Portfolio Alpha indicates the difference between the portfolio’s expected return and the expected return of the entire market*. That is, a positive Alpha shows how much more the portfolio is expected to earn compared with the entire market.

Alpha is calculated using Jensen’s measure (see formula here) and is always considered in conjunction with Portfolio Beta. Investors generally aim to get a good portfolio performance (i.e., a positive Alpha) for the level of portfolio volatility indicated by Beta.

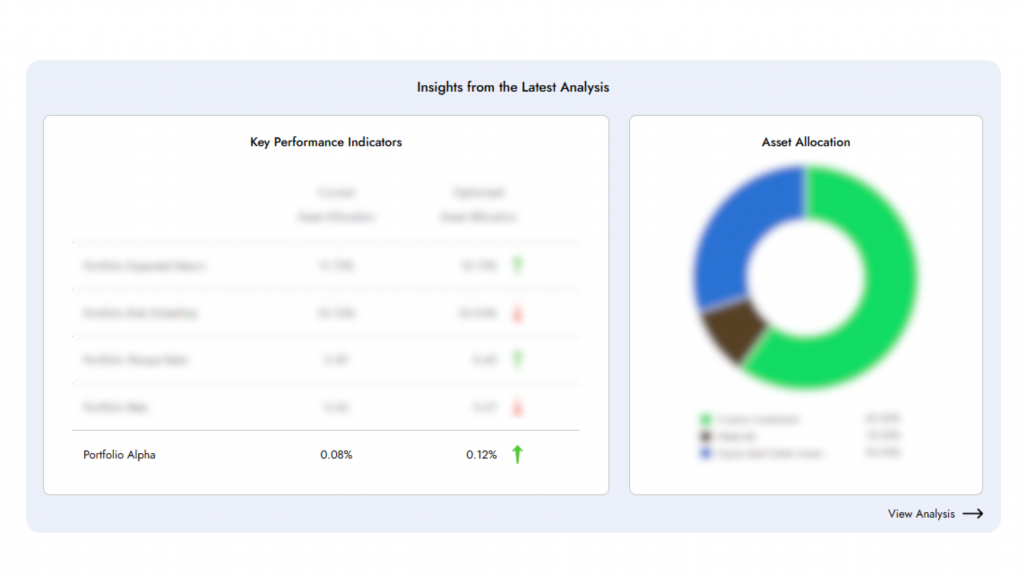

You can find the Portfolio Alpha value on your dashboard or the Diversiview analysis page, under the ‘Performance & Benchmark’ section. The table shows two values:

- The left value indicates the portfolio alpha of the current asset allocation.

- The right value indicates the portfolio alpha of the optimal asset allocation.

*For the purpose of Alpha calculations using Jensen’s method, Diversiview uses the index that you select from your profile settings. To learn how to select your preferred market benchmark, click here.

For more help, visit Diversiview’s YouTube channel and check out our explanatory videos.

Ready to learn more about your portfolio’s alpha? Log in or sign up to your account today to start analysing and optimising your investment portfolio.