Investors are increasingly conscious of the environmental impact of their investments. As the climate crisis intensifies, it’s imperative to consider ethical factors when making investment decisions.

This article compares Northern Star Resources (ASX:NST) and Ramelius Resources (ASX:RMS) based on their environmental performance, providing insights for ethically minded investors.

The two securities are analysed using Diversiview, a powerful portfolio analysis tool, leveraging data from Polairis, a platform that simplifies the accessibility and interpretation of pollution data from the National Pollutant Inventory (NPI) and National Greenhouse Gas Emissions Register (NGER). This integration provides investors with deeper insights into the environmental footprint of ASX-listed securities.

Comparing Northern Star Resources and Ramelius Resources

Northern Star Resources and Ramelius Resources are both Australian gold producers listed on the ASX since 20031 2.

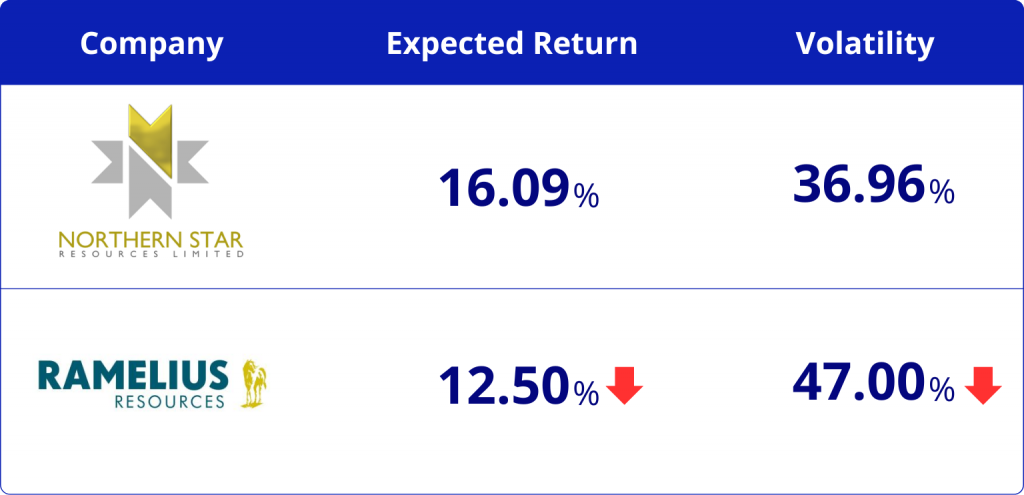

Both operating primarily in Western Australia, these companies share a similar geographic focus and industry. As of September 10, 2024, Northern Star Resources had a trading price of $14.69, while Ramelius Resources was at $2.14. Given their close proximity and similar operations, investors may want to consider factors such as expected financial performance and environmental practices when evaluating these two companies for their investment portfolios.

While these metrics suggest that Northern Star Resources is the favourable investment with both a higher expected return and a lower volatility, a deeper dive into their environmental impact is necessary for ethical investors.

Environmental Performance Analysis

Key Findings of Environmental Performance Analysis

Overall Emissions

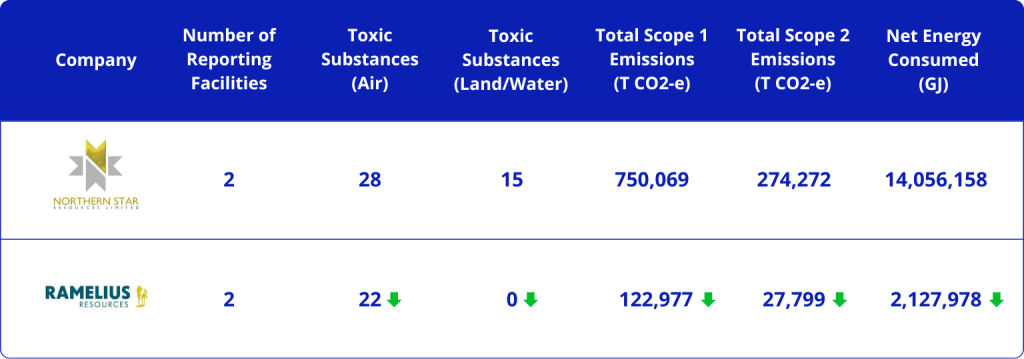

- Scope 1 Emissions: Ramelius Resources has significantly lower Scope 1 emissions (122,977 t CO2-e) compared to Northern Star Resources (750,069 t CO2-e).

