The Importance of Global Diversification

In today’s interconnected world, global diversification is essential for building resilient portfolios. Relying solely on your home market exposes you to concentrated economic, political, and sector risks.

By investing across multiple countries and industries, you gain access to diverse growth opportunities while reducing dependence on any single market. For example:

- U.S. tech companies may outperform during innovation booms,

- while Asian consumer markets may lead during global recovery cycles,

- and European dividend stocks can provide income stability.

When combined strategically, these exposures balance one another, smoothing returns over time and improving your portfolio’s risk-adjusted performance.

Globally diversified exchange-traded funds (ETFs) make this possible, offering access to thousands of securities and regions with a single trade. As LENSELL explains, global ETFs “allow investors to tap into growth across developed and emerging markets, gain targeted sector exposure, and benefit from diverse economic cycles.”

Why Australian Investors Still Struggle with True Global Exposure

Despite Australia’s strong financial markets, many investors remain home-biased, overexposed to domestic equities, property, and a handful of large-cap names.

This happens for several reasons:

- Comfort and Familiarity – Local investors tend to stick with what they know: ASX-listed blue-chips, domestic super funds, and Australian ETFs.

- Limited Model Portfolio Options – Many “global” model portfolios in Australia are still dominated by U.S. large-caps or single-region ETFs, offering only partial diversification.

- Access and Structure Issues – International brokerage access, tax implications, and currency management can be challenging for smaller firms and retail investors.

- Lack of Optimisation – Building a genuinely efficient portfolio requires quantitative optimisation, correlation analysis, and periodic re-balancing — something not often done in static model portfolios.

The result? Many portfolios labelled as “global” don’t deliver the breadth, balance, or efficiency that investors actually need.

The Gap: Efficient Global Model Portfolios Are Hard to Find in Australia

While global ETFs are available, finding model portfolios that are both truly global and quantitatively optimised is rare in Australia.

A strong global portfolio should:

- Cover multiple regions and sectors, not just U.S. or developed markets.

- Include both developed and emerging economies for genuine diversification.

- Use low-correlation optimisation to minimise risk overlap.

- Be re-optimised regularly as market dynamics shift.

Unfortunately, few models in the local market meet these standards, which leaves Australian investors underserved.

How LENSELL’s Diversiview Model Portfolios Change That

At LENSELL, we set out to bridge this gap through Diversiview, our portfolio optimisation platform, and a new suite of Model Portfolios-as-a-Service.

Our Diversified Global Equity Leaders Model Portfolio is designed to provide investors with true global diversification and efficiency based entirely on data, not bias.

Key Features of Our Diversified Global Equity ETF Model Portfolio

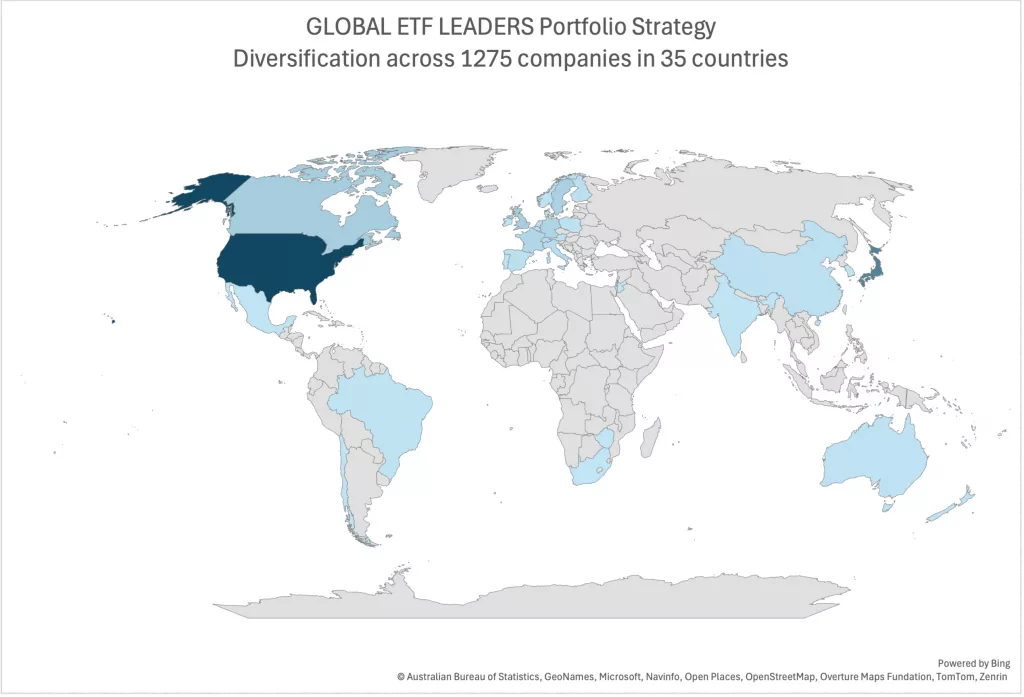

🌎 Extensive Global Coverage – The portfolio spans 1,275 securities across 35 countries, ensuring genuine geographical diversification.

