Portfolio management is a critical aspect of investing, involving a delicate balance of risk, reward, and strategy. One of the essential tools used in effective portfolio management is portfolio backtesting. Backtesting is a way to simulate the performance of a portfolio or strategy using historical data to gain insights into its potential future performance. It’s an essential element in crafting investment strategies, allowing investors to quantify potential risk, optimize and backtest portfolio asset allocation, and anticipate performance based on past market conditions. With backtesting, investors can confidently make informed decisions, reducing the probability of unwelcome surprises. Backtesting holds immense importance, actively offering an objective lens to evaluate and refine your investment strategy critically.

What is Portfolio Backtesting and its Benefits?

Portfolio backtesting is a technique used in finance to assess the viability of a trading strategy or portfolio design. It involves applying trading rules to historical market data to determine how a portfolio would have performed during that time. This simulation process allows investors to assess the effectiveness of a strategy or portfolio design without risking any actual capital.

Backtesting has numerous benefits. Firstly, it allows for risk assessment. By running a strategy against past market conditions, investors can observe how the portfolio would have reacted to various market events, thereby better understanding potential risk levels.

Secondly, backtesting validates your strategy. If a portfolio performs well during backtesting, it provides confidence that the strategy could perform similarly in the future. However, it’s important to remember that past performance does not guarantee future results but provides a useful benchmark.

Lastly, backtesting can help improve performance. By tweaking various parameters and observing the resulting changes in performance, investors can optimize their strategies for better returns.

With these benefits, it’s clear that backtesting is a powerful tool in any investor’s arsenal. By using a systematic approach to validate strategies and manage risk, backtesting can contribute significantly to an investor’s success.

How to Backtest a Portfolio

Understanding how to backtest a portfolio is vital for any investor. The process involves several steps:

- Define Your Strategy or Portfolio Allocation: This is the first and most crucial step. It would be best to understand what you want to test clearly. This could be a specific investment strategy, a combination of different asset classes, or a selection of specific stocks or bonds.

- Collect Historical Data: Once you have your strategy or allocation in place, you need to gather historical data relevant to your portfolio components. This data might include price data, dividend history, and market events. Reliable sources for such data include financial news sites, financial databases, and investment platforms.

- Run the Simulation: With your strategy and data in place, you can now run the backtest. This involves applying your strategy or allocation to the historical data and observing its performance. Some investors do this manually, while others use backtesting software for efficiency and accuracy.

- Analyze the Results: Once the simulation is complete, you need to analyze the results. Look at total return, Sharpe ratio, and maximum drawdown metrics. These can help you assess the strategy’s performance, risk, and potential for future success.

- Refine Your Strategy: Backtesting is an iterative process. Based on the results, you may need to adjust your strategy or allocation and re-run the backtest. The goal is to improve the strategy until you’re satisfied with the balance of risk and return.

Choosing the Right Backtesting Software

Choosing the right backtesting software is crucial for accurate results. When considering which platform to use, you should look at several factors:

- Usability: The software should be user-friendly, even for those who are not tech-savvy. It should be straightforward to input data, run simulations, and interpret results.

- Accuracy: The software should provide accurate results. This depends largely on the quality of the historical data it uses and how well it simulates market conditions.

- The Complexity of Strategies: Some software can handle only simple strategies, while others can manage more complex ones involving multiple asset classes, rebalancing rules, and different risk measures.

- Speed: Backtesting can be time-consuming depending on the complexity of your portfolio and the length of the historical data. Good software should be able to run simulations quickly.

- Support: Check whether the software provider offers support if you encounter problems or have questions. Good customer support can make a significant difference in your backtesting experience.

- Cost: Lastly, consider the cost. While some tools to backtest a portfolio are free, others require a subscription. Consider your budget and the tool’s features to determine whether it offers good value for money.

Remember, the best portfolio backtesting software depends on your specific needs and skills. Try different options, use the best option, and never stop learning and experimenting.

Using Diversiview for Portfolio Backtesting

Diversiview is a comprehensive investment research platform that provides a robust portfolio backtesting feature. This tool allows you to simulate how your portfolio would have performed in the past, using real market data. Understanding how to use this feature can significantly enhance your investment decision-making process.

The backtesting tool in Diversiview is designed to be user-friendly and intuitive. To use it, you simply input your portfolio details, including the allocation of assets. The tool then uses historical market data to recreate how your portfolio would have performed during the past year.

The benefits of using Diversiview for backtesting are several. Firstly, it allows you to test your investment strategy against real historical data, which can provide valuable insights into its effectiveness. Secondly, Diversiview’s backtesting tool enables you to analyze your portfolio’s risk and return profile and see how it would have held up during different market conditions. This information can help you make more informed decisions about allocating your assets and managing risk.

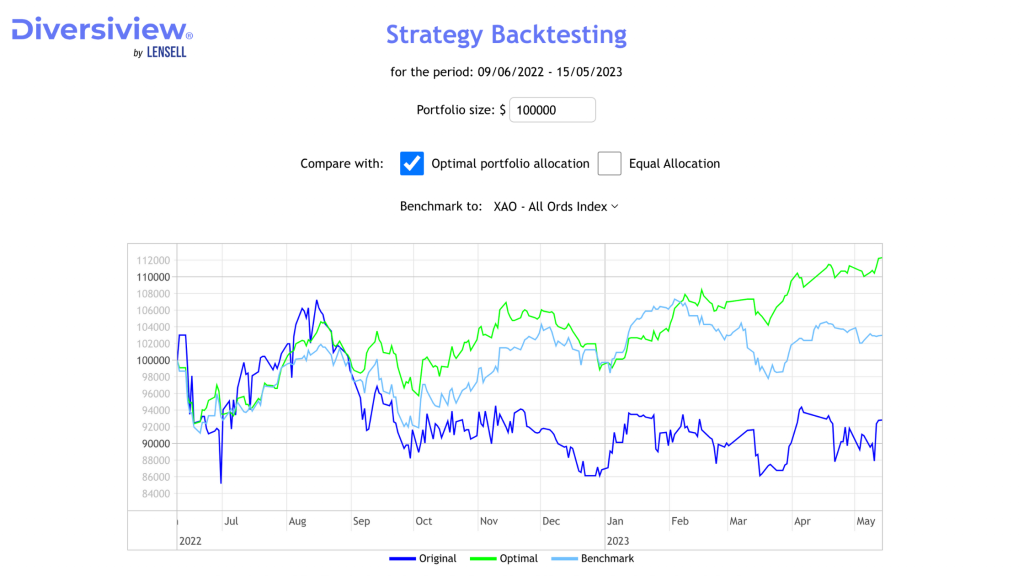

See an example below, where a portfolio’s asset allocation strategy is backtested and compared with another allocation strategy and with a major Australian index (All Ords).

Diversiview’s backtesting feature is a powerful tool for any investor. It provides a tangible way to evaluate your investment strategy, helping you understand potential risks and returns and make more informed investment decisions.

Conclusion

As an investor, being able to backtest portfolio allocation is a crucial step in the investment process. It provides you with a historical perspective on your investment strategy and helps you understand the potential risks and returns. It does not guarantee future performance, but it offers valuable insights that can inform your decisions. Moreover, using a reliable portfolio backtesting tool aids in refining your strategy by simulating different market scenarios. It’s a formidable weapon in an investor’s arsenal, helping you validate and enhance your investment strategy. Remember, though, that backtesting should always be combined with other analysis and risk assessment types. After all, the best investment strategy is balanced, incorporating historical data and future projections.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.