- Scope 2 Emissions: Ramelius Resources has significantly lower Scope 2 emissions (27,799 t CO2-e) compared to Northern Star Resources (274,272 t CO2-e).

- Net Energy Consumed: Northern Star Resources consumes significantly more energy (14,056,158 GJ) than Ramelius Resources (2,127,978 GJ).

Threshold Breaches

- Ramelius Resources: Adheres to all emission thresholds, with no recorded breaches.

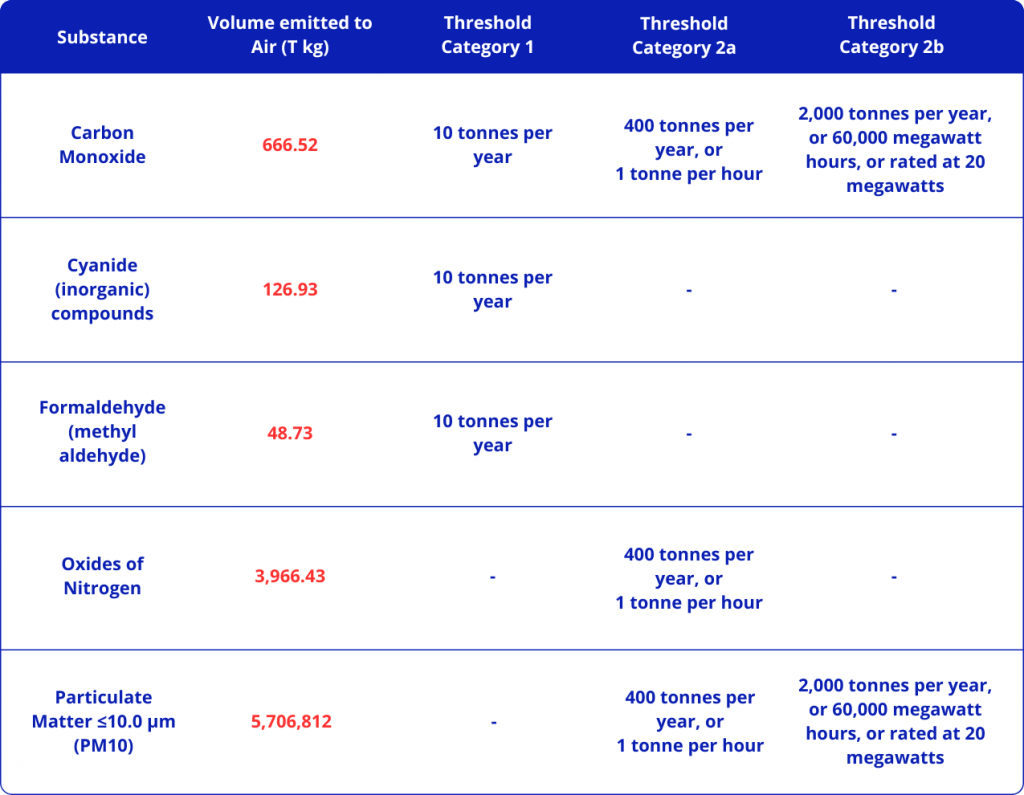

- Northern Star Resources: Exceeds emission thresholds for five toxic substances emitted to air:

Facility-Level Performance

- Ramelius Resources: Both facilities operate below emission thresholds.

- Northern Star Resources: At least one facility is exceeding emission thresholds for the listed toxic substances.

