There are many investing strategies to take advantage of, and knowing which one to take is sometimes overwhelming. Among the many approaches, growth and momentum investing stand out as two common ways that have attracted significant attention from both novice and experienced investors alike.

As the name suggests, growth investing zeroes in on companies projected to grow at an above-average pace, promising potential high returns. Whereas momentum investing capitalises on market trends, riding the waves of stocks that exhibit strong performance patterns.

Below, we will look into growth and momentum investing, unpacking their principles, advantages, and potential pitfalls.

Growth Investing Explained

Growth investing is a strategy centered on capital appreciation. At its core, growth investors seek companies poised for rapid expansion, betting that these businesses will continue to do well, leading to increasing stock prices. Such companies often have some innovation, disruptive technologies or are gaining a stronghold in emerging markets, setting them apart from their competitors.

While these businesses might not always pay stockholders a dividend, their reinvestment into operations or research often fuels their growth trajectory. This differentiates growth stocks from dividend or value stocks, which might offer more consistent returns.

One of the primary metrics for identifying a potential growth stock is its Earnings Per Share (EPS). A consistently rising EPS over consecutive quarters or years can signal a company’s ability to increase its profitability. Sales growth is another pivotal indicator. Even in challenging economic environments, a company witnessing steady revenue growth can testify to its resilience and potential to expand.

However, like any investment strategy, growth investing comes with risks. The projected growth might not always materialise, leading to volatile stock prices. So, while the rewards can be substantial, investors should research and understand the company’s fundamentals and growth prospects before investing.

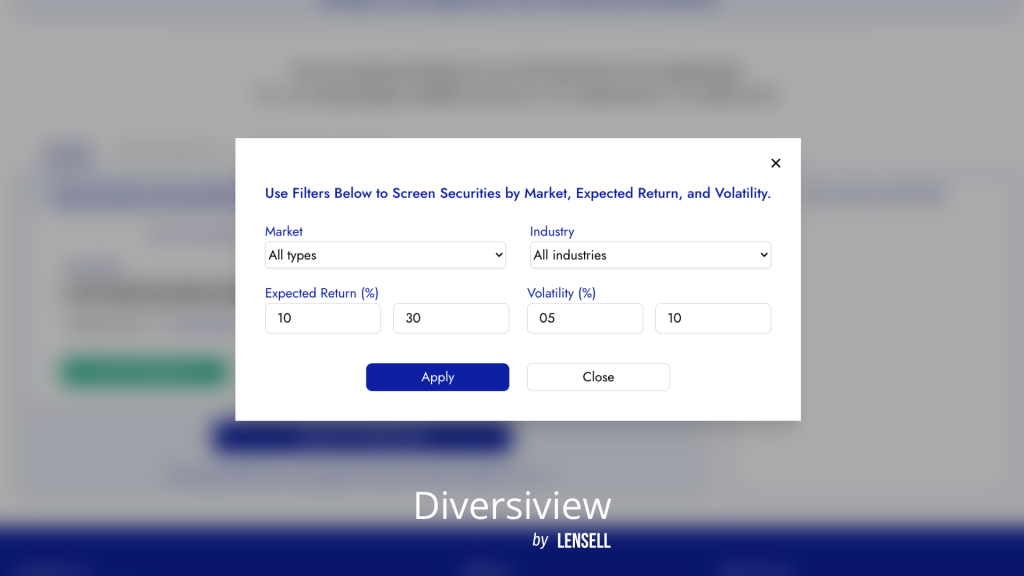

These metrics can be analysed and compared using a variety of online tools. Diversiview, for instance, offers comprehensive portfolio analysis and optimisation features that can help investors identify potential growth stocks. The Diversiview Explorer Page allows you to screen for companies by their expected return and volatility.

Advantages and Risks of Growth Investing

Growth investing offers numerous advantages, attracting investors to this strategy. The most important is the potential for high returns. As growth stocks represent companies on the brink of significant expansion, the uptick in their stock prices generally outpaces the general market, leading to impressive capital gains.

Another compelling advantage is diversification. Including growth stocks in a portfolio introduces an asset class that behaves differently from value or dividend stocks. This diversification can act as a buffer in certain market conditions, even if it might seem counterintuitive given the inherent volatility of growth stocks.

However, this strategy is not without its risks. Growth stocks often come with high valuations. Their price-to-earnings ratios can be significantly higher than the market average, signaling that investors have high expectations for these companies. If these expectations aren’t met, the stock might correct sharply, leading to outsized losses.

