Maintaining a diversified portfolio is crucial for long-term investment success. However, market fluctuations can cause asset class allocations to drift from your initial targets. This is where portfolio rebalancing comes in. This case study explores three common portfolio management strategies and compares their performance over a three-year period (February 2021 – June 2024) using a real model portfolio from a provider, containing a mix of ETFs :

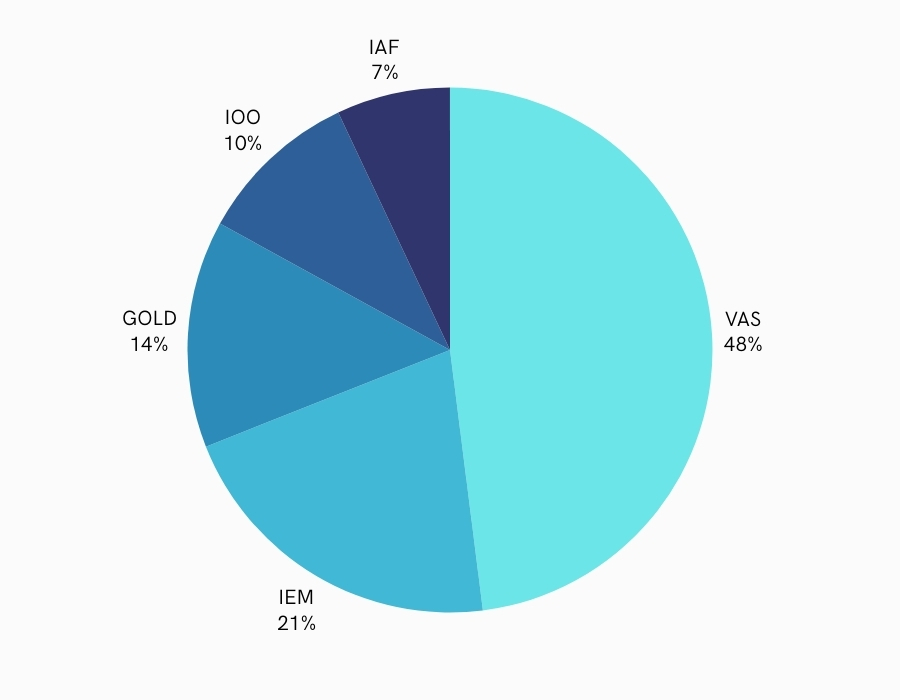

- Vanguard Australian Shares Index ETF (VAS): Tracks the performance of the S&P/ASX 300 Index.

- iShares Global 100 ETF (IOO): Tracks the performance of the largest 100 companies outside the US.

- iShares Emerging Markets ETF (IEM): Tracks the performance of companies in emerging economies.

- iShares Core Composite Bond ETF (IAF): Invests in a diversified basket of investment-grade US bonds.

- Global X Physical Gold (GOLD): Tracks the price of physical gold bullion.

In this example, the sample portfolio was initially (Feb 2021) allocated as follows:

Portfolio Management Strategies

In this example we look at 3 popular approaches:

Strategy A: Buy and Hold – This strategy involves purchasing the initial asset allocation and holding the portfolio without rebalancing.

Strategy B: Rebalance to Original Allocation – This strategy rebalances the portfolio back to the initial allocation annually in February.

Strategy C: Rebalance to Optimal Allocation – This strategy rebalances the portfolio to a new, calculated optimal allocation using Diversiview each year in February. The backtesting data used for the optimal allocation strategy only considered historical data available from the time the portfolio was opened. For example, the first rebalance in 2022 only considered one year of data (Feb 2021-Feb 2022), while the third rebalance in 2024 used three years of data (Feb 2021 – Feb 2024).

Key Differences Between Portfolio Management Strategies

The three strategies differ in their level of portfolio management activity.

- Strategy A: Buy and hold requires no user intervention but allows allocations to drift from the target.

- Strategy B: Rebalancing to the original allocation maintains the initial diversification but may not reflect changing market conditions.

- Strategy C: Rebalancing to an optimal allocation offers the potential for improved performance. While it requires more specialised skills, there are tools like Diversiview that can help you calculate your optimal portfolio allocation and send you alerts when the portfolios risk level fluctuates outside your comfort zone.

