For Sharesight users, analysing investment portfolios in Diversiview and optimising their asset allocation has never been so easy!

We have integrated Diversiview and Sharesight via APIs, which means you can seamlessly login to your Sharesight account and import any portfolio you may have, in seconds.

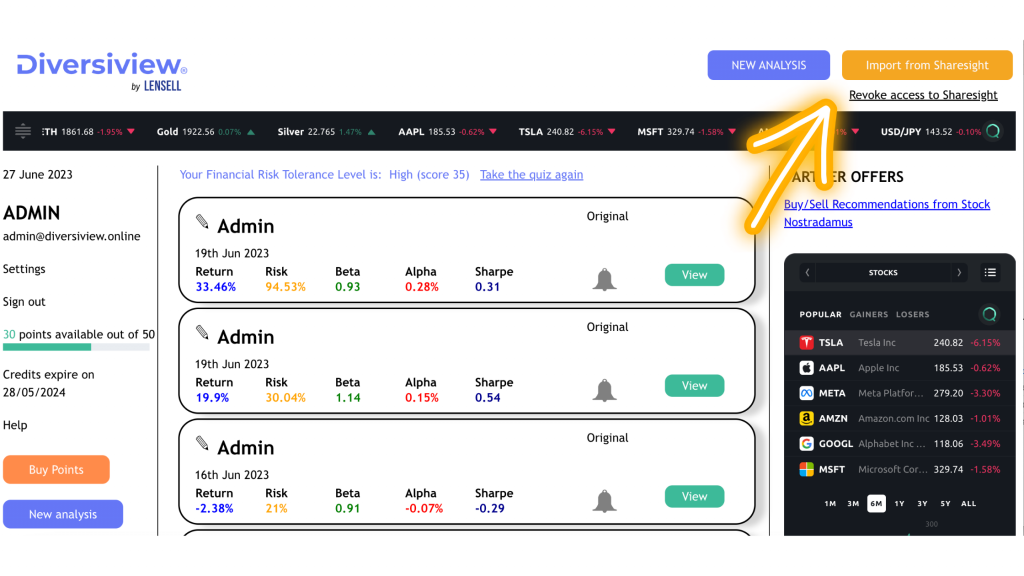

STEP 1 Simply login to your account, and you will be taken to your dashboard.

Click on the orange “Import from Sharesight” button (located in the top right corner).

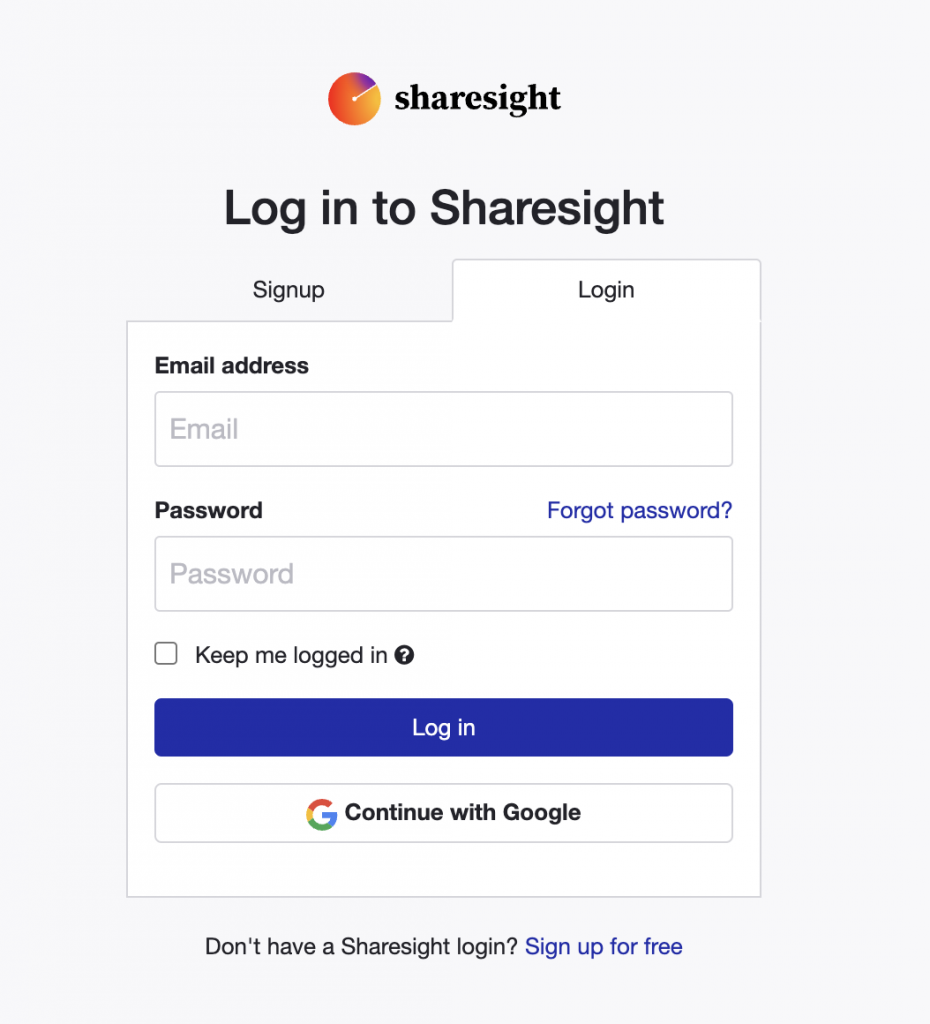

You will be prompted to login to your Sharesight account.

