Why You Need a Consolidated, Portfolio Performance Report

Investing can be complex and emotionally challenging, especially when your portfolio spans multiple stocks, ETFs, mutual funds, and other assets. Many investors struggle to understand how their portfolio truly performs, partly because data is scattered across brokerage platforms, spreadsheets, and tracking apps. This fragmentation makes it difficult to get a clear, objective view of your investment success or areas needing improvement.

Without a consolidated performance report, it’s easy to miss critical insights. Are your returns beating the market? How much risk are you really taking? Is your portfolio diversified enough? Are there hidden concentrations or risks you haven’t considered? And importantly, what can you do next to improve?

That’s why a comprehensive, easy-to-understand portfolio performance software and reporting is essential. It brings together all your portfolio data, benchmarks it against relevant market indices, and provides clear analysis of both returns and risks.

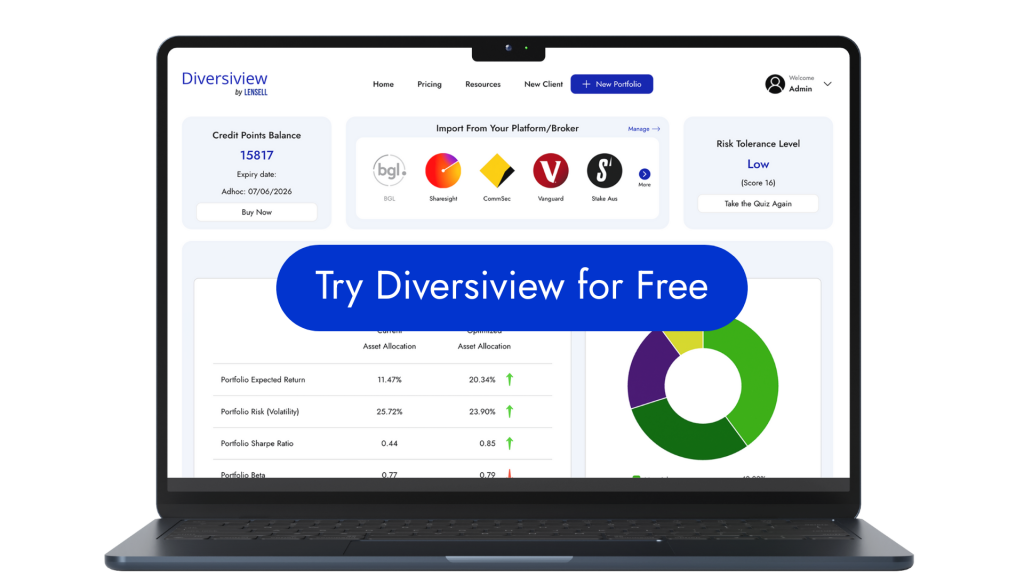

Diversiview’s free portfolio performance software takes the complexity out of portfolio management. Powered by sophisticated analytics and a growing global database, the report helps you accurately calculate investment performance and take confident next steps.

This is not just for professionals—the report is designed to empower everyday investors with actionable insights usually only available through expensive advisory services.

What’s Included in the Portfolio Performance Report?