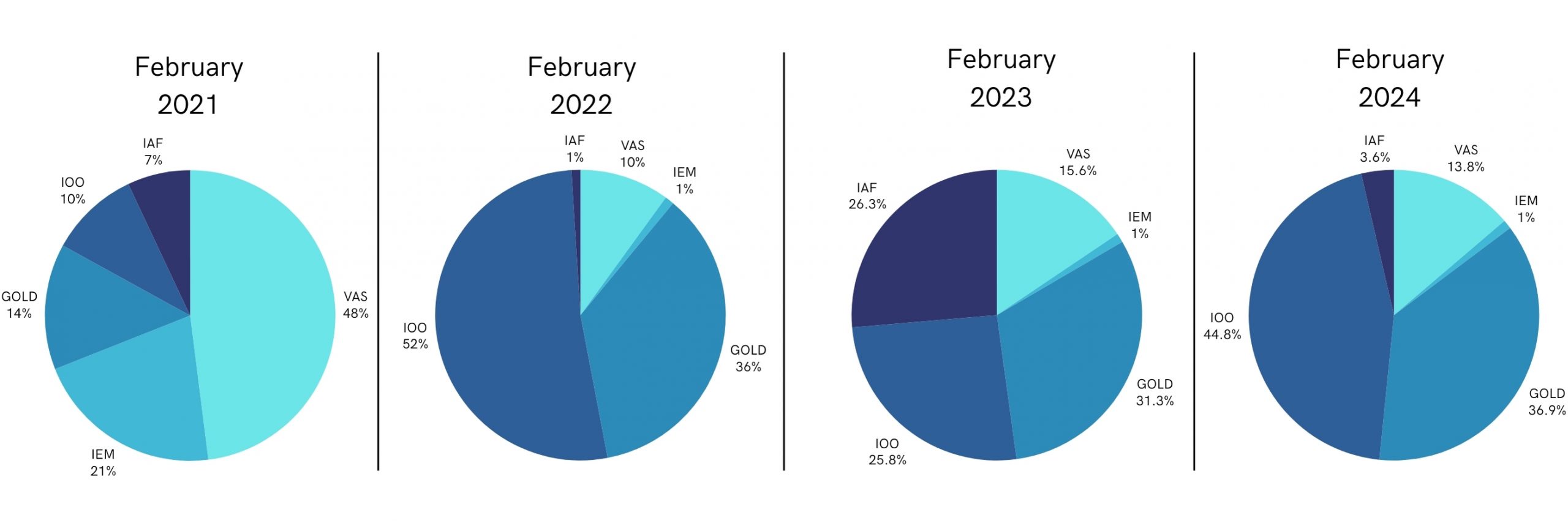

Optimal Portfolio Allocation

Strategy C employs a dynamic approach, rebalancing the portfolio to a new optimal allocation each year in February. This optimal allocation is calculated by Diversiview using mathematical algorithms based on the Modern Portfolio Theory. The result is a potentially more efficient portfolio that adapts to changing market conditions.

Here, we can see the impact of this dynamic approach on the portfolio allocation over the three years. Each pie chart will represent the optimal allocation for a specific year. By comparing these pie charts, we can observe how the optimal asset allocation is adjusted year-over-year. This will provide valuable insights into how Strategy C actively seeks to optimise portfolio performance and increase expected returns.

Strategy Comparison

The line graph reveals a compelling story about the performance of each strategy over the three-year period, from a starting value of $100K in Feb 2021.

- Strategy A: The buy and hold approach achieved a final value of $120.2K.

- Strategy B: While being the most common practice, the rebalance to original allocation strategy ended at $117.7K, resulting in both other rebalancing strategies outperforming it. Demonstrating that maintaining the initial allocation may have missed opportunities for better returns.

- Strategy C: Notably, the rebalance to optimal allocation strategy achieved the highest value of $130.5K. This suggests that the dynamic rebalancing to the optimal asset allocation captured favorable market movements, ultimately leading to a higher overall portfolio value.

For Strategy B and C, transaction fees for buying and selling respective securities upon rebalancing were also considered.

How Diversiview Empowers You

Diversiview equips you with the tools to make informed investment decisions:

- Optimal Asset Allocation gives data-driven insight for allocating your funds across chosen investments, with the ideal balance between risk and return.

- Regular Rebalancing to optimal portfolio positions helps you stay on track by optimising your portfolio based on historical data.

- Portfolio Backtesting visualises the performance of your portfolio using your investment’s market fluctuations of the previous three years.

Don’t leave your portfolio’s potential to chance! Get a free Diversiview analysis today and experience the power of data-driven investing.

Disclaimer: This portfolio management strategy comparison demonstrates the potential benefits of periodically rebalancing to the optimal portfolio allocation. The results achieved are not guaranteed and may not apply to all portfolios. Regular optimisation is a valuable practice, but every portfolio is unique. Market conditions and individual goals significantly impact performance. Diversiview helps you calculate optimised portfolio allocations that you need to match to your specific risk tolerance and investment goals.