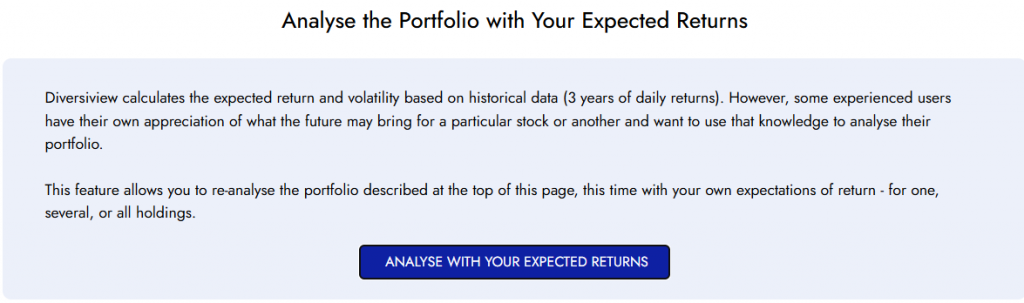

Diversiview calculates the expected return and volatility based on historical data (3 years of daily returns). However, some experienced users have their own appreciation of what the future may bring for a particular stock and would prefer to use that knowledge to analyse their portfolio.

This feature allows you to re-analyse the portfolio with your own expectations of return – for one, several, or all holdings.

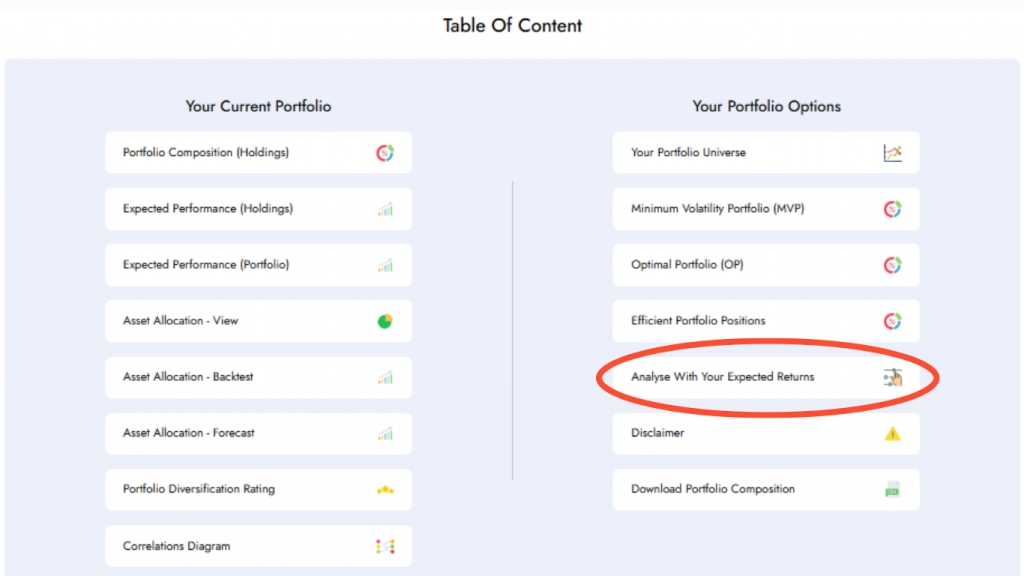

1. Find the ‘Analyse With Your Expected Returns’ Option

- To access this optimisation feature, click on the ‘Analyse With Your Expected Returns’ option from the Table of Content in your Analysis Report.

2. Select the ‘Analyse With Your Expected Returns’ Option

- Click on the blue ‘Analyse With Your Expected Returns’ button.

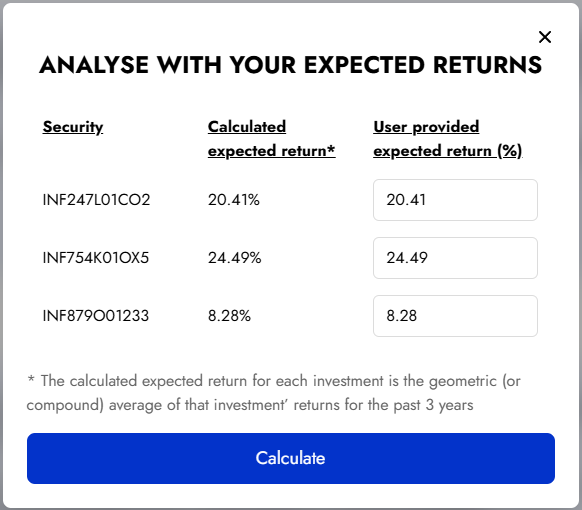

3. Select Your Preferred Expected Returns

- Change the expected returns for any of the securities listed in your portfolio. By default, the calculated expected return is inputted.

Ready to learn more about your portfolio’s expected performance? Log in or sign up today to start analysing and optimising your investment portfolio using your preferred expected returns.