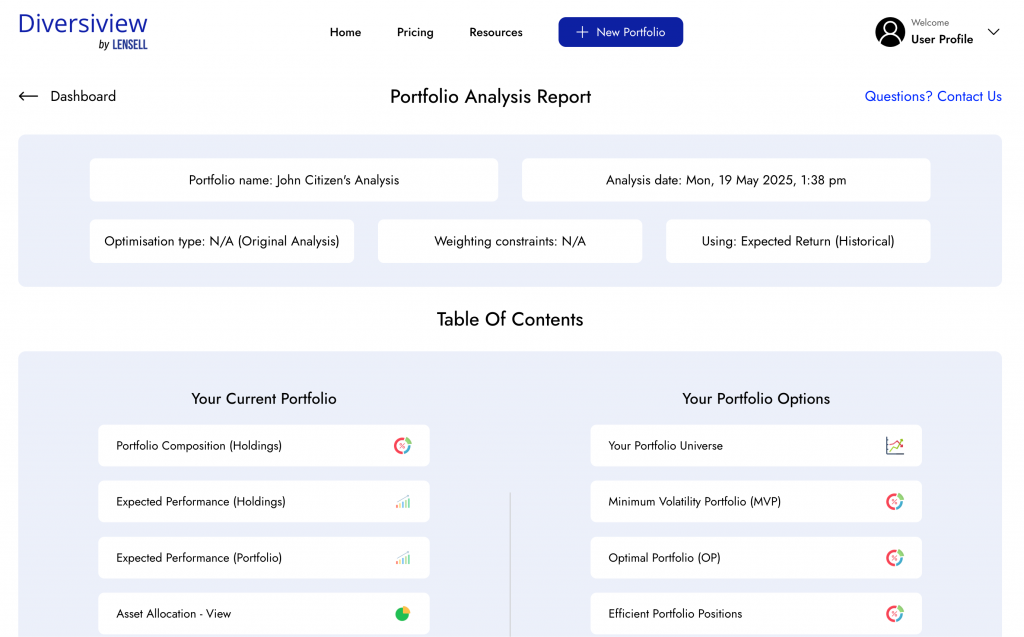

When you generate your free portfolio performance report with Diversiview, you receive an in-depth snapshot crafted to visualise all aspects of your portfolio’s health. Here’s what you can expect:

Performance vs Benchmark

One of the foundational metrics every investor wants to know is how their portfolio’s returns stack up against the market benchmarks. Diversiview compares your portfolio’s:

- Total returns: The percentage growth or loss over the specified period.

- Historical Expected Returns: Calculated as the annualised geometric (compound) average of its daily returns over the past three years.

- Expected Returns based on CAPM: Calculated using the established Capital Asset Pricing Model formula.

- Benchmark comparison: How your portfolio fared relative to relevant indices like the All Ordinaries Index, S&P 500 Index, S&P BSE SENSEX 50, NIFTY50 Index, Hang Seng Index.

- Growth charts: Visual graphs showing cumulative returns over time for your portfolio vs the benchmark.

This benchmark comparison gives you critical perspective on whether your active investment decisions are adding value or if passive, index-based investing might suffice.

Risk Metrics

Returns alone are only half the story. Understanding the risk involved is crucial for long-term investing success. Diversiview’s portfolio performance software includes:

- Volatility: The degree to which your portfolio’s value could swings over time.

- Sharpe Ratio: A measure of risk-adjusted return, showing how much return you may get for the risk taken.

- Maximum Drawdown: The biggest peak-to-trough loss during the past 3 years history, a key indicator of potential downside.

- Maximum Drawdown Recovery Time: How quickly the portfolio recovered from the biggest peak-to-trough loss during the past 3 years history

- Alpha: The excess return your investment or portfolio is expected to ear relative to a benchmark after adjusting for risk.

- Beta: Your portfolio’s sensitivity to overall market movements.

Together, these metrics provide a detailed picture of how much uncertainty and risk you have tolerated to achieve your returns, helping you assess whether your portfolio matches your risk tolerance.

Asset Allocation Analysis

Your portfolio’s performance and risk are strongly influenced by how your assets are allocated. The report delivers a detailed breakdown that includes:

- Asset classes: Equities, fixed income, cash, alternatives, and more.

- Market Capitalisation: The size of a company is often an indication of their potential volatility of returns, and therefore the potential impact on the overall portfolio risk.

- Asset Allocation Backtesting: Explore how the portfolio’s asset allocation would have translated into total portfolio value over the last 36 months using a chosen starting value. Optional comparisons include a benchmark index and alternative allocation mixes over the same period.

Asset Allocation Forecasting: View a projection that illustrates how the portfolio could evolve under the current allocation and the model’s expected volatility assumptions. These forecasts are scenario‑based illustrations, not guarantees or predictions, and are intended for informational purposes only.

