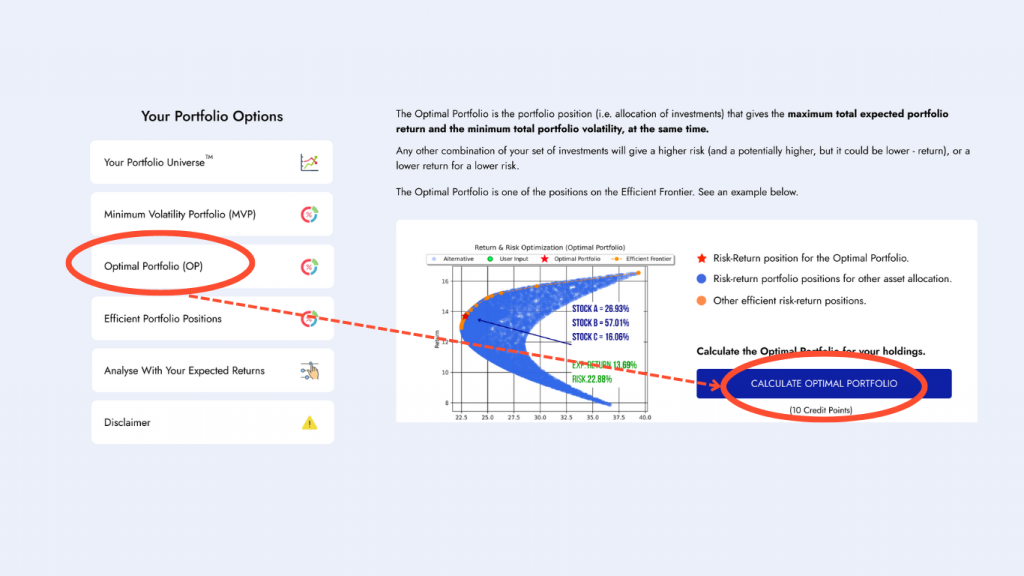

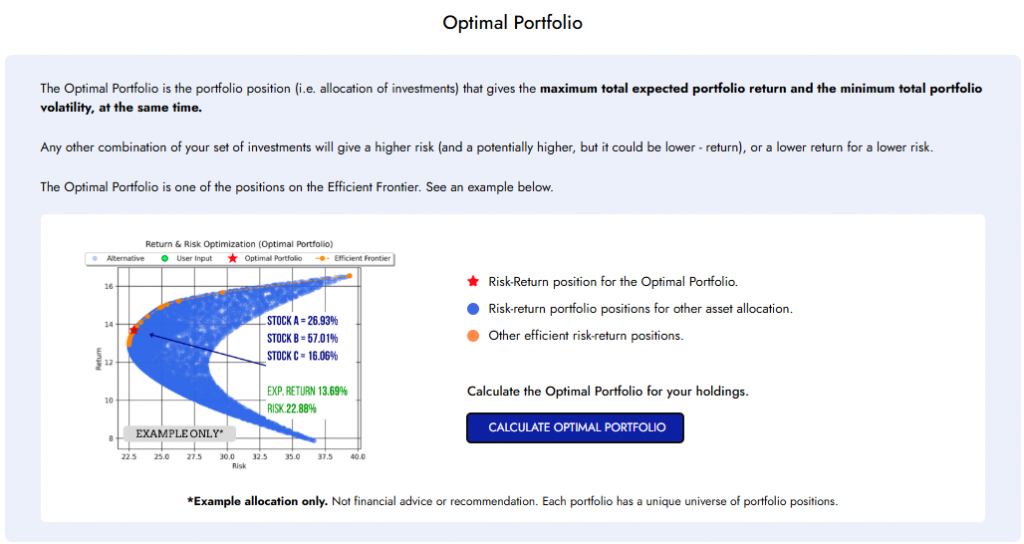

An optimal portfolio is an investment strategy that provides the optimal balance between risk and return. Using Your Portfolio UniverseTM, the Optimal Portfolio is indicated by the red point on the graph:

Diversiview’s Optimal Portfolio optimisation leverages sophisticated algorithms to identify the ideal investment allocation that maximises return and minimises risk. This guide will walk you through calculating your optimal portfolio and unlocking valuable insights to make informed investment decisions.

1. Analyse Your Portfolio:

- Before optimising, run a portfolio analysis (click here for an in-depth guides).

