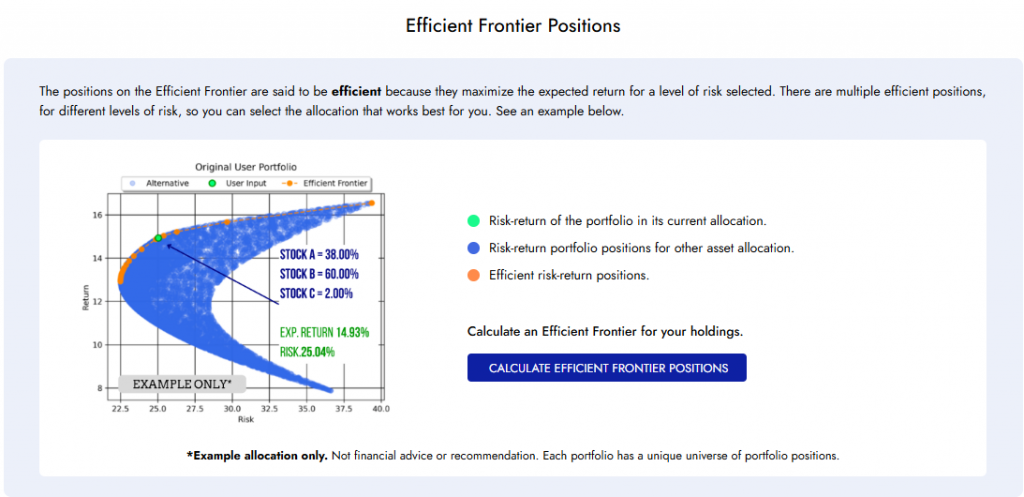

For any set of investments, there are multiple ways to combine them, i.e. to allocate money between investments. Only some of those positions are efficient, meaning that they give the maximum level of portfolio expected return for a given level of risk. Those efficient positions lie on what is known as the “Efficient Frontier”, shown as orange points (or cyan, when weighting constraints are applied) in Your Portfolio Universe®:

Diversiview allows you to select a point from the Efficient Frontier and calculate the asset allocation that will take the portfolio to that risk-return position.

Here’s a straightforward written guide to calculate the efficient frontier positions unlocking valuable insights:

1. Analyse Your Portfolio:

- Before calculating allocations for efficient frontier positions, you need to run a portfolio analysis that will create the Your Portfolio Universe diagram (click here for an in-depth guide).

2. Identify the Efficient Positions of interest:

- Click on the “Your Portfolio Universe” item in the Table of Contents (example highlighted below).

- This will take you to the diagram showing the multitude of potential risk-return positions for your portfolio (blue points), your current position based on the current portfolio allocation (the green point) and the Efficient Frontier positions (orange points if default weighting constraints have been used, or cyan points if customised weighting constraints have been used).

