Here’s a straightforward written guide to manually entering your portfolio and unlocking valuable insights:

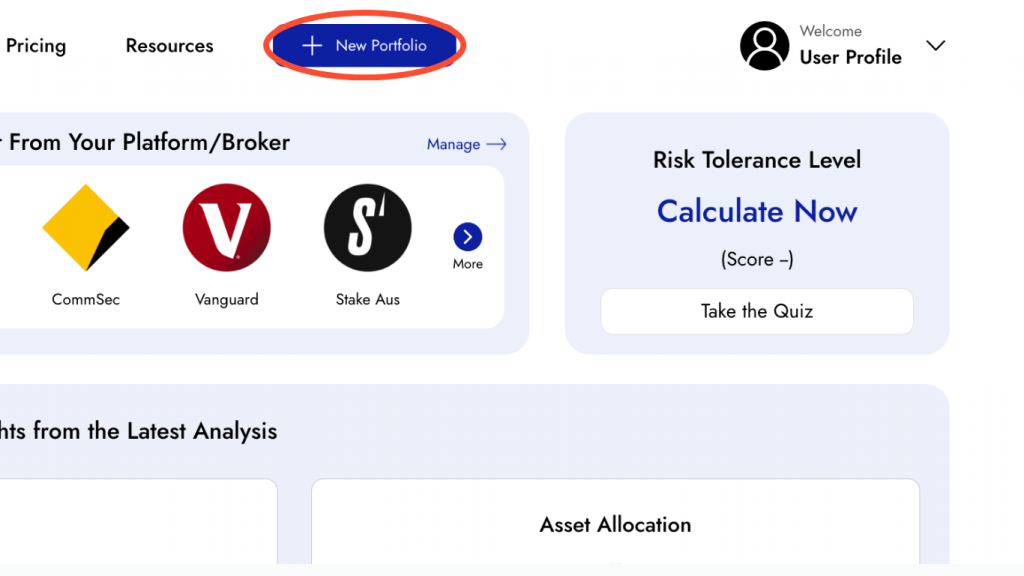

1. Access the Portfolio Entry Section

- From your Diversiview dashboard, locate and click on the

button on the top right-hand corner of the webpage. This will take you to the New Portfolio page.

button on the top right-hand corner of the webpage. This will take you to the New Portfolio page.

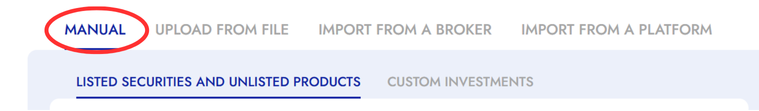

2. Choose Manual Entry

You’ll see a tab titled “Manual” pre-selected by default. This confirms you want to enter your portfolio manually.

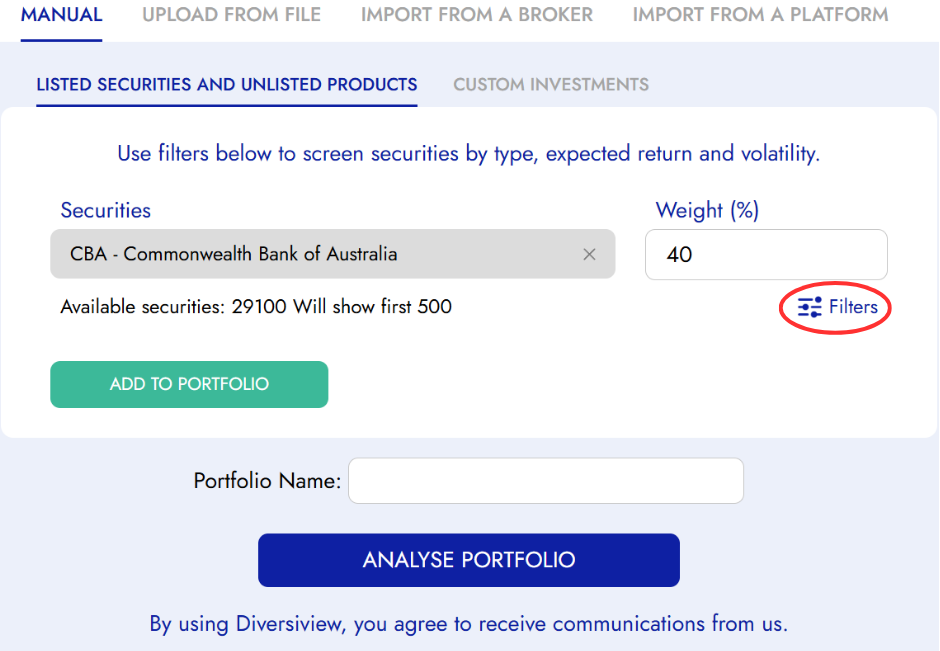

3. Find Your Investments

- Type the name of your investment (stock, ETF, etc.) in the “Search Securities” bar and choose your security from the drop-down list.

