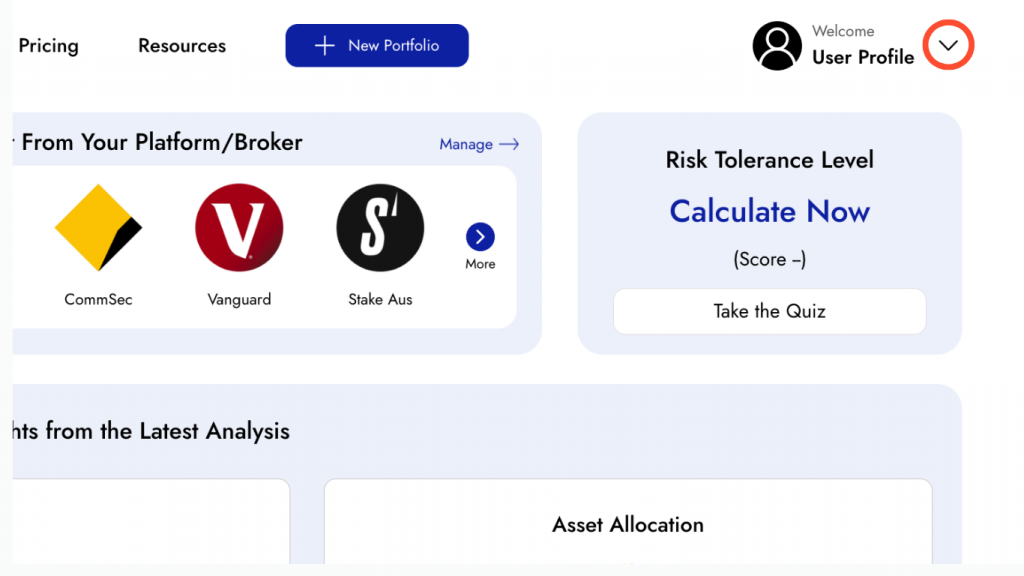

- You can find your Settings in the drop-down menu next to your profile name in the top right-hand corner of your dashboard.

2. Select Your Preferred Calculation Method for Expected Return:

- In your Settings page, in the Profile section, select your preferred calculation method for expected return from the drop-down menu and and click

.

. - Your preferred calculation method for expected return is what your Analysis Report will use to measure your portfolio’s performance.

Ready to calculate your portfolio’s expected return? Log in or sign up to your account today to start analysing and optimising your investment portfolio.