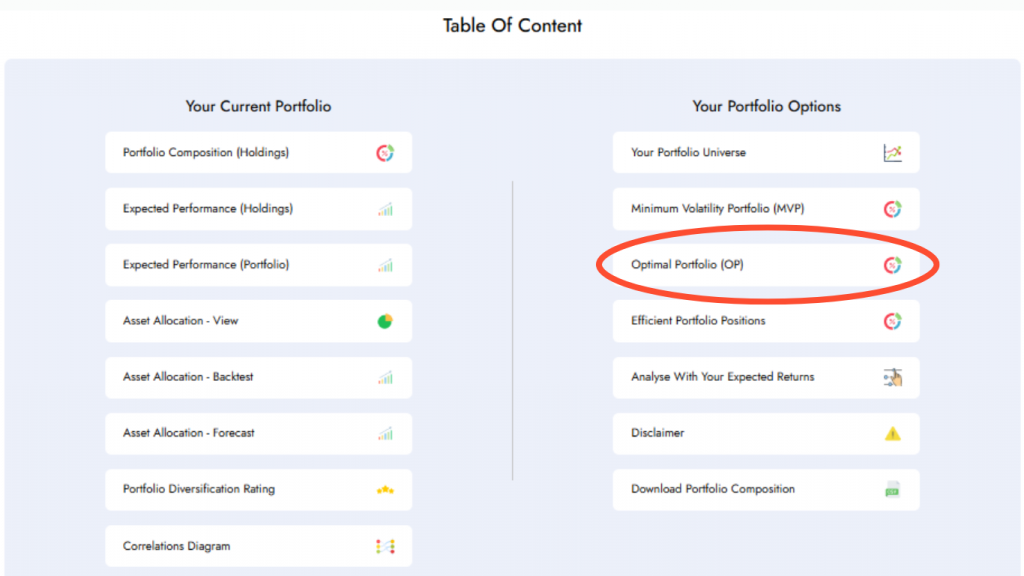

2. Locate the Optimal Portfolio Optimisation Option:

- From your Portfolio Analysis Report, scroll down to reveal the Table of Contents.

- Click “Optimal Portfolio” under “Your Portfolio Options” in the right column. This will display the optimal portfolio within Your Portfolio UniverseTM.

3. Calculate the Optimal Portfolio:

- Click on ‘Calculate Optimal Portfolio’.

- You will be prompted with a dialogue box. Click ‘OK’ if you wish to continue.

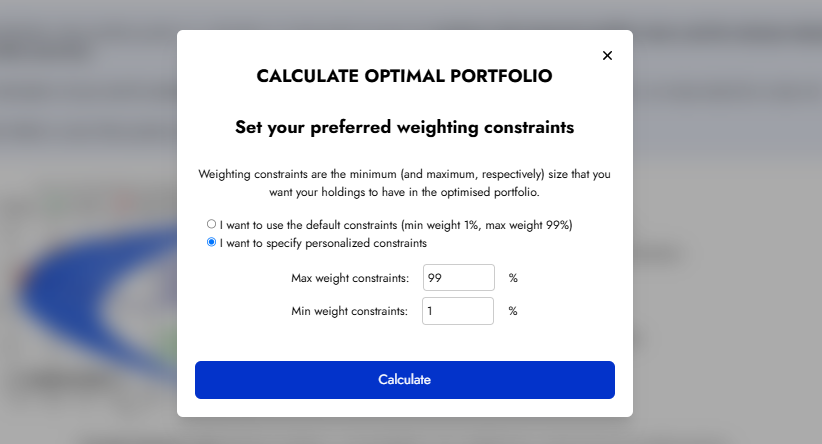

4. Specify Weighting Constraints:

- Before you run the optimisation, you can select you weighting constraints. Here you can choose your maximum and/or minimum weighting constraints.

- For example, if you don’t want to hold more than 40% in any investment, move the max weight slider to 40%.

- Similarly, if you don’t want to hold less than 2% in any investment, move the min weight slider to 2%.

- Click ‘Calculate’ once you are happy with your selection.

5. View Your Analysis Report:

- Within a few minutes, your personalised optimal portfolio analysis report will be ready for viewing on your Diversiview dashboard. This report offers valuable insights into your portfolio’s asset allocation, risk profile, and potential areas for improvement.

Ready to calculate your optimal portfolio? Log in or sign up to your account today to start analysing and optimising your investment portfolio.