Note that none of your credentials are stored on our servers. We use a secure connection to Sharesight, so your credentials are validated at their end.

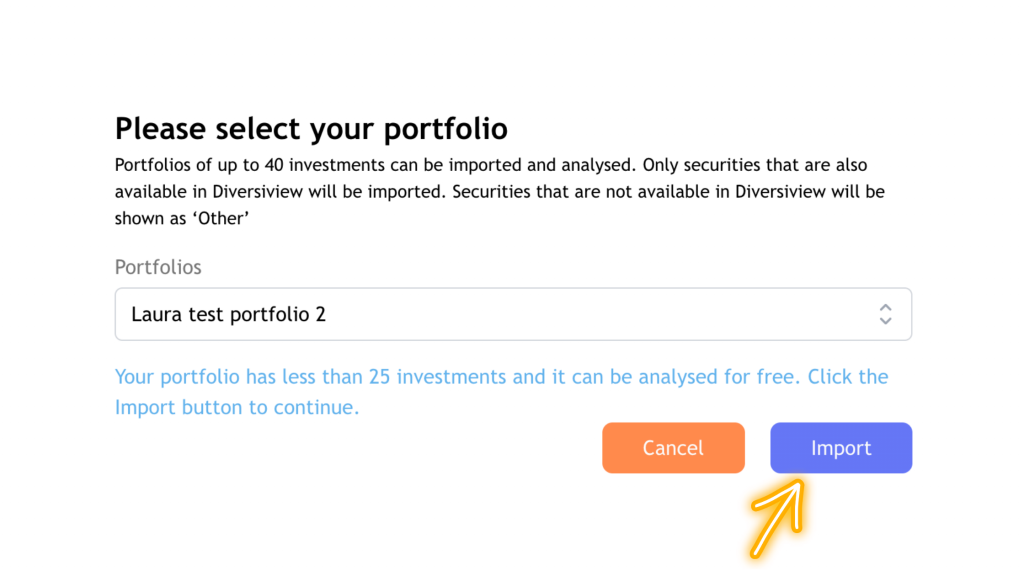

STEP 2 Once you login to Sharesight, you will be able to select any of your active portfolios on that platform.

At that time you will be also informed if your analysis can be run for free (under 25 investments) or if credit points need to be charged for it (for portfolios between 25 and 40 investments).

At this stage, portfolios of more than 40 investments cannot be analysed from your dashboard. Please contact the team at hello@diversiview.online and they will be happy to run it for you (subject to reasonable portfolio size).

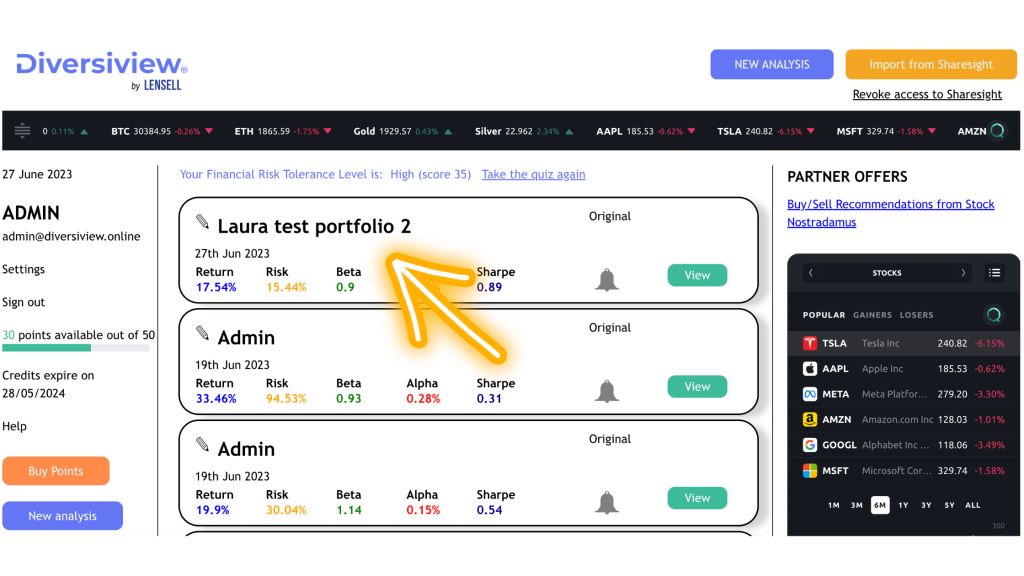

STEP 3 Clicking on the Import button will create a new portfolio analysis for you, which will be listed in your dashboard in the same way as any other analysis.

Click on the green “View” button to see the results page.

Note: All securities that are also supported in Diversiview* will be included in the analysis; non-supported securities will be grouped as “Other”.

*Currently (Jun’23) all over 2200 ASX listed securities (stocks, ETFs, bonds, mutual funds) and the top 1000 US stocks by market capitalisation (NASDAQ and NYSE) are covered. More markets coming soon.

***

The 3 steps above should take less than a couple of minutes, depending on your connection.

QUESTIONS?

Contact the team at hello@diversiview.online and we will be very happy to help.