A well-diversified portfolio is like a well-balanced diet—it provides the right mix of nutrients to keep the body (or, in our case, the portfolio) healthy. In financial terms, it’s a critical strategy to help investors manage risks and potentially increase returns. This article aims to guide you through practical steps to approach diversification, enabling you to structure your portfolio effectively. Let’s explore how you can diversify your investments, minimize risks, and set the course for robust returns.

The Basics of Diversification

At its core, diversification is the practice of spreading your investments across various assets to reduce exposure to any one particular asset. It is a risk management strategy founded on the premise that a variety of investments will, on average, yield higher returns and pose a lower risk than any individual investment within the portfolio – a more efficient portfolio.

The importance of diversification stems from its ability to mitigate risk. In a diversified portfolio, losses from underperforming investments are likely to be offset by successful ones. It’s crucial to understand that diversification is not about maximizing returns but achieving balance. A diversified portfolio aims to maintain its balance under varying market conditions, ensuring steady performance over time.

Practical Steps to Diversifying Your Portfolio

While the idea of diversification might be straightforward, its application can be complex. To simplify, let’s break it down into practical steps:

- Diversify across asset classes: The first step to diversification involves spreading your investments across different types of assets or asset classes. These could include equities, bonds, real estate, commodities, or even cash. For example, stocks and bonds have historically shown periods of negative correlation, meaning when one rises, the other falls. This inverse relationship can provide a stabilizing effect on your portfolio, protecting it from extreme market swings.

- Diversify within asset classes: Diversification doesn’t stop at the asset class level. Within each asset class, ensure your investments are spread across various sectors or industries. If you are investing in equities, for example, don’t just invest in tech stocks. Consider pharmaceuticals, utilities, consumer goods, and more to hedge industry-specific risks.

- Diversify across geographies: Don’t confine your investments to one geographical location. Investing in different regions or countries can further diversify your portfolio and reduce the risk of localized economic downturns impacting your entire portfolio.

- Diversify across time (Dollar-cost averaging): Timing the market perfectly is a near-impossible task. A more practical approach is Dollar-cost averaging (DCA), which involves investing a fixed amount at regular intervals, regardless of price fluctuations. This approach ensures that you buy more shares when prices are low and fewer shares when prices are high, resulting in a lower average cost over time.

Remember, the aim of these steps is to create a portfolio that can weather the ups and downs of various market conditions, ensuring consistent growth in the long run.

Measuring Diversification

Diversification is not just about picking stocks from different sectors. It’s about how these stocks interact – their correlation. In finance, the correlation coefficient is a statistical measure that expresses the extent to which two securities move in relation to each other.

Correlation coefficients range from -1 to +1. A correlation of +1 implies that the two assets will move in the same direction 100% of the time, while a correlation of -1 means they’ll move in opposite directions. A correlation of zero indicates that the price movements are random and have no correlation.

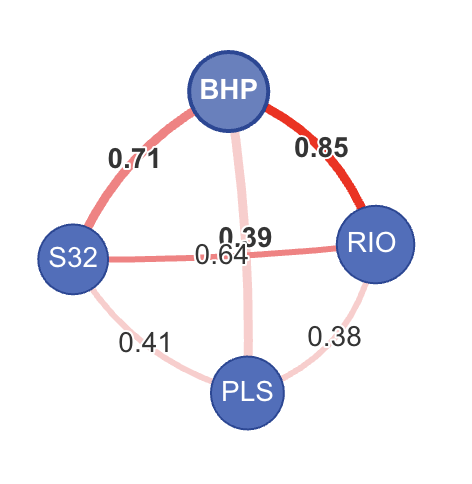

For example, the correlation coefficient between BHP and RIO is 0.85 which means that the share prices for those two stocks will move pretty much together in the same direction, up or down.

It is very important to understand that pairs of stocks from the same industry group could have different correlation coefficients. See an example below, where four ASX stocks – all from Materials industry – have different correlations, some very strong (closer to 1) and some less strong (under 0.5).

Why are correlation values important?

Correlations play a critical role in calculating total portfolio risk. The formula for calculating portfolio risk is quite complex and require one to have access to:

- volatility (risk) of each investment,

- the weight of each investment in the portfolio, and

- the correlations between pairs of investment

Therefore, to get good returns while also mitigating the inherent risks, the advice is to find investments with good expected returns and that are negatively correlated (or not correlated at all) with each other.

Utilising ETFs for Diversification

Exchange-Traded Funds (ETFs) are an incredibly versatile tool for diversification. Essentially, an ETF is a basket of various securities that you can buy or sell through a brokerage firm on a stock exchange. This basket can consist of different types of investments, including stocks, bonds, commodities, or a mix of asset types.

One of the standout features of ETFs is the instant diversification they offer. When you purchase an ETF, you’re essentially buying a slice of an entire portfolio or market index. For instance, if you buy shares of an S&P 500 ETF, you are effectively investing in 500 of the largest U.S. companies in one go. This aspect of ETFs allows investors to diversify across industries, sectors, and even countries with a single investment.

