Volatility is the measure of how much a security’s price fluctuates over time, an inherent risk in investing. Understanding volatility is crucial for safeguarding your portfolio’s long-term health. Diversiview is a powerful portfolio analysis and optimisation tool, offering a suite of features to help you manage your portfolio’s volatility with accurate asset allocation.

What Influences Market Volatility?

Volatility is influenced by various factors, including:

- Economic Indicators: Economic news and events can significantly impact market volatility. For example, unexpected changes in interest rates, inflation data, or GDP growth can lead to sharp swings in stock prices.

- Geopolitical Events: Global political instability, such as wars, trade disputes, or natural disasters, can create uncertainty and volatility. Investors may react to these events by selling off assets, leading to market declines.

- Company-Specific Factors: Earnings reports, product launches, and other company-specific news can influence stock prices. Positive or negative surprises can cause a stock’s price to fluctuate significantly.

- Market Sentiment: Investor sentiment plays a crucial role in driving market volatility. Periods of optimism can lead to rising prices, while pessimism can result in market declines.

- Macroeconomic Factors: Broader economic conditions, such as the business cycle and liquidity in the financial system, can also contribute to market volatility.

Understanding these factors can help you better anticipate and manage the risks associated with investing in volatile markets. Before diving into portfolio asset allocation, it’s essential to assess your risk tolerance.

Understanding Your Risk Tolerance

Diversiview’s Risk Tolerance Calculator provides a personalised assessment based on your comfort level with risk. The scale is based on extensive research1 and made freely available to all investors. This information may help you choose strategies that align with your risk appetite.

Please note: the score of this quiz is intended for and must be used for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action.

Exploring Securities Risk with Diversiview

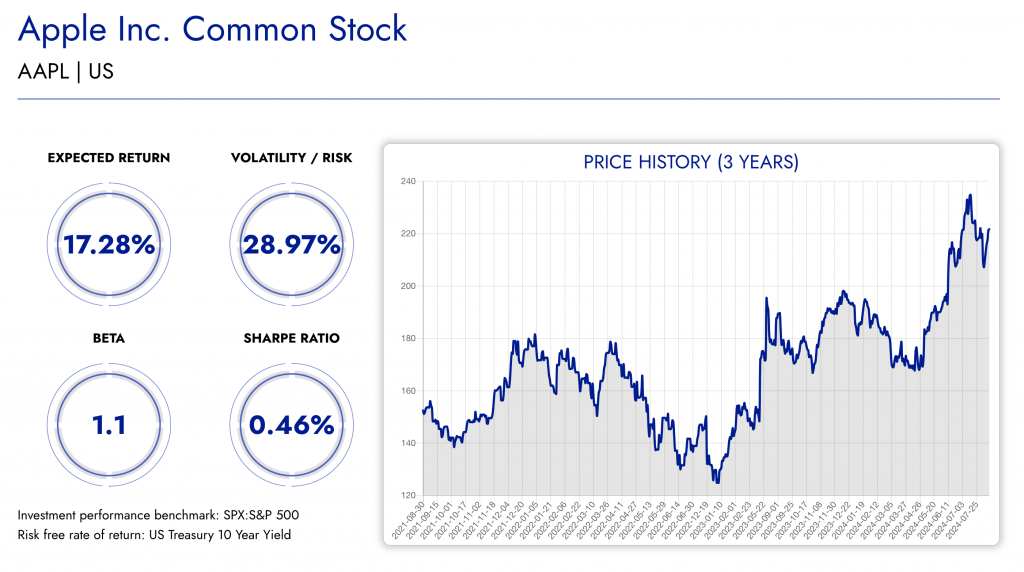

Diversiview’s Explorer page (which can be accessed by searching for a security under the “Resources” tab) offers a comprehensive view of individual securities. Key performance metrics such as price history, expected return, volatility, beta, Sharpe ratio, and environmental footprint (where applicable) provide valuable insights into each asset’s risk-return profile.

