Integrating Artificial Intelligence (AI) in financial technology marks a significant shift in the space. This AI-driven fintech era is redefining the norms of financial services, offering unparalleled insights, efficiency, and decision-making prowess. AI’s application ranges from algorithmic trading and personalised financial advice to sophisticated risk assessment and portfolio management, setting new standards in the financial industry.

Amidst this technological revolution, Diversiview emerges as a significant player, harnessing the power of AI and mathematical models for tech-driven portfolio management. Its advanced analytics and machine learning algorithms offer investors a cutting-edge tool for optimising portfolio allocation, enhancing their capacity for making strategic investment decisions. Diversiview helps investors navigate the complex waters of modern finance, demonstrating the transformative potential of AI in reshaping investment strategies for success.

The Evolution of AI in Finance

Integrating Artificial Intelligence (AI) into finance has been a gradual yet transformative journey, reshaping financial services. This evolution began many years ago, with AI initially being used for basic data analysis and automated tasks. However, the real leap occurred with more sophisticated machine learning and predictive analytics, enabling AI to tackle complex financial modeling and decision-making processes.

In the early stages, AI’s role was primarily confined to back-office functions in financial institutions – streamlining operations and enhancing efficiency. But as technology advanced, AI began to take a more front-and-center role. One of the most notable early applications was in algorithmic trading. AI systems could analyse vast amounts of market data at incredible speeds to identify trading opportunities that would be impossible for human traders to see and take advantage of.

Today, the impact of AI in finance has expanded exponentially. It’s now integral in risk management, fraud detection, customer service (through AI-driven chatbots), and personalised financial advice. Robo-advisors, for example, use AI algorithms to provide strategic investment decisions based on individual investor profiles, optimising portfolio allocations tailored to each investor’s goals and risk tolerance.

The evolution of AI in finance has allowed a shift from a one-size-fits-all approach to a more personalised, data-driven strategy in financial services. This change is both technological and philosophical, as AI empowers investors to make more informed, strategic decisions, allowing a new wave of personalised financial planning and portfolio management.

AI-Driven Finance: Transforming Portfolio Management

The advent of AI-driven finance has simply revolutionised the field of portfolio management, shifting from traditional methods to more sophisticated, data-driven approaches. AI’s ability to analyse massive datasets, identify patterns, and predict market trends has helped portfolio managers with powerful tools to enhance investment strategies.

One significant impact of AI in portfolio management is in risk assessment and mitigation. AI systems can predict market volatility more accurately and suggest diversification strategies using machine learning algorithms to minimise risk. For instance, in 2018, BlackRock launched[1] an AI-driven exchange-traded fund (ETF) that uses algorithms to select stocks based on market sentiment, news, and other data sources.

Additionally, AI has enabled the development of sophisticated robo-advisory services[2]. These platforms use AI algorithms to provide personalised investment advice and dynamic portfolio rebalancing. AI-driven finance has also democratised access to advanced portfolio management. With platforms like Diversiview, individual investors can access tech-driven portfolio management tools that were once available only to institutional investors. These tools use AI to optimise portfolio allocation, ensuring investors are well-positioned to capitalise on market opportunities while managing inherent risks.

In essence, AI in finance has transformed portfolio management and redefined it, making it more efficient, personalised, and accessible.

