Why Portfolio Optimisation Software Matters

When it comes to managing your investments, having the right portfolio analysis software and portfolio optimisation software can make all the difference. These tools enable you to track performance, assess risks, and optimise your portfolio for better returns. Among the many options available, two popular choices are Portfolio Visualiser and Diversiview, but which one is right for you?

Portfolio Visualizer: Powerful Portfolio Analysis

Portfolio Visualizer stands out for its sophisticated analytics and in-depth modelling features. Geared toward advanced investors and financial professionals, it offers comprehensive portfolio analysis and optimisation capabilities:

- Asset Allocation Analysis: Evaluate how your investments are diversified across asset classes.

- Performance Metrics: Measure historical and simulated performance using various metrics.

- Monte Carlo Simulations: Model thousands of future scenarios to assess potential portfolio outcomes.

- Backtesting & Factor Analysis: Analyse historical data and performance drivers using multiple risk factors.

- Scenario Analysis: Test your portfolio’s resilience under different economic and market conditions.

- Customisation & Benchmarking: Compare your portfolio against benchmarks; flexible for those who want granular analytics.

Strengths:

- Deep analytics for professional-grade modelling and optimisation.

- Free access to many features; paid plans unlock enhanced reports and collaboration.

- Ideal for investors focused on US and Canadian markets.

Limitations:

- No real-time market data or custodian integration.

- Less suitable for beginners due to its complex interface.

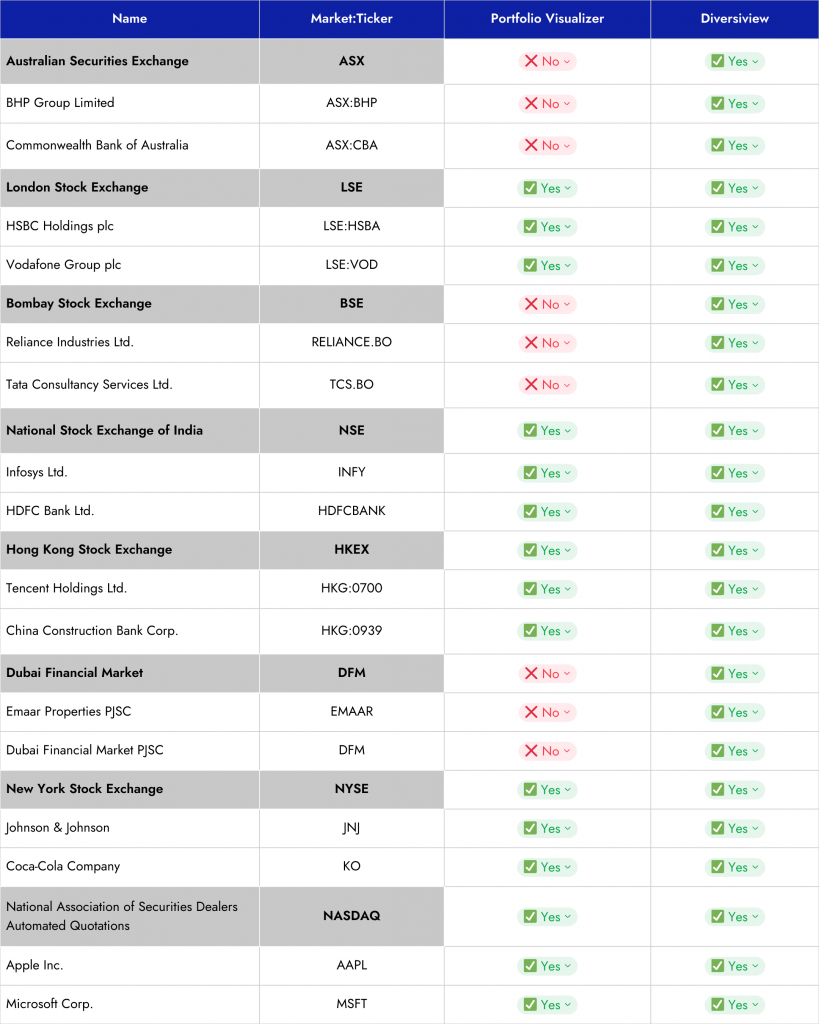

- Global market coverage is limited, with a primary focus on North America.

Diversiview: Modern, Global Portfolio Optimisation

Diversiview is a newer entrant in the portfolio analysis software space but is rapidly gaining users thanks to its blend of advanced analytics and user-friendly design. Its features make it a compelling choice for both retail and professional investors globally:

- Comprehensive Portfolio Analysis: Supports up to 40 investments per portfolio, including stocks, ETFs, mutual funds, and cash across major markets (ASX, NYSE, NASDAQ, LSE, NSE, BSE, HKEX, and Indian mutual funds).