3. Calculate Efficient Frontier Positions:

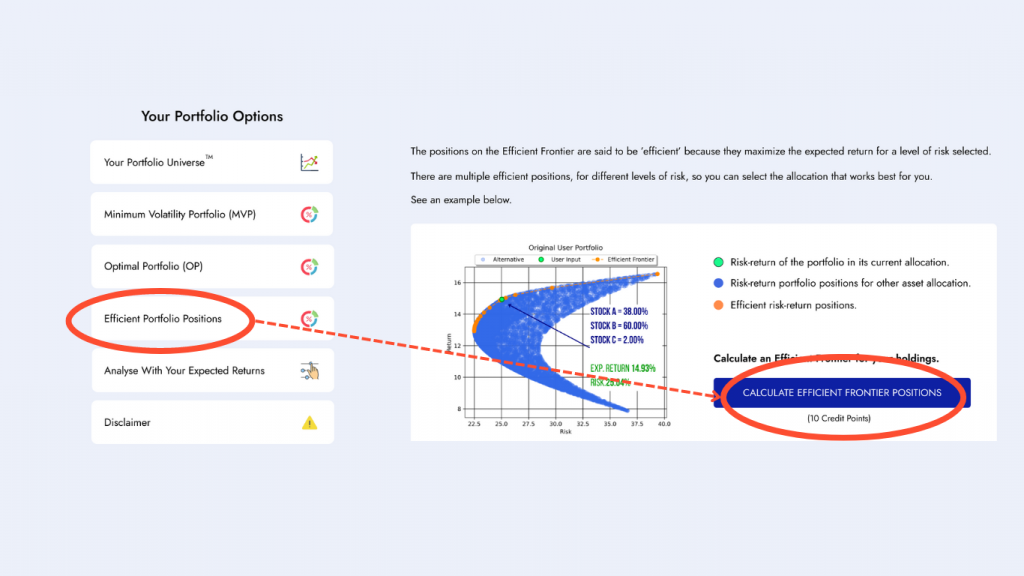

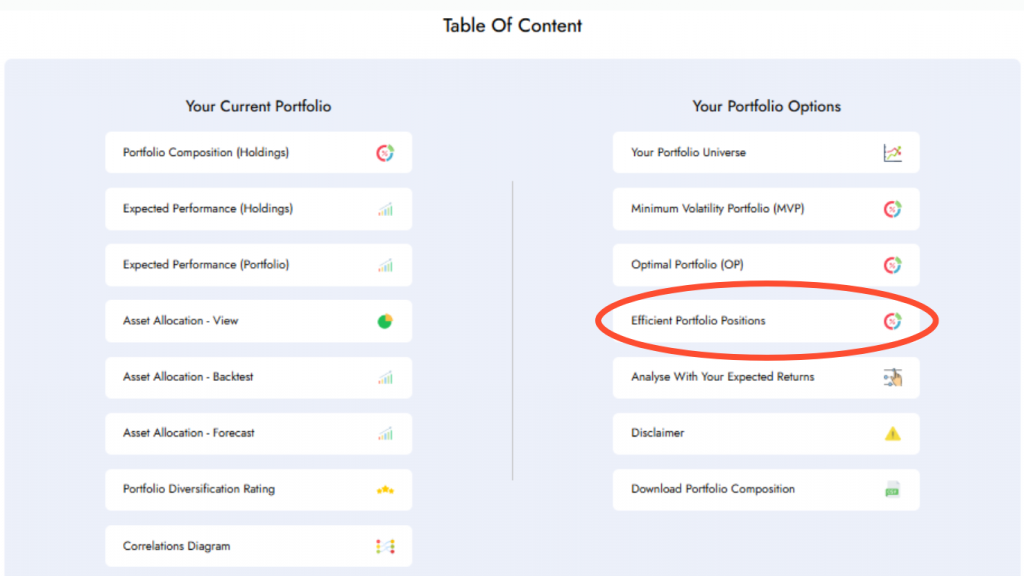

- Click on the “Efficient Portfolio Positions” item in the Table of contents (example highlighted below) or scroll down to find the third optimisation option, where you can calculate allocations for Efficient Frontier positions .

- Click on ‘Calculate Efficient Frontier Positions’ and you will be prompted with a dialogue box indicating the cost of the optimisation. Click ‘OK’ to continue.

4. Specifying the exact Efficient Frontier Positions:

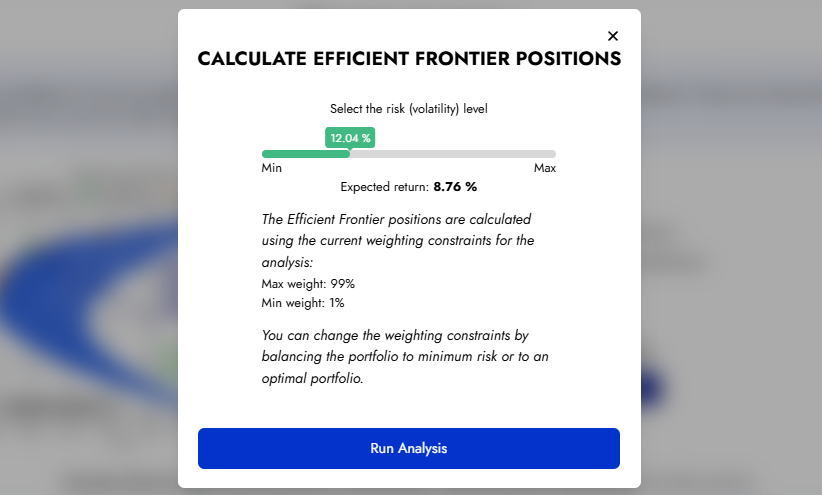

- A popup will allow you to select the particular position on the Efficient Frontier for which you want to calculate the allocation. Drag the risk/volatility selector to the desired level. You will see the expected portfolio return for that level of risk, displayed directly under the selector.

- Once you are happy with the selected risk-return combination click ‘Run Analysis’.

5. View Your Analysis Report:

- Within minutes, your personalised analysis report will be ready for viewing on your Diversiview dashboard.

- The report is similar with the original portfolio analysis report, however it shows the calculated allocation for the Efficient Frontier position selected, all portfolio expected performance indicators calculated for that allocation, and the Portfolio Universe showing the portfolio position that you have calculated.

Ready to calculate Efficient Frontier positions for your portfolio? Sign up or Sign in to your account and start optimising your portfolio today.