Introduction

Expected portfolio return is a core metric for investors aiming to anticipate potential gains across their investments. Traditional methods calculate expected portfolio return by weighting the expected performance of each asset class by its allocation. However, modern investing often uses a Total Portfolio Approach (TPA) — evaluating each individual investment contribution to the overall portfolio risk and return.

TPA allows dynamic capital allocation across individual assets, maximizing total portfolio efficiency.

Tools like Diversiview simplify this process, helping investors to calculate expected portfolio return across all holdings. One simply enters, loads or imports a portfolio of individual holdings to Diversiview, and the expected portfolio return (together with several other metrics) is calculated in seconds.

Why Expected Portfolio Return Matters

Calculating expected portfolio return helps investors:

- Forecast potential portfolio growth

- Compare investment options across asset classes

- Evaluate risk-adjusted performance

Traditional weighted-average calculations at asset class level can overlook portfolio-level individual correlations. While correlations are not required to calculate portfolio expected return, by integrating TPA one can visualise the combined risk-return performance of the entire portfolio, providing a holistic view and potential improvement options for the expected return as well.

What is the Total Portfolio Approach (TPA)?

The Total Portfolio Approach (TPA) evaluates investments as part of a unified portfolio rather than isolated asset classes. Key benefits include:

- Holistic portfolio evaluation: Measures each investment’s contribution to total return and portfolio risk. For example, the contribution of each listed security rather than the contribution of a basket of listed securities as an asset class.

- Cross-asset optimization: Allocates capital across each equity, bond or alternative investments for optimal risk-adjusted return.

- Dynamic risk management: Focuses on overall portfolio volatility, Sharpe ratio, and other performance metrics.

How Diversiview Supports a Total Portfolio Approach

Diversiview empowers investors implementing TPA by:

- Calculating portfolio-level expected return: Aggregate public and private holdings to see total expected return.

- Running scenario analysis: Test “what-if” reallocations and measure impact on total portfolio risk and return.

- Risk budgeting: Visualize each asset’s contribution to portfolio volatility, Sharpe ratio, and other metrics.

By combining TPA principles with Diversiview analytics, investors can make data-driven portfolio allocation decisions, improving efficiency and maximizing potential returns.

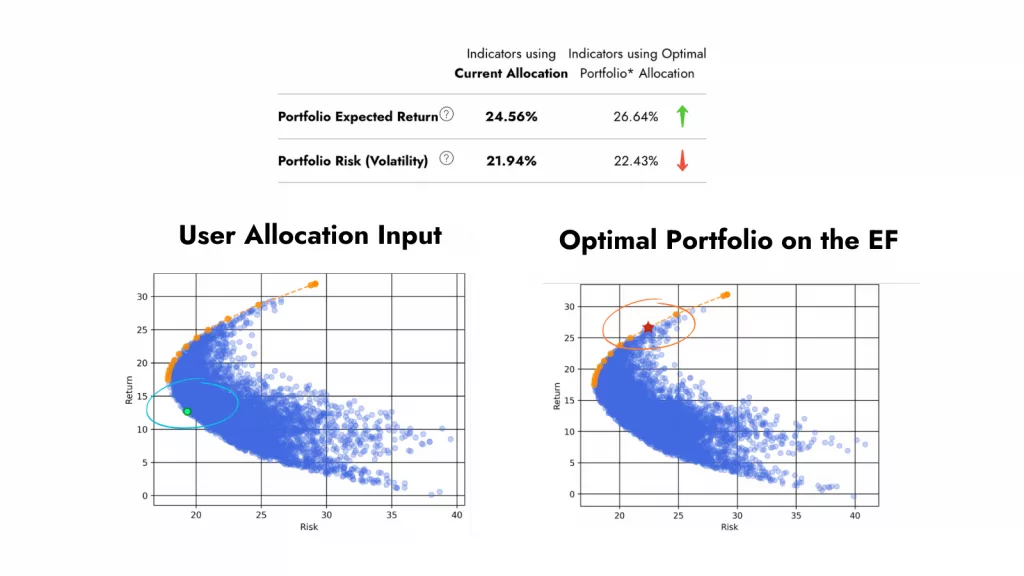

Below example shows the difference in risk-return profile for a normal, user provided portfolio of 5 assets (not optimised) and compared with the risk-return profile of the Optimal Porftolio for the same set of investments. The total portfolio volatility in this example increases slightly in the optimised allocation but so did the portfolio expected return.

Conclusion

Expected portfolio return is essential for informed investing. When paired with a Total Portfolio Approach and supported by Diversiview, investors can:

- View the portfolio as a single, optimized entity

- Identify investments that improve total risk-adjusted return

- Make data-driven allocation decisions across all assets

it.

Want to calculate the expected return of your portfolio? Analyse your Portfolio today with a free Diversiview account.

Disclaimer:

LENSELL GROUP Pty Ltd, ACN 646 467 941, trading as LENSELL, is a Corporate Authorised Representative of Foresight Analytics & Ratings Pty Ltd ( Australian Financial Services Licence No. 494552). All information provided to you by LENSELL is intended for general informational purposes only. It does not consider your individual financial circumstances and should not be relied upon without consulting a licensed investment professional or adviser.

The content on this website and in any of its applications is not a financial offer, recommendation, or advice to engage in any transaction. Investment products referenced in our software or marketing literature carry inherent risks, and you should note that past performance does not guarantee any future results. In all our modelling, no transaction costs or management fees are factored into performance analysis.

The information on our website or our mobile application is not intended to be an inducement, offer or solicitation to anyone in any jurisdiction in which LENSELL is not regulated or able to market its services.

Furthermore, all information used across our platform or website may be based on sources deemed reliable but is provided “as is” without guarantees of accuracy or updates. LENSELL and Foresight Analytics & Ratings disclaim all warranties and accepts no liability for any loss or damage resulting from use or reliance on any material or data embedded in our technology platform or digital media. Where liability cannot be excluded by law, it is limited to resupplying the information.

Please view our Financial Services Guide, Terms Of Service and Privacy Policy before making any investment decision using the information available on our website or on any of our applications. LENSELL, Diversiview and TableBits are trademarks registered in Australia.