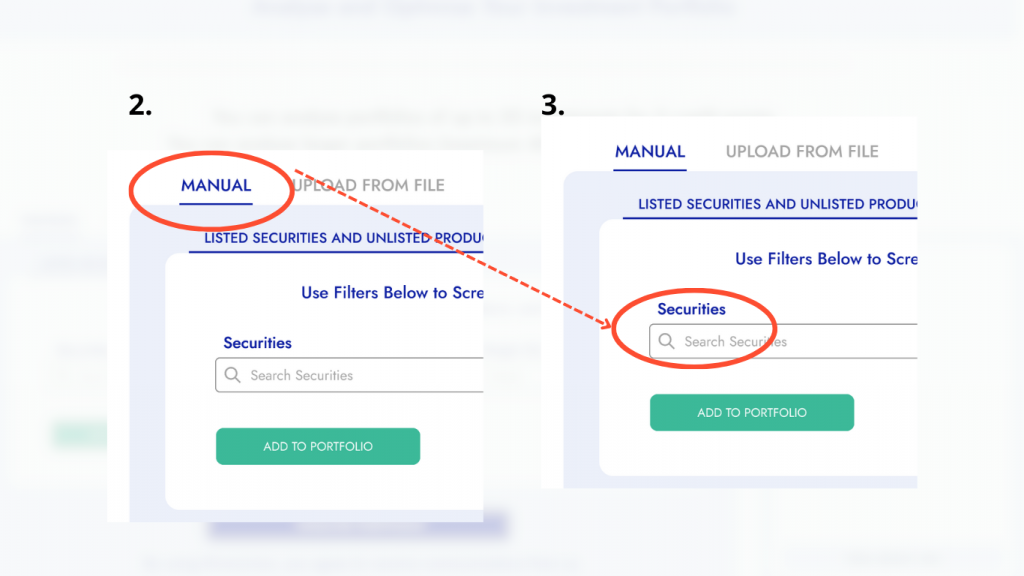

4. Set Your Weightings

Diversiview offers you flexibility in setting weightings for each investment. This allows you to specify the percentage each holding represents within your overall portfolio.

- Equal Weighting: If you leave the weighting section blank, Diversiview will automatically distribute your portfolio value equally among all your entered securities.

- Custom Weighting (Optional): To customise your allocation, enter a specific percentage value in the weighting field. Important Note: Remember that the total percentages must add up to exactly 100%.

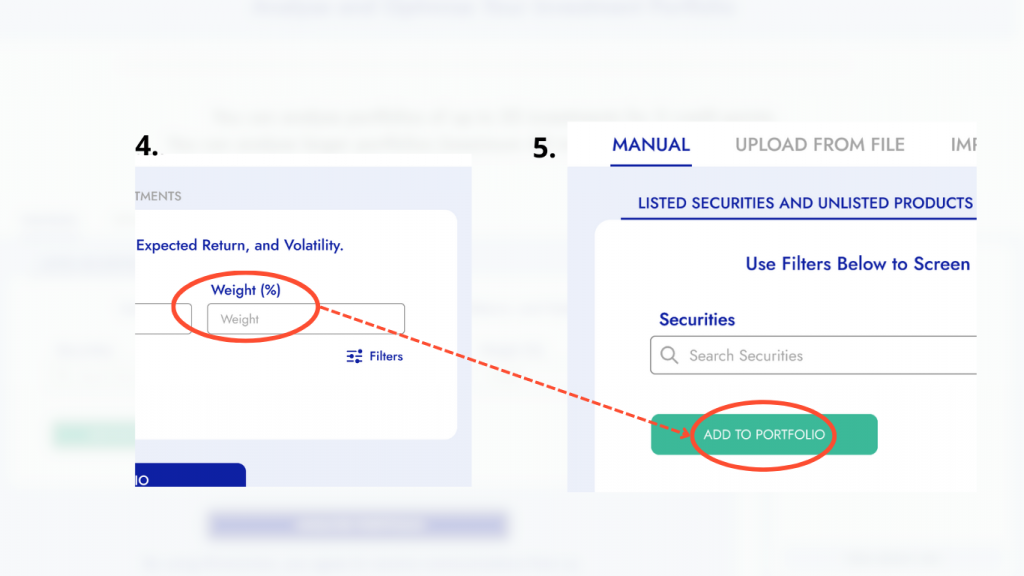

5. Add Your Investment

- Once you’ve selected your investment and chosen its weighting (if applicable), click the green “Add to Portfolio” button. This will add your chosen asset to your portfolio analysis.

