In today’s interconnected world, investors have access to opportunities far beyond their home markets. Yet, many Australian investors still hold a strong home bias and concentrate most of their portfolios in ASX-listed companies.

While the Australian market has its strengths, a closer look at global equity performance over recent years reveals an important insight: international diversification can significantly enhance returns without necessarily increasing risk.

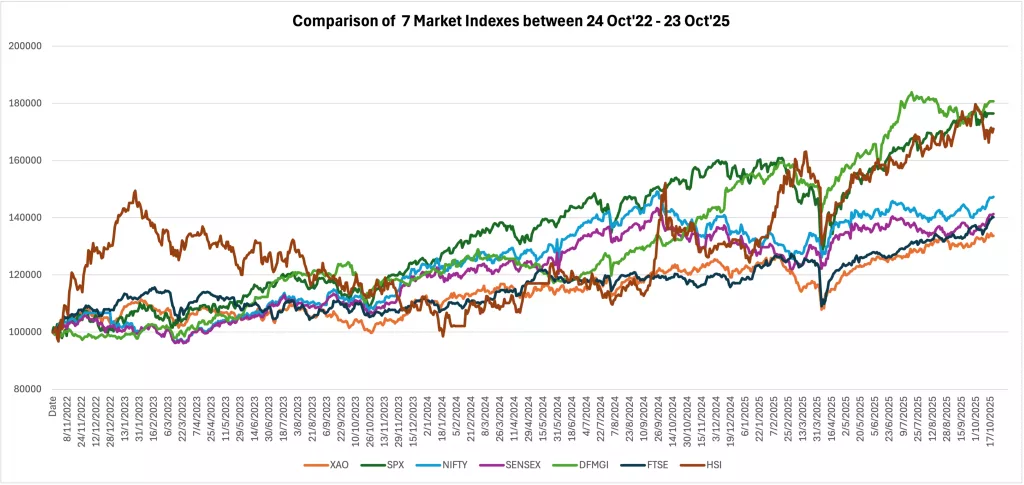

Comparing Global Market Performance

Figure 1 below shows how a $100K portfolio invested in each of the 7 indexes representing the ASX, US, BSE, NSE, DFM, LSE and HKEX markets would have performed during the 3 years period between October 2022 and October 2025. Local currencies were converted to USD for accurate comparison, with the FX rates sourced from RBA (Reserve Bank of Australia).

Furthermore, Table 1 summarises the compound annual growth rate (CAGR) and volatility of each global market index mentioned, over the same period (sorted by CAGR descending).

| Index | CAGR | Volatility |

|---|---|---|

| DFMGI (Dubai Financial Market) | 21.84% | 10.58% |

| S&P 500 (SPX) | 20.86% | 14.68% |

| HSI (Hong Kong) | 19.62% | 24.82% |

| NIFTY (India) | 13.80% | 11.89% |

| SENSEX (India) | 12.23% | 11.83% |

| FTSE (UK) | 11.92% | 10.64% |

| ASX (XAO) | 10.17% | 11.45% |

What stands out immediately is that all these global indexes delivered higher CAGR than the ASX. Moreover, for most markets (except HSI and SPX), the volatility was lower or comparable to that of the ASX. Also, in all cases except HSI, the volatility % was lower than the CAGR %, meaning that the return was in a safe range during the 3 years period and any declines were not eating out the benefit of the growth periods.

This combination of higher returns and comparable or lower volatility demonstrates the strength of international diversification — capturing global growth trends while managing risk.

Lessons from Global Markets

Each market tells a unique story:

- United States (S&P 500): Driven by innovation and global tech leaders, the U.S. market continues to deliver strong returns, albeit with slightly higher volatility.

- Dubai (DFMGI): This market stands out with the highest CAGR (21.84%) and one of the lowest volatility levels, showing how emerging financial hubs can provide exceptional opportunities.

- India (NIFTY & SENSEX): Fast economic growth, a young population, and a thriving technology sector have powered consistent gains with moderate volatility.

- United Kingdom (FTSE 100): Offers more stable, dividend-driven performance with solid returns relative to risk.

- Hong Kong (HSI): Reflects higher volatility due to geopolitical and economic uncertainty, a reminder that not all markets behave the same way, which makes diversification valuable.

By spreading investments across regions with different economic drivers, investors can reduce portfolio risk while enhancing long-term performance potential.