The very nature of betting on future potential makes these stocks more volatile. They tend to swing more in both directions – upward in booming markets and downward in declining ones. This volatility means that growth stocks can experience larger drawdowns during market downturns, intensifying losses.

While growth investing offers significant potential rewards, it’s crucial for investors to understand the associated risks and ensure they align with their risk tolerance and investment horizon. Diversiview’s analysis tools can be a valuable asset in this process, helping you keep risk management in mind, with optimisation features such as Minimum Risk Portfolio (MVP) calculations or Efficient Frontier analysis.

“You can take the Diversiview free risk tolerance calculator to determine what level of risk you are comfortable with.”

Momentum Investing Unveiled

Momentum investing is an intriguing strategy that capitalises on the continuation of existing market trends. The strategy operates on a fairly straightforward premise: buy securities that have performed well recently and sell those that have underperformed. It embodies the age-old adage, “The trend is your friend.”

Unlike fundamental analysts who dig deep into company financials to find intrinsic value, momentum investors are more attuned to price patterns and trends in the stock market. They believe that stocks that have been ascending will continue to do so in the near future and vice versa for declining stocks.

One of the key tools for momentum investors is technical analysis. Various indicators assist in identifying and confirming trends. Moving averages, for instance, smooth out price data to create a single flowing line, which makes it easier to identify the direction of the trend. If a stock price is above its moving average, it might be considered an uptrend.

Another widely used tool is the Relative Strength Index (RSI), which measures the magnitude of recent price changes to determine overbought or oversold conditions. An RSI above 70 may indicate a stock is overbought and could be due for a reversal, while an RSI below 30 might suggest the opposite.

Momentum investing is about recognising and riding waves, capturing profits based on the principle that stock prices tend to move in trends.

Advantages and Risks of Momentum Investing

There are a few advantages and risks to be aware of for momentum investing.

Advantages:

- Potential for Outsized Returns: Momentum investing often seeks to capitalise on short-term trends. When correctly identified, these trends can offer significant returns relatively quickly.

- Capitalising on Market Psychology: One of the driving factors behind momentum is the collective psychology of the market. As more investors pile into a trending stock, its price can increase.

- Benefiting from Behavioral Biases: Many investors tend to chase performance, buying rising stocks and selling those falling. This herd mentality can create strong momentum in stock prices, which momentum investors can exploit.

Risks:

- Rapid Trend Reversals: Trends can reverse as quickly as a stock can ride the wave of positive momentum. External factors like unexpected news, earnings misses, or broader market downturns can halt momentum abruptly.

- Potential for Buying at Peak Prices: When a trend is identified, the stock might be nearing its peak. This could lead to buying at elevated prices, with limited upside potential and a higher downturn risk.

- Increased Transaction Costs: Momentum investing often requires frequent trading to capitalise on short-term trends. This can result in higher transaction costs, which can eat into potential profits, especially if trades are made frequently.

Remember, momentum investing is a short-term strategy, and technical analysis should be used in conjunction with other factors, such as company news and broader market conditions, to make informed investment decisions. Diversiview can provide valuable tools for technical analysis, but it’s crucial to consider the bigger picture before acting on momentum alone.

Growth vs. Momentum: Differences and Where They Overlap

While growth and momentum investing focus on achieving capital appreciation, they operate on different principles. Growth investing zeroes in on companies with intrinsic attributes that suggest above-average growth in the future, typically looking at fundamentals like earnings per share and sales growth. Momentum investing, on the other hand, is based on trends and market psychology, relying more on technical indicators.

However, these strategies can converge. Consider a high-growth tech company releasing innovative products. This company might attract growth investors due to its potential. Simultaneously, its stock price could be surging, making it a target for momentum investors.

Deciding Which Strategy is Right for You

Choosing between growth and momentum – or blending both – depends on several factors. Your investment horizon is important; short-term investors might lean more towards momentum, while long-term ones might prefer growth. Risk tolerance is another determinant: Are you comfortable with the volatility of momentum investing? Furthermore, current market conditions and personal investment objectives can shape your strategy.

Conclusion

Both growth and momentum investing come with their sets of rewards and risks. While they cater to different investment philosophies, understanding where they intersect can provide a richer perspective. As an investor, looking into both approaches and weighing their pros and cons can guide you to a strategy that best aligns with your financial goals and risk tolerance.

Ready to achieve the optimal portfolio balance with Diversiview? Create a free account and analyse your first portfolio for free!

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.