This helps you identify concentrations or gaps, enabling more effective diversification and alignment with your goals.

Portfolio Optimisation

Data becomes more practical when it informs clear decisions. Diversiview provides analytics and allocation insights across four core capabilities:

- Minimum Risk Portfolio

Identify the allocation that achieves the lowest overall volatility for the current investable set and constraints. Results include expected portfolio risk, asset‑level risk contributions, and a comparison to the current mix so it’s clear how small weight shifts can reduce total variance while maintaining diversification. - Optimal Portfolio

Compute the allocation that targets the best risk–return trade-off under Modern Portfolio Theory assumptions, given available assets and user constraints. The output highlights the expected return and volatility of the optimised mix, changes versus the current portfolio, and how the proposal moves the portfolio toward a more efficient position. - Efficient Frontier Calculation

Map allocations along the efficient frontier to visualise the trade‑off between risk and return. Diversiview presents efficient portfolios across the EF curve. - Analysis with Your Expected Returns

If forward views differ from model estimates, input custom expected returns to rerun the optimisation. Diversiview recalculates the minimum risk, optimal portfolio, and frontier positions under those assumptions, making the impact of views explicit on weights, expected performance, and concentration.

Across these options, Diversiview reports before/after metrics, asset weight changes, and risk contributions, helping translate optimisation outputs into practical allocation decisions while staying within your defined constraints and preferences.

How to Generate Your Free Portfolio Performance Report in Diversiview

Getting your portfolio performance report has never been easier with Diversiview’s streamlined process:

Step 1: Upload or Import Your Portfolio

- Multiple Input Options:

- Manual entry for those who want precise control.

- Upload a CSV file exported from your current tracker.

- Connect your brokerage account or Sharesight for automatic importing.

- Comprehensive Asset Support:

Equities, ETFs, mutual funds, cash equivalents, and more are all supported across global markets, including ASX, NYSE, NASDAQ, LSE, NSE, BSE, and HKEX.

Step 2: Name Your Portfolio and Set Your Preferences

Easily label your portfolio for easy reference. You can also customise your benchmark and preferred returns method.

Step 3: Generate Your Report

With a click, Diversiview’s backend engine aggregates your data, pulls market pricing, and runs robust analytics to produce a comprehensive portfolio performance report.

Step 4: Review and Act

- View detailed reports within minutes.

- Download or share PDF summaries for personal records or advisory consultations.

- Explore rebalancing and optimised asset allocations.

Why This Report Makes You a Better Investor

1. Clarity and Transparency

Having a clear, consolidated snapshot lets you see your portfolio’s performance without the fog of scattered data sources or confusing spreadsheets. Metrics like Sharpe ratio and maximum drawdown give you a risk-aware perspective that simple statements of returns can’t.

2. Objective Analysis Over Emotions

Emotional investing—panic selling or chasing returns—is a key reason portfolios underperform. An objective, data-driven report removes guesswork, helping you stick to your plan during market ups and downs.

3. Actionable Insights

Knowing how your portfolio performs is one thing—but acting on that knowledge is another. The optimisation suggestions offer clear next steps that could improve your investment outcomes.

4. Confidence and Control

With a detailed understanding of your portfolio’s strengths and weaknesses, you gain confidence to make informed decisions and take control of your financial future.

The Recap

Don’t leave your investment performance to chance or piecemeal tracking. Generate your free portfolio performance report with Diversiview today and unlock a new level of clarity and control.

- See how your portfolio performs against the market

- Understand your true risk exposure with advanced metrics

- Get data-driven and optimised asset allocations

- Make smarter decisions backed by data, not guesswork

Ready to start? Get your free report in minutes – no commitment, no cost. Transform your investing with Diversiview and take confident steps toward your financial goals.

Note: Diversiview does not provide financial advice or recommendations. Investment Portfolio Analyses are intended to provide investors with data driven insights and information. You should do your own further research, or speak with a licenced professional before making changes to your investment portfolio.