Optimising Portfolio Allocation with AI

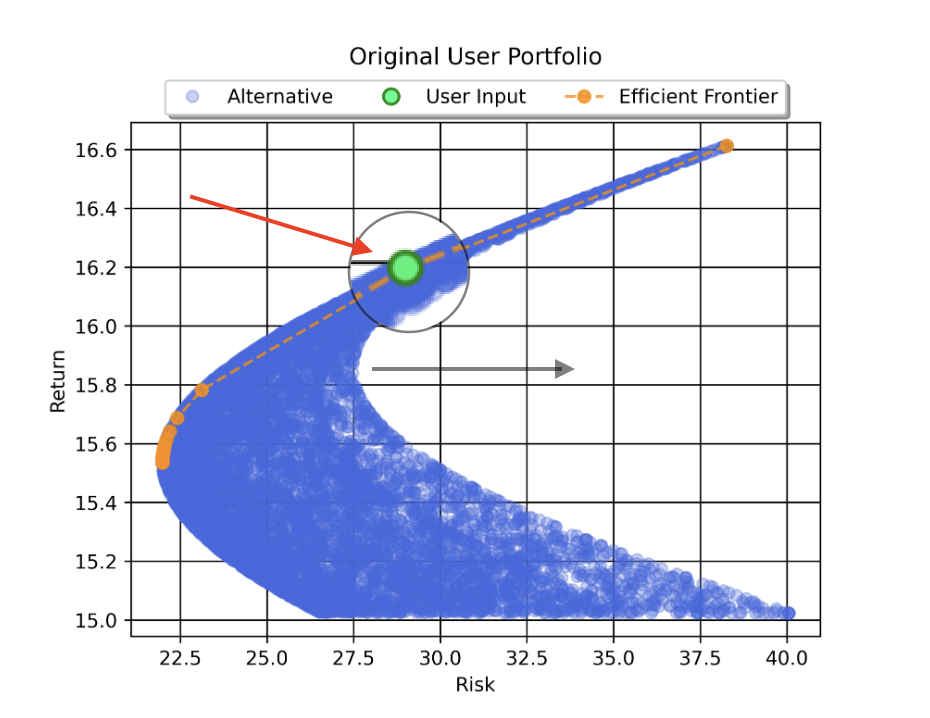

Optimising portfolio allocations is crucial for balancing risk and maximising returns. AI-driven strategies have significantly enhanced this aspect of portfolio management, enabling a more nuanced and responsive approach. AI excels in processing vast amounts of data – from market trends and economic reports to geopolitical events – and extracting actionable insights, a task too complex for humans alone.

One of the key strengths of AI in optimising portfolio allocation lies in its predictive analytics. By employing machine learning models, AI can forecast market movements and suggest allocation strategies that align with these predictions. This capability allows for proactive adjustments in portfolio composition, potentially increasing resilience against market downturns and capitalizing on growth opportunities.

Diversiview embodies the power of AI for portfolio optimisation. It leverages AI algorithms to analyse an investor’s portfolio against current market conditions, providing recommendations for allocation that optimise for desired outcomes, whether risk minimisation, return maximisation, or a balance of both.

AI has transformed portfolio allocation from a static, one-time exercise into a dynamic, ongoing process. Platforms like Diversiview are at the forefront of this transformation, harnessing the power of AI in fintech to provide investors with sophisticated yet user-friendly tools for financial success.

Planning for Financial Success in the AI Era

The AI era has unlocked financial planning for the masses, offering investors advanced tools to craft more informed, data-driven strategies for financial success. To harness the full potential of AI-driven finance, investors need to embrace these technologies and integrate them into their investment planning process.

Firstly, leveraging AI for financial forecasting can provide a significant edge. AI’s ability to analyse historical data, recognise patterns, and make predictions about future market trends can inform investment decisions and risk management strategies. Investors should seek platforms with predictive analytics to attempt to anticipate market movements and adjust their portfolios accordingly.

Secondly, investors should consider incorporating AI tools like Diversiview into their investment planning for enhanced portfolio analysis and optimisation. Diversiview’s AI algorithms can assess an investor’s portfolio in real-time, suggesting adjustments based on changing market conditions and personal financial goals. This proactive approach to portfolio management ensures that investments remain aligned with individual risk profiles and financial objectives.

Additionally, AI can aid in scenario analysis and stress testing. Investors can use AI tools to simulate different market conditions and test how their portfolios might perform, allowing them to adjust ahead of time.

Future Trends in AI Finance

The future of AI in finance promises a landscape rich with innovation and unprecedented advancements. As AI technology evolves, we can anticipate a deeper integration into various aspects of financial services. One significant trend is the development of more sophisticated AI algorithms capable of understanding and interpreting complex financial regulations and compliance requirements, potentially changing the compliance and regulatory framework within the financial industry. Anyone who has worked in the industry knows how cumbersome and challenging they can be.

Another emerging trend is the use of AI in enhancing personalised financial services. Future AI systems are expected to offer hyper-personalised financial advice and products tailored to individual customer profiles made from their financial behavior, preferences, and goals. This customisation will extend beyond investment advice to include all aspects of personal finance management.

AI is also likely to play a pivotal role in detecting and preventing financial fraud. Advanced machine learning models, capable of detecting anomalies and patterns indicative of fraudulent activities, will become more refined, offering stronger security layers in financial transactions and operations.

Moreover, integrating AI with blockchain technology and the growing field of decentralised finance (DeFi) could create entirely new financial products and services, further expanding AI in finance.

Conclusion

AI has undeniably transformed fintech and investment strategies, offering tools and insights that were previously unimaginable. As we go further into this AI-driven era, platforms like Diversiview stand at the forefront, empowering investors with advanced, AI-powered tools for making strategic financial decisions. Embracing these AI-driven tools is not just about keeping up with technological advancements; it’s about harnessing their potential to achieve financial success and security. The journey of AI in finance is just beginning, and its full potential is yet to be realised, offering exciting possibilities for the future of investment and financial planning.

[1] https://www.barrons.com/articles/blackrock-unveils-7-a-i-powered-sector-etfs-1521826251

[2] https://www.forbes.com/sites/ilkerkoksal/2020/04/18/how-ai-is-expanding-the-applications-of-robo-advisory/

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.