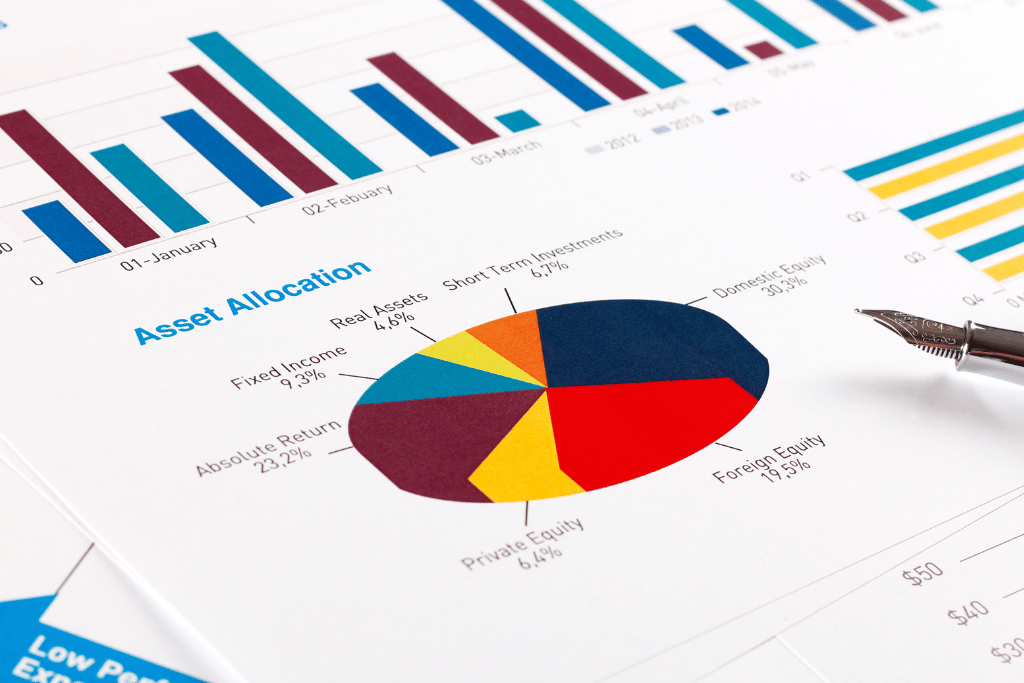

Asset allocation, the strategy of distributing investments across various asset classes like stocks, bonds, and real estate, is a fundamental practice for investors in Australia and around the world. It’s a balancing act designed to maximise returns while managing risk, tailored to your unique goals and the ever-changing economic and political landscape.

Model portfolios, pre-designed investment options encompassing these asset classes, offer a structured approach based on comprehensive research and expert insights. But with today’s increasingly interconnected financial markets, even the best model portfolios need constant optimisation to navigate market fluctuations.

This is where asset allocation optimisation comes in, a crucial step for investors seeking smarter and more resilient portfolios. Studies suggest that a significant portion of a portfolio’s return can be attributed to its asset mix, highlighting the importance of getting it right. Here’s where innovative financial technology solutions like Diversiview can empower Australian investors.

Asset Allocation and Its Significance with Diversiview

Asset allocation is grounded in the principles of diversification and risk management. By spreading investments across different asset classes, investors can buffer against market volatility, enhancing stability and potential returns. This process is not a one-size-fits-all approach. It requires a tailored strategy based on individual investor goals, risk tolerance, and time horizons. Strategic asset allocation aligns your investment portfolio with these personal factors, enabling a responsive and effective investment strategy in the Australian financial market.

Diversiview, a powerful portfolio analysis and optimisation software, can be incredibly helpful in navigating this process. It empowers you to take an active role in optimising your asset allocation within model portfolios:

- Analyse your current asset allocation and identify areas for improvement using Diversiview’s comprehensive tools.

- Explore optimised asset allocations identifying the optimal portfolio to balance Risk-Return or the Minimum Risk Portfolio.

- Visualise the Efficient Frontier positions to discover the asset allocation that best aligns with your risk tolerance and investment goals.

Model Portfolios and Robo-Advisors

Model portfolios are professionally curated collections of investments designed to meet specific financial goals and risk profiles. These portfolios often encompass asset classes such as equities, fixed income, commodities, and alternatives, seeking a balanced risk-return profile, depending on what risk bucket you fall into. They represent a ready-made solution for investors, providing a structured pathway to investment based on comprehensive research and expert insights.

Robo-advisors have emerged as a modern and innovative extension of this concept, particularly prominent in Australia’s investment scene. These automated platforms leverage algorithms and artificial intelligence to provide asset allocation advice and manage investments on behalf of the client. They consider a specific risk tolerance and time frame, creating and dynamically adjusting a model portfolio accordingly.