Northern Star Resources’ Sustainability Initiatives

Northern Star Resources is committed to reducing its environmental impact and has set several initiatives to achieve their goals3:

Key Goals:

- Achieve net zero Scope 1 and Scope 2 emissions by 2050.

- Reduce absolute Scope 1 and Scope 2 emissions by 35% by 2030 compared to the 2020 baseline.

Decarbonisation Projects:

- Prioritising solar, wind, and battery electric storage systems for electricity transition.

- Progressing projects at Carosue Dam, Kanowna Belle, KCGM, and Jundee to achieve decarbonisation goals.

Sustainability Initiatives:

- Establishing sustaining Indigenous Business supply contracts worth at least A$20 million per annum.

These initiatives demonstrate Northern Star Resources’ commitment to sustainability and its efforts to reduce its environmental impact.

Ramelius Resources’ Sustainability Initiatives

Ramelius Resources has made significant strides in sustainability, focusing on reducing emissions and energy consumption. Some of their highlights include4:

Key Achievements:

- Achieved a 13% reduction in Scope 1 and Scope 2 emissions from FY22 to FY23.

- Maintained an emissions intensity below the industry average for Australian gold miners.

Decarbonisation Projects:

- Developed a multi-year roadmap to reduce operational emissions.

- Investigating renewable energy sources and low-emission vehicles to reduce emissions.

- Implementing measures to optimise energy consumption and reduce emissions.

These initiatives demonstrate Ramelius Resources’ dedication to sustainability and its efforts to minimise its environmental impact.

Ethical Considerations

While Northern Star Resources offers superior financial performance, its breaches of emission thresholds and overall environmental impact raise ethical concerns. Ramelius Resources, despite its lower financial performance, demonstrates a strong commitment to environmental sustainability.

Investors must carefully weigh these factors when making investment decisions. Those prioritising financial returns may find Northern Star Resources attractive, while those seeking a more sustainable option may prefer Ramelius Resources. However, the choice ultimately depends on individual values and investment goals.

A Key Ethical Question

When evaluating these companies, investors may face a dilemma:

- Choose a company with higher financial performance but lower environmental standards.

- Choose a company with lower financial performance but stronger environmental practices.

The answer to this ethical question depends on individual priorities. Investors may prioritise financial returns, even if it means accepting some environmental compromises. Alternatively, strict adherence to emission thresholds may be a more important factor for ethically minded investors.

Diversiview’s Role

Diversiview empowers investors with data-driven insights to make informed decisions. By using Diversiview’s tools, you can assess your risk tolerance, analyse individual securities, and optimise your portfolio for both financial returns and environmental considerations.

Sign-up for a FREE Diversiview portfolio analysis and start analysing your investments’ environmental footprint today!

Note: This analysis is based on the provided data and does not constitute financial advice. All data accurate as of September 2024. Investors should conduct their own research and consult with a financial advisor before making investment decisions.

- “Intelligent Investor.” 2015. Intelligent Investor. 2015. https://www.intelligentinvestor.com.au/shares/asx-nst/northern-star-resources-ltd/float. Accessed 17 September, 2024.

↩︎ - Ramelius Resources. “Company Overview.” Ramelius Resources. https://www.rameliusresources.com.au/company-overview/. Accessed 17 September, 2024.

↩︎ - Northern Star Resources Ltd. n.d. Review of Environment & Social Responsibility Approach at Northern Star FY24. Northern Star Resources Ltd. Northern Star Resources Ltd. Accessed September 17, 2024. https://www.nsrltd.com/media/bzpltmkl/fy24-esr-suite-esr-approach.pdf.

↩︎ - Ramelius Resources. n.d. Review of RAMELIUS RESOURCES SUSTAINABILITY REPORT 2023. Ramelius Resources. Accessed September 17, 2024. https://www.rameliusresources.com.au/wp-content/uploads/bsk-pdf-manager/2024/01/Ramelius-SUSTAINABILITY-REPORT-2023.pdf.

↩︎