- Adding More Securities:

Repeat steps 3-5 to add additional investments to your portfolio.

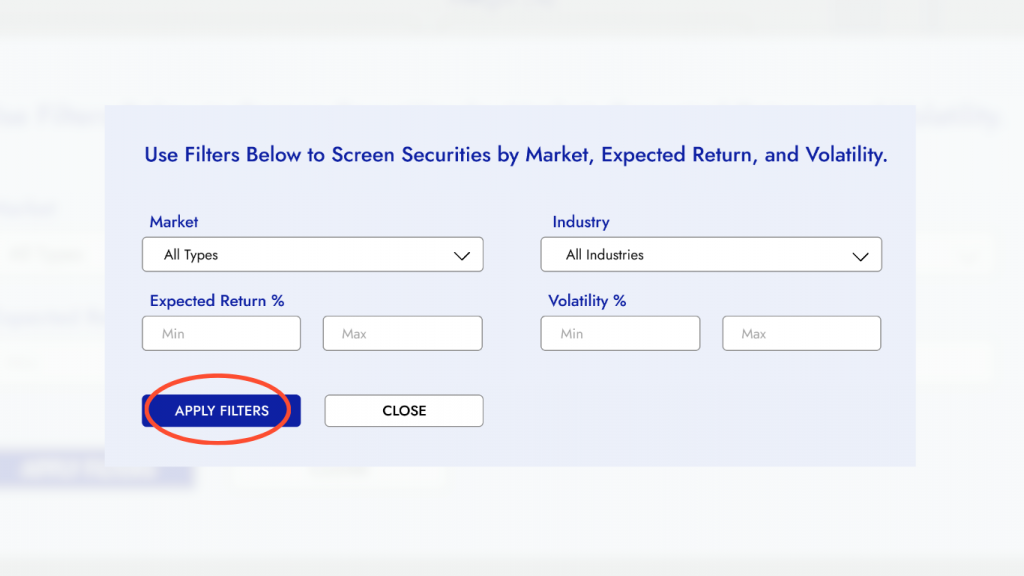

- Applying Filters (Optional):

Explore the “Using the Stock Screener” guide available on our Help Page (link this). This guide will show you how to utilise filters for a more targeted search within the “Search Securities” bar.

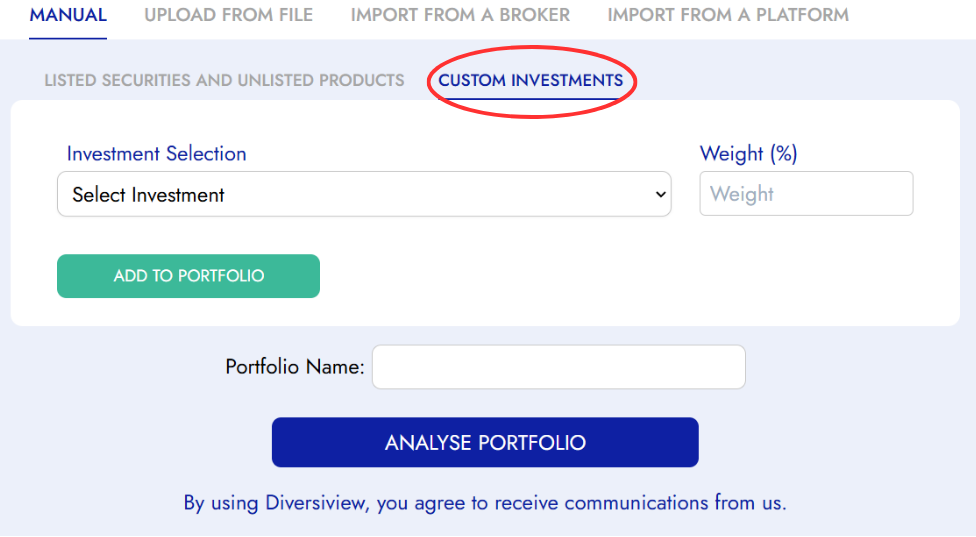

6. Add Custom Investments (Optional)

- By clicking on the ‘Custom Investments’ tab, you can add various assets to your portfolio. Select your investment type (cash, term deposit, or investment property) and for each custom investment, you must specify both the expected return and its weighting within your portfolio.

Important Note: Remember, when using custom investments, all holdings in your portfolio require weight allocation. The total weights must add up to 100%.