Why Home Bias Hurts Performance

Australian investors often prefer familiar names: big banks, miners, and local blue chips. However, this home bias can mean missing out on sectors and economies that drive global growth, such as:

- Technology (U.S.)

- Manufacturing and services (India, Europe)

- Renewable energy and infrastructure (Middle East, UK)

The ASX represents only about 2% of global equity markets, meaning a purely domestic portfolio ignores 98% of the world’s investment opportunities.

Limiting exposure to one market also concentrates risk in a single economy and currency. When the local economy slows, a globally diversified portfolio can provide resilience through exposure to markets performing better elsewhere.

Balancing Risk and Return Through Global Diversification

Diversification isn’t about chasing the highest-return market each year. It’s about building a portfolio that performs steadily across different market conditions.

As the data shows, some of the best-performing markets also had manageable volatility, proving that higher returns don’t always come with proportionately higher risk.

A well-constructed global portfolio might include:

- U.S. equities for innovation and scale

- European equities for stability and income

- Emerging markets like India or the Middle East for growth potential

- Australian equities for local exposure and dividends

By combining markets with different risk-return profiles, investors can achieve more consistent performance over time — a key principle behind Modern Portfolio Theory and Diversiview’s portfolio optimisation approach.

How to Practically Achieve Global Diversification

Modern investors have multiple ways to access international markets:

- Global ETFs and Index Funds – Low-cost, diversified vehicles that track broad regions (e.g., global equity ETFs, MSCI World Index ETFs).

- Direct International Shares – For investors seeking targeted exposure to specific companies or markets.

- Managed Portfolios or Model Portfolios – Professionally built strategies that combine international diversification with tailored risk management.

Platforms like Diversiview can help investors evaluate and optimise their portfolios to ensure they’re diversified across asset classes, geographies, and risk levels.

Similarly, Model Portfolios like the Diversified Global Equity ETF Leaders can help investors speed up the investment process with quant-driven investment selection and regular asset allocation review and optimisation.

What This Means for Australian Investors

The data tells a clear story:

- Australian equities have lagged behind global peers in compounded growth.

- Global markets like the U.S., India, and Dubai have outperformed with similar or lower volatility.

- International diversification is not just a defensive measure, it’s a growth strategy.

By embracing a broader investment universe, investors can reduce overexposure to local market dynamics and participate in global growth trends that drive wealth creation.

Key Takeaway

International diversification is not just a buzzword, it’s a proven strategy to balance performance and risk. By including global assets, investors can build resilient, high-performing portfolios that capture growth opportunities worldwide.

Tools like Diversiview make it easier to model different scenarios, evaluate geographic exposures, and ensure portfolios align with individual goals and risk tolerance. Give it a try today!

Disclaimer

Past performance does not guarantee future results.

However, historical data provides valuable insights into how diversification and global exposure can impact portfolio outcomes over time. Investors should always consider their own circumstances and consult professional advice when building or adjusting their investment strategies.

LENSELL GROUP Pty Ltd, ACN 646 467 941, trading as LENSELL, is a Corporate Authorised Representative of Foresight Analytics & Ratings Pty Ltd ( Australian Financial Services Licence No. 494552). All information provided to you by LENSELL is intended for general informational purposes only. It does not consider your individual financial circumstances and should not be relied upon without consulting a licensed investment professional or adviser.

The content on this website and in any of its applications is not a financial offer, recommendation, or advice to engage in any transaction. Investment products referenced in our software or marketing literature carry inherent risks, and you should note that past performance does not guarantee any future results. In all our modelling, no transaction costs or management fees are factored into performance analysis.

The information on our website or our mobile application is not intended to be an inducement, offer or solicitation to anyone in any jurisdiction in which LENSELL is not regulated or able to market its services.

Furthermore, all information used across our platform or website may be based on sources deemed reliable but is provided “as is” without guarantees of accuracy or updates. LENSELL and Foresight Analytics & Ratings disclaim all warranties and accepts no liability for any loss or damage resulting from use or reliance on any material or data embedded in our technology platform or digital media. Where liability cannot be excluded by law, it is limited to resupplying the information.

Please view our Financial Services Guide, Terms Of Service and Privacy Policy before making any investment decision using the information available on our website or on any of our applications. LENSELL, Diversiview and TableBits are trademarks registered in Australia.