Are You Making the Most of Your Portfolio?

In an era where financial markets are more volatile and interconnected than ever, relying on traditional investing methods or gut feelings can leave your portfolio vulnerable. Many investors unintentionally expose themselves to risks or miss out on growth opportunities simply because they lack access to sophisticated investment tools that can analyse and optimise their portfolios effectively.

The good news is that technology has evolved to bridge this gap. Diversiview’s portfolio optimisation software empowers investors by providing a comprehensive, data-driven approach to managing portfolio returns. Whether you are a beginner or a seasoned professional, using a portfolio analysis tool can transform how you approach investing, helping you make smarter, data driven decisions that align with your financial goals.

Most investors are not getting the full potential from their portfolios. Issues such as poor diversification, emotional decision-making, and missed opportunities stem from not utilising portfolio optimisation software. In today’s data-driven landscape, the difference between average and superior performance is now decided by the tools you use for portfolio analysis online.

If you want to consistently maximise your portfolio’s expected return while managing risk, you need a sophisticated platform like Diversiview that turns possibilities into real results.

Step-By-Step Walkthrough: Maximising Portfolio Returns with Diversiview

1. Upload or Import Your Portfolio

Starting your journey with Diversiview is quick and easy, plus your first analysis is free:

- Manual Entry: Enter your assets (stocks, ETFs, cash, term deposit) one by one, supporting all major global exchanges.

- Import Options: Seamlessly connect external investment platforms such as Sharesight or BGL, or upload a CSV file for instant portfolio upload.

- Comprehensive Coverage: Whether your assets are in equities, ETFs or Indian mutual funds, Diversiview’s flexible input sets the stage for meaningful holistic analysis. You can also add cash!

Benefit: All of your holdings are automatically processed and aggregated, giving you a complete and current snapshot for the asset allocation optimiser.

2. Set Your Portfolio Optimisation Objectives

No two investors have identical needs or tolerances for risk. Diversiview lets you analyse your holdings and calculate portfolio positions that work for you:

- Portfolio Expected Return: Forecast how your expected returns may change after optimisation. Diversiview’s analytics highlight the impact of every asset allocation adjustment on your overall risk and potential reward.

- Asset Allocation Calculator: Decide whether you want to maximise risk-adjusted returns, minimise portfolio volatility, or pursue maximum growth. Customisable settings allow you to match the software calculations to your precise ambitions and comfort levels.

- Efficient Frontier Calculator: Instantly visualise your portfolio’s location on the risk-return spectrum. Adjust allocations to move closer to the “efficient frontier”—the set of portfolios that offer the highest expected return for every level of risk.

Benefit: Holistic, data-based optimisation helps you make informed decisions.

Diversiview Use Case for Portfolio Optimisation:

Suppose you want to reduce portfolio risk during turbulent market conditions but don’t want to forgo reasonable returns. By choosing “Calculate Minimum Risk Portfolio,” Diversiview’s portfolio optimisation tool calculates a new allocation for your assets that aims to make your investment journey low risk.

Explore Interactive Analytics and Deeper Insights

Once you’ve set your objectives, Diversiview turns large datasets into actionable, visually compelling analytics:

- Portfolio Analysis Online Report: Detailed breakdown by asset and sector to reveal areas of over- or under-concentration.

- Historical performance and risk metrics: review volatility, Sharpe ratio, and maximum drawdown over time.

- Correlation Matrix: Identify asset overlaps and hidden risks. Knowing how investments move together is critical for avoiding unintentional concentration.

- Efficient Frontier Calculator: See your current and projected positions alongside the efficient frontier. Clearly visualise how diversification or rebalancing moves your allocation into more optimal territory.

- Coming soon: Scenario Analysis: Stress-test your portfolio against various historical and hypothetical events, like recessions, bull markets, or market shocks, so you’re never caught off guard.

Benefit: With a complete view of risk, return, and diversification, you can confidently adjust your portfolio to navigate ever-changing market conditions.

Expanded Scenario:

Let’s say your analysis reveals that your current allocation is well below the optimal point on the efficient frontier, signalling significant unnecessary risk for returns you are actually achieving. By shifting allocations, using the efficient frontier calculation from Diversiview, you can capture higher expected returns at a lower or similar risk level.

Rebalancing: Stay on Course Over Time

Ongoing discipline is as important as smart initial decisions. Diversiview’s advanced portfolio optimisation software ensures no opportunity or risk is left unaddressed:

- Automated Alerts: Get timely reminders whenever your portfolio drifts from your target allocation, helping maintain your targeted allocation (coming soon).

- Visual Impact: Immediately see how rebalancing suggestions affect risk, return, and the all-important Sharpe ratio.

Benefit: Consistently reviewing your portfolio helps you stay aligned with your financial objectives. By setting periodic check-ins and assessing your investment progress, you can make timely adjustments and ensure your portfolio remains positioned to meet your goals—rather than slipping into neglect or drifting away from your intended strategy.

