View the top 10 stocks by market (ASX and US), sorted by expected annual return*.

You can also see the top performing ETFs and top performing Indian mutual funds for the month.

* Expected annual return is calculated as geometrical (compound) average of daily returns from the past 3 years, annualised. Expected volatility is based on historical volatility.

Only stocks older than 3 years have been included, to allow a fair comparison.

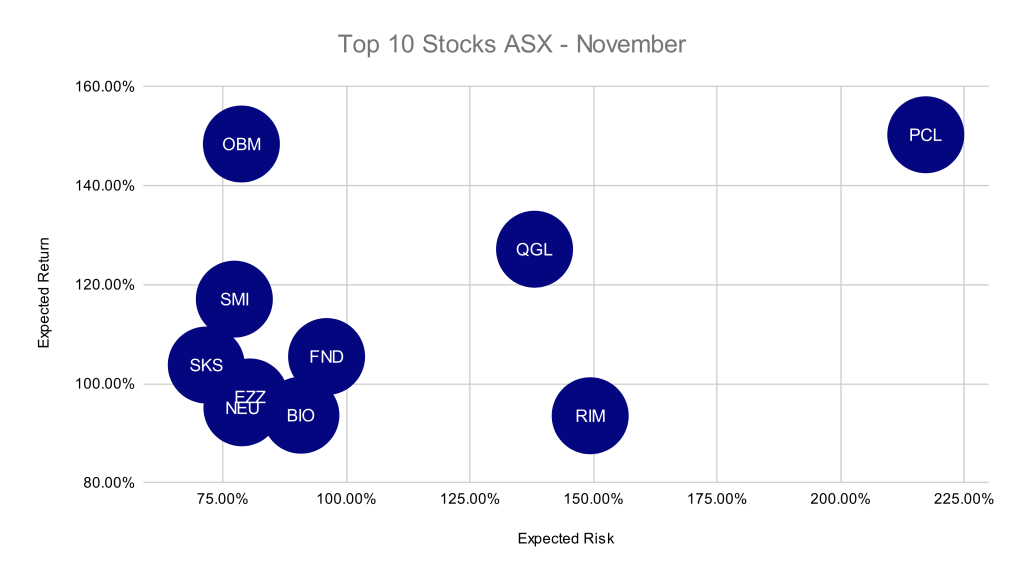

Australian Market (ASX)

| Ticker | Security | Industry | Expected Return | Volatility |

| PCL | Pancontinental Energy NL | Energy | 150.3% | 217.2% |

| OBM | Ora Banda Mining Ltd | Materials | 148.4% | 78.7% |

| QGL | Quantum Graphite Ltd | Materials | 127.1% | 138.1% |

| SMI | Santana Minerals Ltd | Materials | 117.1% | 77.3% |

| FND | Findi Ltd | Software & Services | 105.5% | 96.0% |

| SKS | SKS Technologies Group Ltd | Capital Goods | 103.8% | 71.6% |

| EZZ | EZZ Life Science Holdings Ltd | Consumer Discretionary Distribution & Retail | 97.3% | 80.4% |

| NEU | Neuren Pharmaceuticals Ltd | Pharmaceuticals Biotechnology & Life Sciences | 95.1% | 78.9% |

| BIO | Biome Australia Ltd | Household & Personal Products | 93.6% | 90.8% |

| RIM | Rimfire Pacific Mining Ltd | Materials | 93.5% | 149.3% |

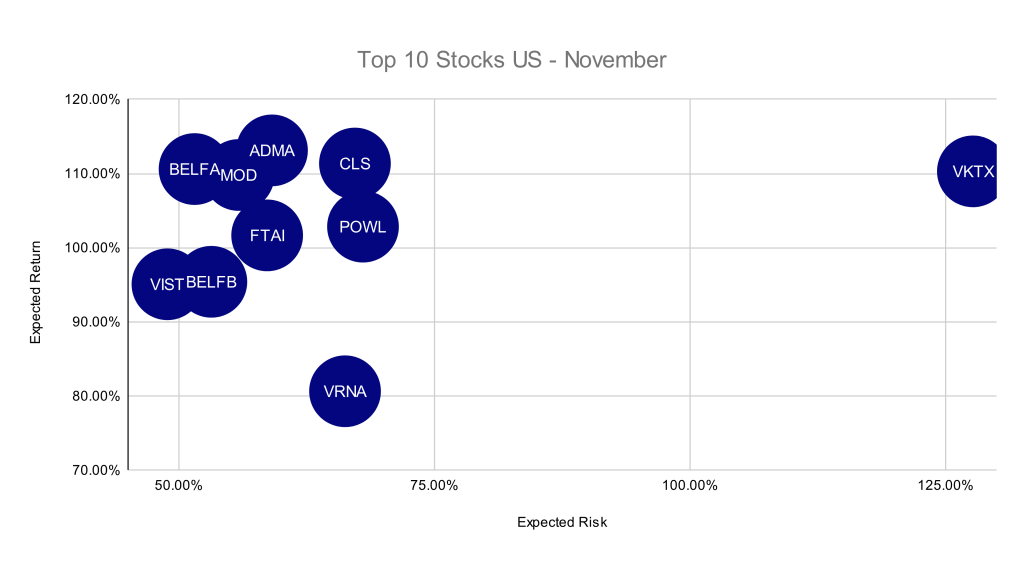

US Market (NASDAQ & NYSE)

| Ticker | Security | Industry | Expected Return | Volatility |

| ADMA | ADMA Biologics Inc Common Stock | Health Care | 113.1% | 59.1% |

| CLS | Celestica Inc. Common Stock | Technology | 111.3% | 67.2% |

| BELFA | Bel Fuse Inc. Class A Common Stock | Technology | 110.6% | 51.5% |

| VKTX | Viking Therapeutics Inc. Common Stock | Health Care | 110.3% | 127.7% |

| MOD | Modine Manufacturing Company Common Stock | Consumer Discretionary | 109.8% | 55.8% |

| POWL | Powell Industries Inc. Common Stock | Energy | 102.8% | 68.0% |

| FTAI | FTAI Aviation Ltd. Common Stock | Industrials | 101.7% | 58.6% |

| BELFB | Bel Fuse Inc. Class B Common Stock | Technology | 95.4% | 53.2% |

| VIST | Vista Energy S.A.B. de C.V. American Depositary Shares | Energy | 95.1% | 48.9% |

| VRNA | Verona Pharma plc American Depositary Share | Health Care | 80.6% | 66.2% |

Analyse any portfolio scenario in Diversiview with a FREE account. Your first analysis is also free!

Diversiview is a trademark of LENSELL GROUP PTY LTD(ACN 646 467 941).

All information on our website (including on this blog) is factual, based on mathematical calculations, and it does not constitute financial advice. Diversiview does not take your personal financial situation into account when calculating any values, including asset allocations.

You are solely responsible to decide if any investment, security or investment strategy mentioned anywhere on the Diversiview website, including blogs and articles, or any other product or service from our referral partners is appropriate or suitable for you.

All investments carry risk, and past performance is not a guarantee of future performance. You should do your own further research and / or consult with a finance professional before making any changes to your investment portfolio.