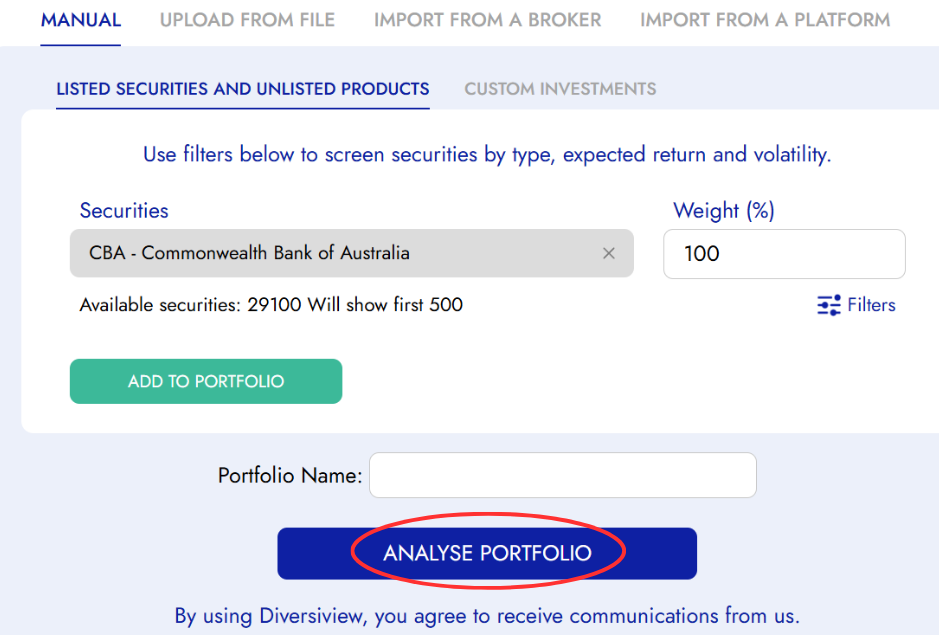

7. Analyse Your Portfolio

- After adding all your securities, click the blue “Analyse Portfolio” button. You will be redirected back to your dashboard whilst Diversiview analyses your portfolio.

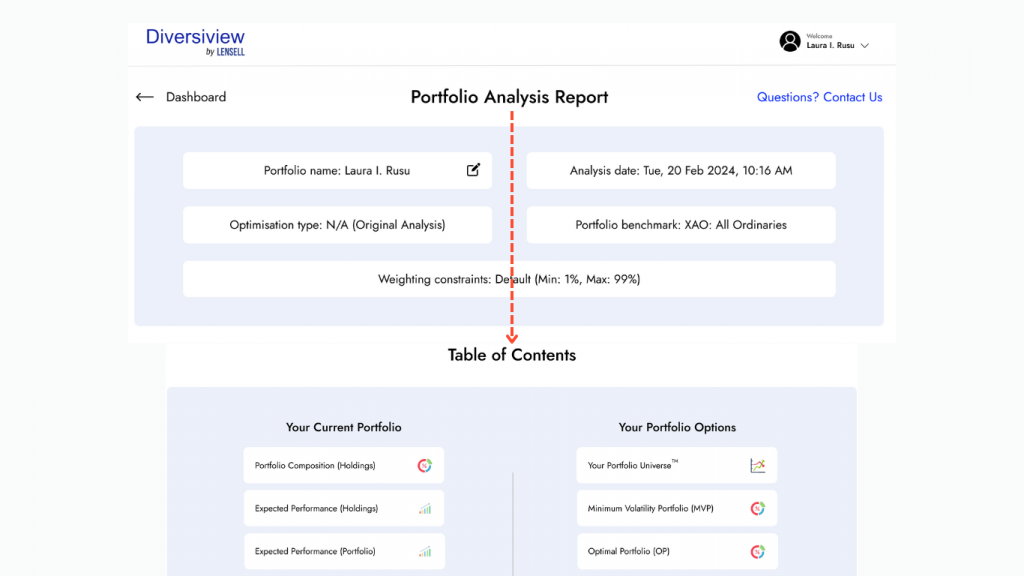

8. View Your Analysis Report

- Within a few minutes, your personalised portfolio analysis report will be ready for viewing on your Diversiview dashboard. This report offers valuable insights into your portfolio’s asset allocation, risk profile, and potential areas for improvement.

To learn more about your Diversiview portfolio analysis click here.

Ready to learn more about your portfolio’s expected performance? Log in or sign up to your account today to enter your holdings manually and start analysing and optimising your investment portfolio.