- Asset Allocation Optimiser: Runs complex mathematical optimisations to find efficient portfolio positions including Minimum Risk Portfolio, Optimal Portfolio and other portfolio positions on the Efficient Frontier.

- Efficient Frontier Visualisation: Instantly see where your portfolio’s expected performance sits relative to the optimal risk-return trade-off and other thousands of potential portfolio positions.

- Interactive Visualisations: Detailed risk/return plots, sector/region breakdowns, correlation matrices, and scenario stress tests.

- Granular Diversification: Correlation values for all pairs of investments in your portfolio. Available as a matrix and as an interactive network graph where you can filter out the noise and focus on the strong positive correlations that impact on your portfolio risk level.

- Seamless Broker Integrations: Connect with over 20 brokers and other investment platforms like Sharesight (international), BGL (Australian), or import portfolios from CSV files.

- Intuitive UX: Designed for all skill levels with guided workflows that flatten the learning curve.

Strengths:

- Advanced analytics combined with exceptional ease of use.

- Global market support for diverse asset classes.

- Actionable, personalised insights for both individual and professional users.

- Broad integration ecosystem and real-time syncing.

- Free analysis for the first portfolio; flexible paid plans and credits for advanced features.

Limitations:

- Up to 40 investments for portfolio analysis and optimisation online; larger portfolios up to 100 securities and scenario analysis available only to enterprise users.

Portfolio Optimisation Software: Feature Comparison

| Feature | Portfolio Visualizer | Diversiview |

| Usability | Medium (complex interface) | High (intuitive, guided workflows) |

| Analytics Depth | Advanced (backtesting, simulation) | Advanced (optimisation, efficient frontier, risk, stock screener) |

| Global Market Coverage | US/Canada | Global (ASX, NYSE, LSE, NSE, HKEX, DFM, etc.) |

| Integrations | Limited (no direct broker links) | Over 20 brokers, Sharesight, CSV uploads |

| Portfolio Size Support | Flexible but mainly US assets | Up to 40 investments per portfolio |

| Optimisation Tools | Mean variance, risk-return optimisation, efficient frontier calculator, Sharpe ratio | Multi-objective risk-return optimisation, efficient frontier calculator, Sharpe ratio, Maximum drawdown |

| Scenario Analysis | Yes | Yes |

| Pricing | Free tier + paid ($360 – $660 Annually) | Free first analysis; flexible paid plans using credit points |

| Pricing Flexibility | Annual Commitment | Flexible, credit points packages of various sizes, valid for 12 months. |

| Target User | Advanced, technical investors | Advanced Retail investors and Investment Professionals. |

Choosing the Right Portfolio Optimisation Software for Your Needs

Selecting the appropriate portfolio analysis and optimisation software is a personal decision that depends on several factors. Consider your investment experience: are you a beginner looking for an intuitive, guided interface, or an advanced investor comfortable with complex modelling? Think about your portfolio’s geographic exposure; do you need a tool tailored to the US/Canada market or one that supports multiple global exchanges? Also, evaluate your portfolio size and the asset types you hold; some platforms handle large, diversified portfolios better than others.

Additionally, reflect on your workflow preferences. Do you prefer automatic syncing via broker integrations to keep your portfolio updated, or are you comfortable manually entering data? Understanding these aspects will help you maximise the benefits of whichever platform you choose.

Ideal User For Each Tool

- Portfolio Visualizer: Best for experienced, data-driven investors and professionals focused mainly on US/Canadian assets, with a preference for advanced modelling and analytics.

- Diversiview: Ideal for global retail and professional investors who value powerful optimisation tools, intuitive design, and seamless broker integrations.

Pricing & Support

- Portfolio Visualizer: Free basic tier; paid plans ($360 – $660/year) enable enhanced reports and team features. Support is primarily online and self-service.

- Diversiview: Free for the first analysis (up to 10 investments); flexible paid plans and credits for advanced functionalities (starting at US$20 per analysis and US$60 per optimisation). Strong focus on customer support and integration with brokers for global portfolios.

Conclusion

The right portfolio analysis software depends on your needs:

- For deep, technical analytics focused on US/Canada, Portfolio Visualizer is a robust choice.

- For global coverage, user-friendly design, and portfolio optimisation, Diversiview is a standout.

Both Portfolio Visualizer and Diversiview offer free versions with limited features, so we recommend exploring each firsthand to see which aligns best with your investment strategy. Whichever portfolio optimisation software you choose, having the right tool can help you make smarter, data-driven decisions and unlock better investment outcomes.

Take control of your financial future! Open a free Diversiview account and get one FREE Portfolio Analysis, and discover how smart, data-driven decisions can help you achieve your goals.

Note: Diversiview does not provide financial advice or recommendations. Investment Portfolio Analyses are intended to provide investors with data driven insights and information. You should do your own further research, or speak with a licenced professional before making changes to your investment portfolio.