However, as with any investment tool, there are pros and cons to consider:

Pros

- Diversification: As mentioned, ETFs offer instant diversification across a broad array of securities.

- Flexibility: ETFs can be bought and sold throughout the trading day, just like individual stocks.

- Lower Costs: Most ETFs have lower expense ratios than mutual funds, making them an affordable option for diversification.

Cons

- Market Risk: While ETFs reduce unsystematic risk through diversification, they are still exposed to systematic market risk.

- Potential Costs: Trading ETFs can incur brokerage commissions, although many brokers now offer commission-free ETFs.

However, investors should be cautious while considering ETFs for diversification, as not all ETFs are created equal. For example, thematic ETFs, such as those focused on a particular sector like energy or technology, often contain many holdings within the same industry. While these ETFs provide an easy way to gain exposure to a specific sector, they may not offer the broad-based diversification you might expect from ETFs in general. By holding many stocks from the same industry, these ETFs may expose investors to industry-specific risks.

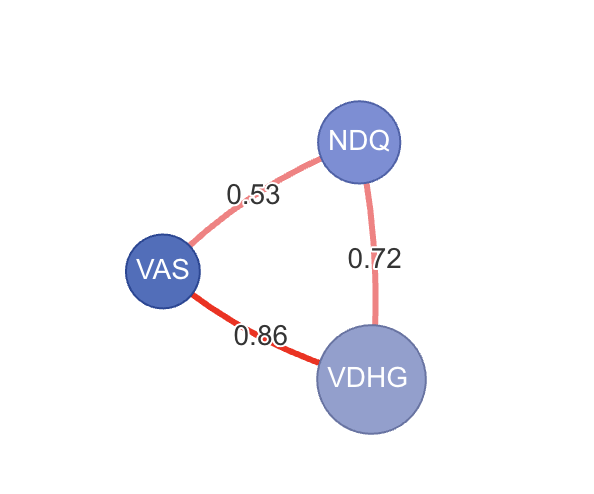

Also, when choosing ETFs for diversification, it’s crucial to understand the ETF’s holdings and their correlations, and ensure they really align with your desired level of diversification and risk tolerance. In the example below three different ETFs listed on ASX have high or very high correlations, meaning that investing in any two of them (or all three) will not bring the full diversification benefit that the user may expect from those investments.

Remember, while ETFs offer an efficient and affordable way to diversify, selecting the right ETFs that align with your investment goals and risk tolerance is still essential.

Case Study: Diversification in Practice

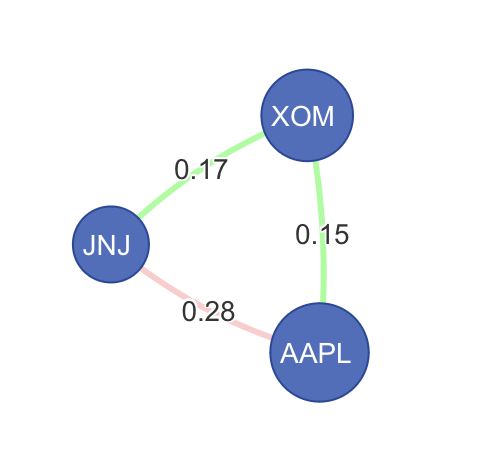

Now, let’s take a closer look at diversification using real-life data. We’ll use three different companies for this case study: Apple Inc. (AAPL), Exxon Mobil Corporation (XOM), and Johnson & Johnson (JNJ).

These three companies represent distinct sectors: technology, energy, and healthcare, respectively. By investing in all three, you’re diversifying across sectors, which is a fundamental principle of portfolio diversification. Each sector responds differently to various economic conditions, which helps to reduce portfolio risk.

In the past, AAPL and XOM have typically had a low to negative correlation, meaning when one moves up, the other tends to stay flat or move down. This inverse relationship can contribute to risk reduction. JNJ, on the other hand, being in a different sector, may show little correlation with either, further contributing to diversification.

In essence, diversification is not just about selecting different assets; it’s about choosing assets that behave differently under various market conditions.

Incorporating Diversification in Your Investment Strategy

Incorporating diversification into your investment strategy is an essential component of wise investing. It’s not just about having a variety of assets, but about understanding how they interact. Your investment decisions should therefore consider the correlation between assets, the weight of each asset in your portfolio, and the inherent risks each asset presents.

One tool that can simplify this process is Diversiview. This software provides invaluable assistance for investors seeking to diversify their portfolio. It includes features for asset allocation, portfolio visualization, and correlation analysis. These tools can guide investors toward a more diversified portfolio and help mitigate risk while potentially improving returns.

Conclusion

In the world of investing, the importance of diversification cannot be overstated. It is a fundamental technique to reduce risk and increase the potential for higher, more stable returns. It’s not just about quantity, but quality and interaction of investments. The outlined steps provide a practical guide toward building a well-diversified portfolio.

Investing doesn’t need to feel like a dangerous venture into the unknown. With tools like Diversiview, you can better understand your portfolio and how to enhance its diversification. Embrace these principles and tools, and you’ll be well on your way to a more confident and informed investment journey.

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.