Festivity fills the air as the holiday season approaches, and markets often respond in kind. This period, stretching from Black Friday to the New Year can bring a unique set of influences to the financial markets, characterised by distinct trends and increased market volatility. The buzz of activity, from retail consumers to institutional traders, transforms the market, often heightening volatility as trader activity fluctuates.

It’s a time when the exuberance of the season can spill over into the trading floors and investment portfolios, creating both challenges and opportunities. Understanding the cause and effect between holiday cheer and market behavior is important for investors looking to navigate this period effectively. Below, we’ll explore some concepts that define the holiday market dynamics, preparing investors to make informed decisions amidst the seasonal ebb and flow.

Image credit to Pexels

The Holiday Effect on Markets

The holiday season has historically been associated with a positive effect on markets, with one trend called the “Santa Claus rally.” Statistically, the stock market has shown a tendency to perform well during the year’s final month, which some attribute to festive optimism, year-end bonuses being invested, and tax considerations. For instance, according to the Stock Trader’s Almanac[1], the S&P 500 has risen about 1.3% on average during the last five trading days of December and the first two trading days of January.

Moreover, consumer behavior during this period significantly impacts the markets. “Black Friday” sales and pre-Christmas shopping sprees can lead to substantial revenue boosts for retailers, often reflected in their stock prices. In 2020, U.S. consumers spent a record $9 billion[2] online on Black Friday, despite the pandemic’s effect on brick-and-mortar stores, according to Adobe Analytics, marking a nearly 22% increase over the previous year.

Investors eagerly watch these shopping events as indicators of consumer confidence and spending patterns. A surge in retail sales can translate into market optimism, pushing stock prices up, while a slump can cast a shadow of market volatility and uncertainty.

Trader Activity During the Holidays

The holiday season often brings a shift in trader activity, significantly affecting market liquidity and volatility. Historically, trading volumes tend to taper off during the latter part of December as institutional investors close their books and retail traders take time off. This dip in trading volume is sometimes associated with increased price volatility, as fewer shares traded can lead to larger price movements on relatively small orders.

Despite the overall drop in volume, the activity that does occur can be particularly impactful. Retail investors, for instance, may have more time to trade during the holidays, and their collective actions can move markets. This effect can be amplified by year-end bonuses and holiday gifts invested into the market and by individuals making year-end adjustments to their portfolios for tax purposes.

Additionally, the rise of online and app-based trading platforms has made market participation more accessible, allowing even casual investors to trade easily, potentially contributing to unexpected market movements. This connection between reduced professional activity and sporadic retail trading creates a unique environment that can lead to short-term opportunities as well as risks, underscoring the importance of strategic planning and market awareness during the holiday season.

Volatility and Opportunity: A Dual-Edged Sword

An analysis by the Chicago Board Options Exchange found that market volatility during the holidays, measured by the VIX index, tends to increase in December. This seasonality effect can create a dual-edged sword scenario where the unpredictability presents both risks and potential rewards.

Astute investors may view this volatility as a potential investment opportunity. Market swings can lead to mispricing of securities, offering chances to buy quality assets at lower prices or sell holdings at a premium. One strategy is to set limit orders, which ensure transactions are executed at predetermined price points, allowing investors to manage entry and exit positions more effectively during swings.

Additionally, investors might consider defensive assets that traditionally exhibit less price volatility as a hedge. For those with a longer-term perspective, holiday-induced fluctuations can be seen as transient noise, opportunities to strengthen positions in fundamentally sound assets at temporarily depressed prices. However, approach these opportunities with a well-researched strategy, as market sentiment during the holidays can be erratic.