A Real Example from Diversiview

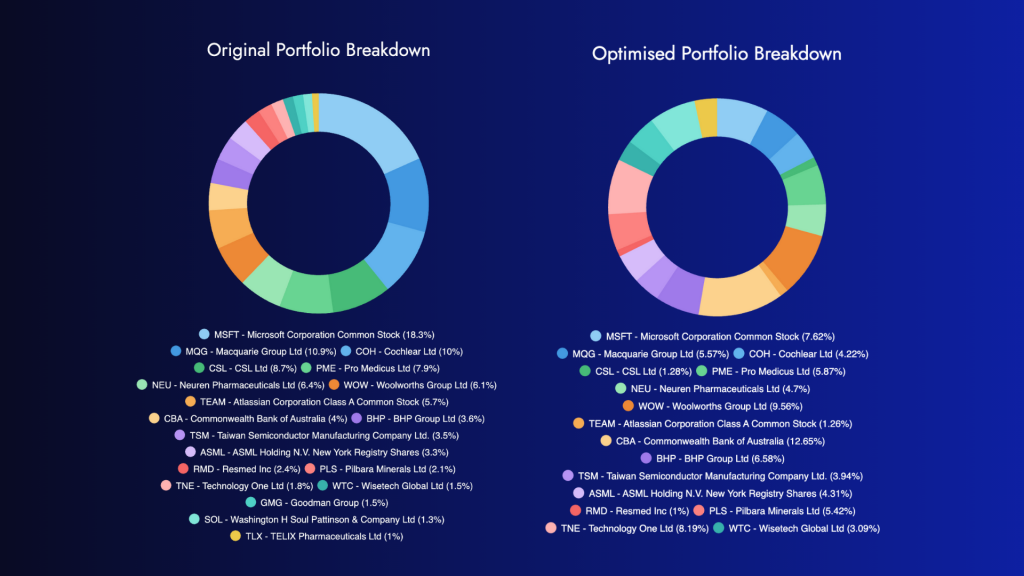

Case Study: From Concentration to Consistency

James (name anonymised for privacy), an investor from Sydney, manages $100,000 in Australian and US stocks.

The Problem: Their portfolio was heavily weighted toward a few tech stocks and they became worried about excess risk and the chance of missing gains elsewhere.

The Diversiview Approach:

- Seamless Import: He connected his broker account for an instant portfolio upload.

- Deep Analytics: The portfolio analysis indicated over-concentration and pointed out highly correlated assets in the Correlations Diagram and Matrix.

- Portfolio Analysis: He analysed his current asset allocation and while reviewing his analysis report he discovered he could be getting better expected portfolio returns at a similar risk. James uses Diversiview to calculate an optimal portfolio position for his holdings .

- Optimised Allocation: Data-driven portfolio optimisation shifting some funds out of tech into industrials and global equities, instantly illustrating the improved efficient frontier position.

- Rebalancing: Guided step-by-step, James decided to make trades that aligned his portfolio with the proposed optimal mix.

| Original Allocation | Optimised Allocation | |

| Initial Value | USD 100,000 | USD 100,000 |

| Current Value | USD 128106.87 | USD 139420.10 |

| CAGR | 19.04% | 26.35% |

To explore more, visit our Portfolio Optimisation Case Studies to see Live Case Study 2.

Why Choose Diversiview?

- Comprehensive Portfolio Analysis Online: See your holdings in detail and accurately gauge expected performance, diversification, risk, and correlations.

- Integrated Efficient Frontier Calculator: Visualise your current and optimal risk-return trade-offs, making theory usefully actionable.

- Reliable Portfolio Optimisation Tool: Continual insights, improvement suggestions, and a constantly evolving feature set.

- Seamless Integrations: Works with Sharesight and 20+ brokers; accepts direct CSV uploads to keep your portfolio current and fully up to date.

- Transparent, User-Friendly Design: First analysis is free, with paid plans to fit investors and professionals at every stage.

- Global Market Coverage: Analyse assets from ASX, NYSE, NASDAQ, LSE, NSE, BSE, HKEX, and 7,000 Indian mutual funds and ETFs.

Conclusion

The investment landscape is constantly evolving, and staying ahead requires more than just knowledge—it demands the right tools. Diversiview offers a powerful combination of advanced analytics, user-friendly design, and global market coverage, making it the ideal portfolio optimisation software for investors who want to maximise returns while managing risk effectively.

By leveraging features like the efficient frontier calculator and granular diversification, you gain unparalleled insight into your portfolio. This clarity enables you to make informed decisions, rebalance strategically, and ultimately build a more resilient and profitable investment portfolio.

Take control of your financial future! Open a free Diversiview account and get one FREE Portfolio Analysis, and discover how smart, data-driven decisions can help you achieve your goals.

Contact us with any questions.

Note: Diversiview does not provide financial advice or recommendations. Investment Portfolio Analyses are intended to provide investors with data driven insights and information. You should do your own further research, or speak with a licenced professional before making changes to your investment portfolio.