📊 Quant-driven Selection & Optimisation – We select holdings with good expected performance and low correlations. We also optimise portfolio weights quarterly to maintain efficiency.

💡 Superior Performance Metrics – Since launch (3 Oct 2022), the model achieved a CAGR of 18.45 %, outperforming its benchmark (Vanguard FTSE All-World UCITS ETF) at 15.29 %, with lower volatility (9.59 % vs 11.83 %).

🔍 Transparency and Accessibility – Investors receive regular updates about the strategy composition, rebalance adjustments, and performance data.

These data points demonstrate that smart global diversification isn’t about chasing returns, it’s about creating a balanced, resilient structure for long-term success.

Why Diversiview’s Approach Works

1. Breadth Without Bias

Our model goes beyond the “U.S. and developed markets only” approach. It includes emerging markets, Asia-Pacific leaders, European innovators, and more, aligning with Modern Portfolio Theory to minimise concentration risk.

2. Dynamic Optimisation

Markets evolve. Correlations shift. Static portfolios fall behind. By re-optimising quarterly, Diversiview ensures that risk and return are constantly recalibrated based on fresh data.

3. Transparency and Evidence-Based Design

All portfolio metrics, including compound annual growth rate, volatility, and benchmark comparisons, are publicly available, giving investors full visibility.

4. Accessibility for Australians

Because many global strategies are built for U.S. investors, Australian access is often limited. Diversiview’s global model portfolios are built and managed with Australian investors in mind, simplifying global exposure within familiar investment environments.

What This Means for Australian Investors and Advisers

For financial advisers, wealth managers, and SMSF trustees, access to a truly global, quantitatively-optimised model portfolio opens new opportunities:

- Expand client offerings beyond local markets.

- Demonstrate strong risk-adjusted performance metrics.

- Build scalable, research-backed global strategies.

- Offer clients control and transparency without managed-account fees.

For individual investors, global diversification helps:

- Reduce risk concentration in Australia’s resource-heavy economy.

- Access growth drivers from innovation hubs worldwide.

- Smooth returns through regional economic cycles.

Risks and Responsible Investing

Even globally diversified portfolios carry risks, including market, currency, and geopolitical factors. However, quantitative diversification helps mitigate these by ensuring exposures are balanced and risk is spread intelligently.

LENSELL’s approach doesn’t eliminate risk; it manages it. By understanding and modelling correlations, we aim to deliver efficient diversification, not overexposure to any single market.

Global Investing for a Global Economy

In a world where capital and opportunity move fluidly across borders, investors can no longer afford to think locally. Global diversification is the key to resilience, and efficient global model portfolios are the tools to achieve it. Yet in Australia, finding model portfolios that are truly global, transparent, and data-driven has long been difficult, until now.

With Diversiview by LENSELL, investors and advisers alike can access portfolios designed to optimise global exposure, manage risk, and outperform traditional benchmarks.

It’s time for Australian investors to look beyond borders, because in a global economy, your portfolio should be global too.

Explore Diversiview’s Global Model Portfolios

Visit LENSELL Marketplace to learn more about our Diversified Global Equity Leaders Model Portfolio and see how global diversification can work smarter for you.

Disclaimer:

LENSELL GROUP Pty Ltd, ACN 646 467 941, trading as LENSELL, is a Corporate Authorised Representative of Foresight Analytics & Ratings Pty Ltd ( Australian Financial Services Licence No. 494552). All information provided to you by LENSELL is intended for general informational purposes only. It does not consider your individual financial circumstances and should not be relied upon without consulting a licensed investment professional or adviser.

The content on this website and in any of its applications is not a financial offer, recommendation, or advice to engage in any transaction. Investment products referenced in our software or marketing literature carry inherent risks, and you should note that past performance does not guarantee any future results. In all our modelling, no transaction costs or management fees are factored into performance analysis.

The information on our website or our mobile application is not intended to be an inducement, offer or solicitation to anyone in any jurisdiction in which LENSELL is not regulated or able to market its services.

Furthermore, all information used across our platform or website may be based on sources deemed reliable but is provided “as is” without guarantees of accuracy or updates. LENSELL and Foresight Analytics & Ratings disclaim all warranties and accepts no liability for any loss or damage resulting from use or reliance on any material or data embedded in our technology platform or digital media. Where liability cannot be excluded by law, it is limited to resupplying the information.

Please view our Financial Services Guide, Terms Of Service and Privacy Policy before making any investment decision using the information available on our website or on any of our applications. LENSELL, Diversiview and TableBits are trademarks registered in Australia.