The stock market offers exciting investment opportunities, but navigating its volatility can be challenging. Diversifying your portfolio with various assets is crucial, but how do you ensure the optimal allocation for maximum return and minimum risk? This is where Diversiview comes in.

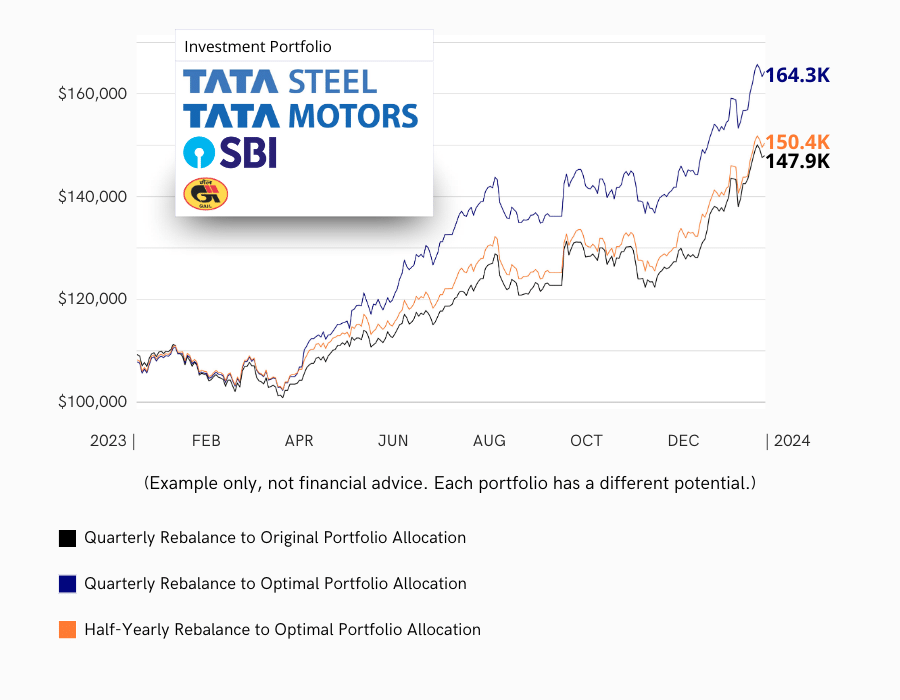

Let’s explore a scenario with four popular NSE stocks:

- Tata Steel (TATASTEEL)

- Tata Motors (TATAMOTORS)

- State Bank of India (SBIN), and

- GAIL Limited (GAIL)

Imagine you invested an initial ₹100,000 in these stocks in January 2022. Diversiview would analyse historical data with backtesting to calculate an optimal asset allocation for the ideal balance between risk and return. This allocation wouldn’t be static, and with the help of Diversiview, investors can continuously optimise their portfolio.

The Power of Regular Optimisation

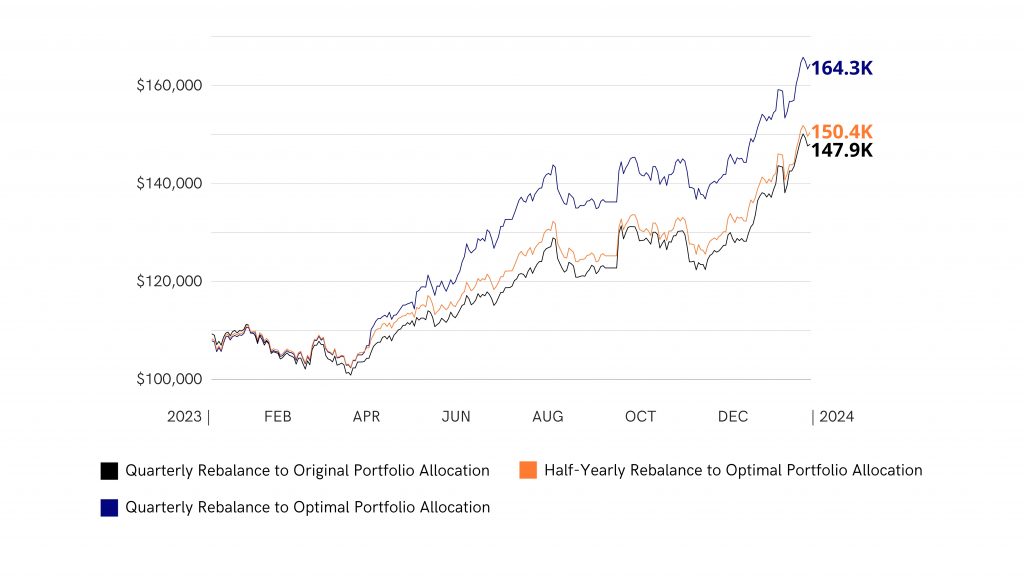

We compared three portfolios with the same initial investment but different rebalancing frequencies:

- Rebalance to Original Weightings: Initial optimal allocation held for 2 years.