One of the drawbacks of model portfolios is the inability to offer really personalised asset allocation. They will match an investor with one pre-made portfolio that is mapped to a risk tolerance range; the same portfolio will be recommended to many other investors within that risk tolerance range. While this approach allows robo-advisors to serve a large number of investors, arguably investors’ personal return needs will differ; moreover, there would be always differences between investors’ level of risk tolerance within the same range.

Another drawback of model portfolios is the frequency of adjusting to market conditions. The robo-advisor may implement an annual frequency for the rebalancing of all their model portfolios, however other frequencies (e.g. quarterly) may give better results for some portfolios (e.g. those that are more volatile and may be impacted more by market dynamics).

Optimising Asset Allocation in Current Market Conditions

The importance of optimising asset allocation cannot be understated. Trying to optimise a portfolio amid current market trends, driven by global economic factors, technological advancements, and regulatory changes, presents opportunities and challenges for investors and financial advisors alike.

Optimising asset allocation requires a keen understanding of market dynamics and the ability to adapt investment strategies accordingly. It involves identifying the right mix of asset classes and continuously rebalancing portfolios to align with changing risk-return profiles. Factors such as interest rates, inflation, geopolitical developments, and industry-specific trends are just a few of the important ones to monitor and adjust your allocations accordingly. Diversiview can be a valuable tool by helping you rebalance your portfolio regularly.

The Future of Technology in Asset Allocation

The field of asset allocation is poised for transformation, thanks to emerging technologies and innovations. As the financial world continues evolving, integrating artificial intelligence (AI), machine learning, and other advanced technologies is revolutionising asset allocation.

AI and machine learning, for example, can analyse vast amounts of data rapidly, allowing for more nuanced and timely asset allocation decisions. These technologies can automate the process, creating efficiencies and allowing for more dynamic adjustments in response to market fluctuations.

While AI and machine learning offer exciting possibilities, there’s a crucial human element to consider: investor understanding and control. Diversiview bridges this gap by empowering investors to actively participate in the optimisation process alongside these powerful technologies.

Here’s how Diversiview integrates seamlessly with the future of asset allocation:

- Diversiview uses Modern Portfolio Theory to analyse complex market data and suggest optimised asset allocation strategies based on your unique goals and risk tolerance. However, the final decision on implementing these strategies remains firmly in your hands. Diversiview empowers you to understand the rationale behind the suggestions and make informed choices about your portfolio.

- As the financial landscape continues to evolve, the ability to adapt your asset allocation is paramount. Diversiview’s scenario modeling capabilities allow you to test different investment strategies under various market conditions. This empowers you to make proactive adjustments and build resilience into your portfolio for a more dynamic future.

- You’ll always have a transparent view of the data and analysis driving the suggested asset allocation strategies, allowing you to make confident investment decisions. With access to features such as Strategy Backtesting, Granular Diversification and Efficient Frontier positions, you will always be empowered with the necessary data needed to make confident investment decisions.

The future prospects for technology in asset allocation are bright. Continually developing new tools and platforms, like Diversiview, opens doors to innovative strategies and methodologies. Investors and financial professionals should remain attentive to these technological shifts. The fusion of technology and investment strategy, with a human-centric approach like Diversiview, heralds a new era in investment management that promises to be both exciting and impactful.

Challenges and Considerations

Optimising asset allocation comes with various challenges and considerations, with some listed below:

- Changing Economic and Political Landscape: The complexity of ever-changing economic and political conditions can make previous allocation strategies ineffective.

- Ethical Considerations: With the emphasis on socially responsible investing, aligning with regulatory compliance and industry standards is important.

- Continuous Monitoring and Adjustment: Markets are fluid, and strategies must be regularly reviewed and adjusted to align with investor goals and market conditions.

- Potential Challenges in Implementation: Utilising new strategies in response to market dynamics requires careful planning and may encounter unforeseen obstacles.

- Compliance Factors: Adhering to legal and regulatory guidelines is difficult but necessary in asset allocation to avoid potential legal consequences.

Optimising asset allocation requires a careful balancing act, considering both the pursuit of optimal returns and the adherence to ethical and compliance guidelines. Whether through robo-advisors or human financial advisors, the approach must be thoughtful and vigilant.

Conclusion

Asset allocation optimisation is paramount in today’s dynamic investment landscape. By leveraging robo-advisors and innovative tools like Diversiview, investors can create and manage portfolios that align with their goals and navigate market fluctuations. Diversiview empowers Australian investors to actively participate in the optimisation process alongside powerful AI and machine learning, fostering a deeper understanding and control over their financial future. This convergence of technology and financial prudence represents a significant step towards smarter and more resilient investing.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.