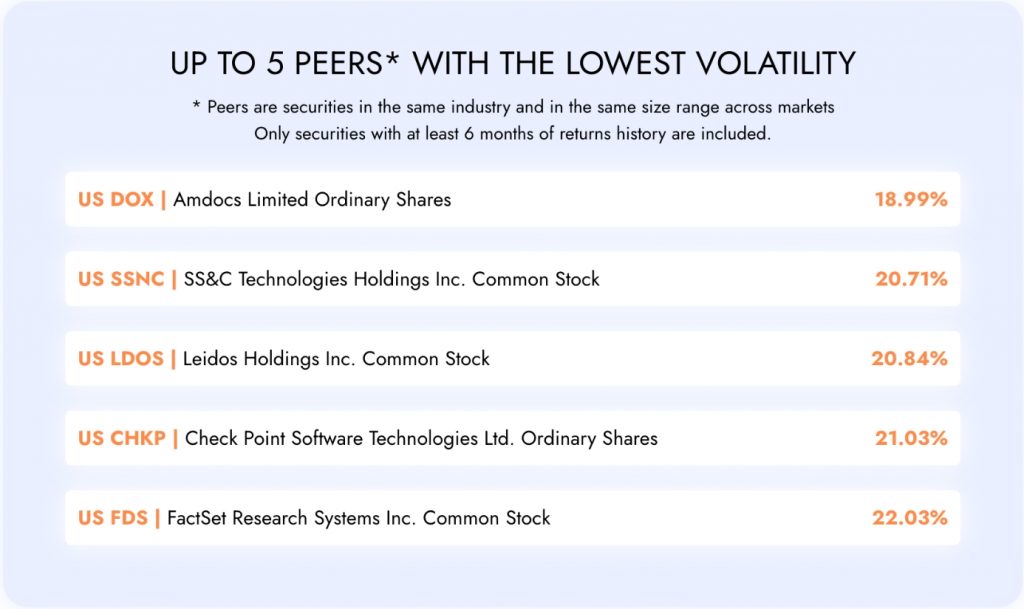

Diversiview further compares securities within the same industry based on risk and return, allowing you to identify potential opportunities and avoid high-risk investments. Additionally, Diversiview provides 5 alternative security options in the same industry and size range across markets, offering a wider range of investment choices with lower volatility.

Filtering Securities for Risk with the Stock Screener

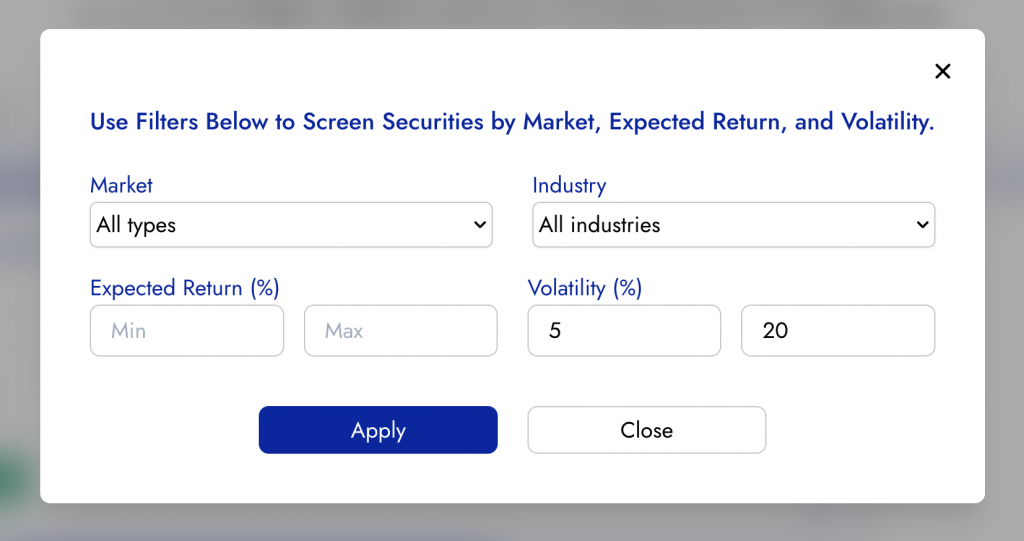

Diversiview’s Stock Screener allows you to filter securities based on various criteria, including market, industry, expected return, and volatility. By specifying your desired volatility range, you can quickly identify assets that align with your risk tolerance. This tool is invaluable for building a diversified portfolio that balances risk and return.

Optimising Your Portfolio Risk with Diversiview

Diversiview offers two optimisation features that leverage the efficient frontier to help you manage volatility. The efficient frontier represents the set of portfolios that offer the highest expected return for a given level of risk. Learn more in our blog “Is Your Portfolio Efficient?” where we explore the Efficient Frontier in greater detail.

- Minimum Volatility Portfolio (MVP): This optimisation aims to identify the asset allocation with the lowest possible risk. By minimising volatility, you can potentially reduce the impact of market fluctuations on your investments. You can find out more about calculating the MVP by clicking here.

- Efficient Frontier Positions: This feature allows you to select a specific level of risk and find the asset allocation that maximises expected return for that risk level. This approach enables you to strike a balance between risk and reward based on your individual preferences. You can find out more about calculating Efficient Frontier positions by clicking here.

Overcoming the Challenges with Diversiview

Effective portfolio management has become more important than ever, with more information more readily available than we’ve ever had. Diversiview provides the tools and insights needed to overcome these challenges. By understanding your risk tolerance, exploring securities, tailoring your portfolio with the stock screener, and optimising your investments using the efficient frontier, you can make informed decisions and build a resilient portfolio that aligns with your long-term financial goals.

Sign-up for a FREE Diversiview portfolio analysis and start managing your portfolio volatility today!

- Grable, J.E., & Lytton, R. H. (1999). Financial Risk Tolerance revisited: The development of risk assessment instrument. Financial Services Review, 8, 163-181. ↩︎