Investing involves a delicate balance between risk and return, necessitating strategies that maximize the latter while diligently managing the former. Central to this balancing act is Mean-Variance Optimization (MVO), a concept that lies at the heart of Modern Portfolio Theory (MPT) and is essential in achieving the Efficient Frontier – the set of optimal portfolios that offer the highest expected return for a defined level of risk. The objective of MVO is to provide investors with the analytical tools necessary to create a portfolio that offers the maximum possible return for their chosen level of risk.

Understanding Mean-Variance Optimization

Mean-Variance Optimization (MVO) is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk, defined as the variance. Its key purpose is to aid investors in making rational decisions about asset allocation by quantifying the trade-off between risk and return.

Fundamentally, MVO operates under the presumption that investors are risk-averse, requiring higher expected returns to accept additional risk. By applying the principles of MVO, investors can identify the asset allocations that yield the highest expected returns for their level of risk tolerance.

However, it’s important to understand the underlying assumptions of MVO. Firstly, it assumes that asset returns follow a normal distribution and that correlations between assets remain consistent over time. Secondly, MVO assumes that investors have rational preferences that can be explained by mean and variance alone, implying that expected returns and risk solely drive the investment decision-making process. Lastly, it assumes investors have a single-period investment horizon.

Although these assumptions don’t always hold in the real world, MVO remains a valuable tool for guiding asset allocation and portfolio optimization decisions. By providing a systematic, quantitative approach, MVO allows investors to make more informed decisions, enhancing the potential for improved investment outcomes.

Mean-Variance Optimization and Modern Portfolio Theory

Mean-Variance Optimization is a crucial component of the Modern Portfolio Theory (MPT), developed by economist Harry Markowitz in the 1950s. The MPT fundamentally shifted how investors approached portfolio construction by introducing the concept of portfolio optimization and the efficient frontier. As per MPT, the goal is to create a diversified portfolio that maximizes return for a given level of risk, and this is where MVO comes into play.

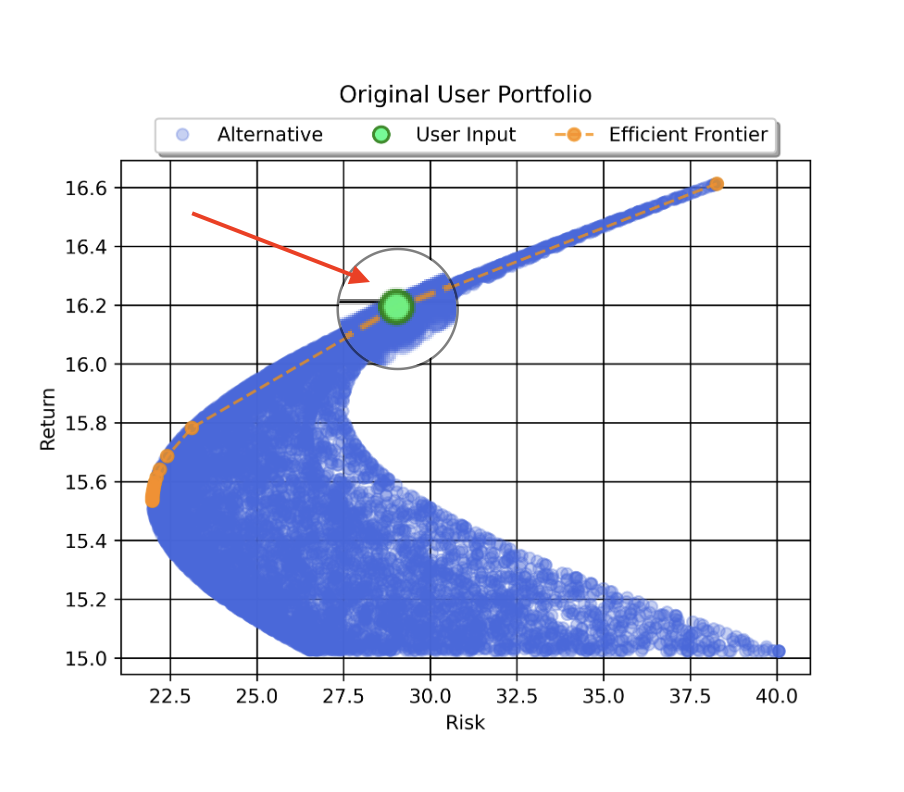

MVO uses expected returns and the covariance matrix (a measure of how different assets in the portfolio interact with each other) to find the portfolio that maximizes expected returns for any given level of risk, or minimizes risk for any given level of expected return. This optimal set of portfolios is known as the efficient frontier, a concept integral to MPT. The portfolios on the efficient frontier represent the best possible combinations of assets – those that offer the highest expected return for a specified level of risk.

While MPT and MVO have their critics, mostly due to the underlying assumptions, they are invaluable financial frameworks. They ushered in a new era of portfolio management, advocating for diversification and the systematic approach to portfolio optimization based on quantitative measures.

Practical Applications of Mean-Variance Optimization

MVO has numerous practical applications, particularly for investors seeking to optimize their portfolios. For instance, MVO helps investors understand the relationship between risk and return, thus aiding in investment decisions. By quantifying the trade-off between risk and return, MVO guides investors toward the portfolios that offer the best possible return for their risk tolerance.

In portfolio management, MVO aids in decision-making by providing insight into how diversifying investments can lower portfolio risk without necessarily reducing expected returns. This not only helps in making rational investment decisions but also forms the basis for strategic asset allocation.

Moreover, MVO’s principles underpin many of the robo-advisors and automated investing platforms that have emerged in recent years. These platforms utilize algorithms based on MVO to automatically create and rebalance portfolios according to individual investor risk preferences.

In addition to individual investors and financial advisors, institutional investors also use MVO to manage large portfolios. For example, pension funds, endowments, and mutual funds use MVO principles to build optimal portfolios that align with their investment objectives.

Overall, the real-world applications of MVO are vast and varied, demonstrating its significant role in modern finance. It’s a tool that empowers investors to understand, control, and optimize their portfolios based on their personal investment goals and risk tolerance.

Using Diversiview for Mean-Variance Portfolio Optimization

Modern technology has made complex financial analyses more accessible to everyday investors, and Diversiview is leading the way in this regard. Diversiview’s powerful portfolio optimization module is built on the principles of mean-variance optimization, making it an invaluable tool for investors.

In Diversiview, you can input your assets and their respective weights to calculate your portfolio’s expected return and risk (standard deviation). Then, by leveraging the optimization feature, you can find the optimal allocation that would provide the highest return for a given risk level, or the lowest risk for a given return. This feature brings to life the efficient frontier concept, allowing you to visually identify and select the best possible asset allocation for your investment goals and risk tolerance.

By integrating mean-variance optimization, Diversiview empowers you to take control of your financial future. The platform provides you with the insights needed to make informed investment decisions and helps you build an optimal, diversified portfolio, aligned with your unique investment goals and risk profile.

Conclusion

Understanding mean-variance optimization and its role in portfolio management is crucial for modern investors. The technique allows you to balance risk and return effectively, helping you construct an optimal portfolio that aligns with your financial goals and risk tolerance. Moreover, tools like Diversiview make implementing MVO strategies more accessible than ever, democratizing financial planning and empowering you to make data-driven investment decisions.

Remember, effective portfolio management isn’t about eliminating risk, but optimizing it, and mean-variance optimization is a powerful method to do just that.

Embrace these principles and leverage modern tools to take control of your investment journey.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.