- Quarterly Rebalancing: Optimised every 3 months.

- Half-yearly Rebalancing: Optimised every 6 months.

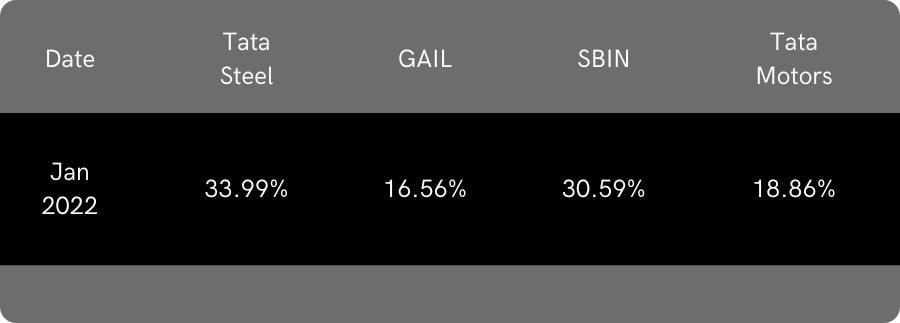

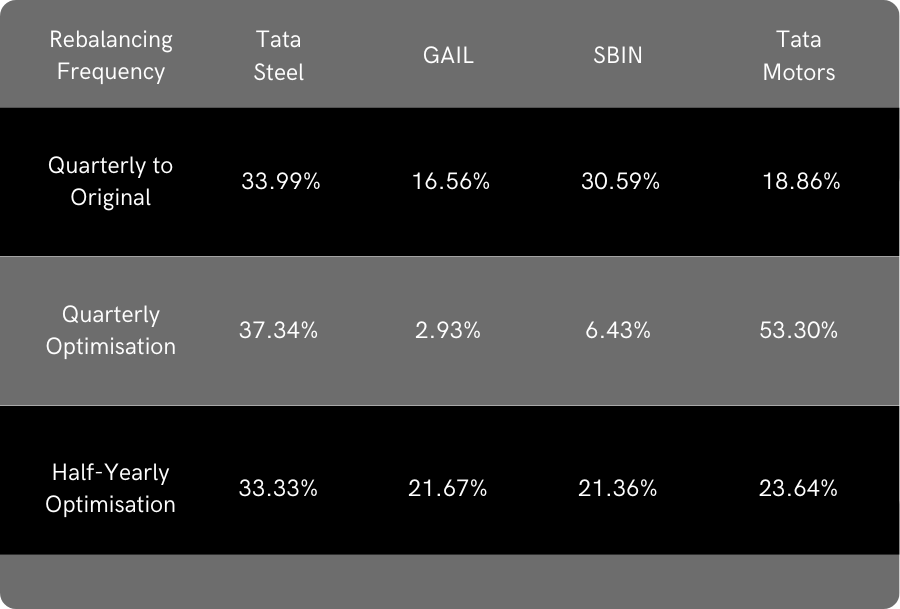

All portfolios were initially optimised in January 2022 with the following allocation:

Diversiview’s strength lies in its ability to adapt to market fluctuations. As the market conditions changed, the optimal allocation for each stock also changed significantly over time. This highlights the potential benefits of regular optimisation, which goes beyond simply rebalancing to the original weights. Here is a notable instance of the asset allocation in April 2023:

Expected Portfolio Performance

The graph showcases the overall performance of the three strategies between January 2023 and January 2024. While the portfolio that was rebalanced to the original allocation did see growth, reaching a potential return of ₹147,900 by January 2024, it significantly underperformed compared to the rebalanced portfolios. The quarterly rebalanced portfolio achieved the highest potential return of ₹164,300 by January 2024, followed by the half-yearly rebalanced portfolio with ₹150,400. This highlights the potential benefits of regular rebalancing, especially in a dynamic market.

It is important to note that this portfolio demonstrates the potential benefits of regular portfolio optimisation using a specific set of stocks. The results achieved are not guaranteed and may not apply to all portfolios. Regular optimisation is a valuable practice, but every portfolio is unique. Market conditions and individual goals significantly impact performance. Diversiview helps you create an optimised portfolio based on your specific risk tolerance and investment goals.

How Diversiview Empowers You

Diversiview equips you with the tools to make informed investment decisions:

- Optimal Asset Allocation gives data-driven insight for allocating your funds across chosen stocks, with the ideal balance between risk and return.

- Regular Rebalancing helps you stay on track by optimising your portfolio based on historical data.

- Portfolio Backtesting visualises the performance of your portfolio using your investment’s market fluctuations of the previous three years.

Don’t leave your portfolio’s potential to chance! Get a free Diversiview analysis today and experience the power of data-driven investing.