The Role of Diversiview in Holiday Market Navigation

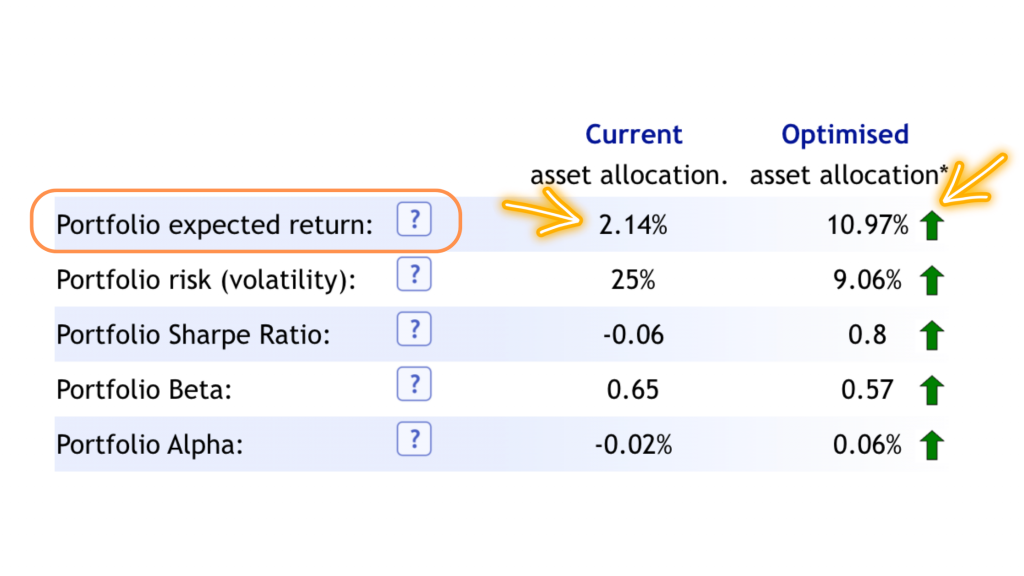

Navigating the holiday market’s choppy waters demands advanced tools like Diversiview. Its optimisation features enable investors to analyse market trends and optimise their portfolios accordingly, making informed decisions based on sophisticated algorithms and historical data. During the holiday season, when volatility spikes and traditional trading patterns may not hold, Diversiview’s insights can be particularly valuable, guiding users to adjust their holdings to withstand market fluctuations better.

Periodic rebalancing is another feature that comes during the holiday period. Diversiview can facilitate this process by providing recommendations for realignment, ensuring that an investor’s portfolio does not drift too far from its target allocation. This is especially important during the holiday season when the temptation to ‘set and forget’ can be strong. By leveraging Diversiview’s capabilities, investors can maintain a disciplined approach to rebalancing, essential for managing risk and capitalising on the season’s investment opportunities. In essence, Diversiview acts as a compass through the festive season’s market volatility, helping to steer portfolios toward their desired destination.

Preparing for the New Year: Investment Resolutions

As the holiday season wanes and the New Year looms, investors often reflect on their financial trajectories and set resolutions for the coming year. This is a prime time to revisit financial goals and fine-tune investment strategies to align with your aspirations and market conditions. Utilising a platform like Diversiview becomes beneficial during this phase. Its comprehensive tools allow investors to review past performance, reassess risk profiles, and adjust portfolios to meet the challenges and opportunities of the New Year. Whether it’s capitalising on growth sectors or shoring up defenses against potential downturns, Diversiview’s analytics can support strategic planning and decision-making, ensuring that investors step into the New Year with a robust, goal-oriented investment plan.

Conclusion

The holiday season casts a distinctive spell on the markets, often bringing volatility and unpredictability. Navigating this period and preparing for the aftermath requires intuition and data-driven decision-making. Robust analytical tools, like those provided by Diversiview, are indispensable. They offer clarity amid seasonal market noise and empower investors to recalibrate their portfolios for year-end success. As the holidays herald a time for reflection and forward-thinking, leveraging technology like Diversiview can help ensure that an investor’s portfolio is well-positioned to capitalise on the New Year’s prospects.

[1] https://www.forbes.com/sites/bill_stone/2022/12/22/will-santa-or-the-grinch-visit-wall-street-this-holiday-season/

[2] https://www.reuters.com/business/retail-consumer/adobe-says-black-friday-online-sales-hit-record-9-bln-2022-11-26/

Questions?

Please contact the team at hello@diversiview.online and we will be happy to help.

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.