One of the essential tools used in effective portfolio management is portfolio backtesting.

Backtesting is a way to simulate the performance of a portfolio or strategy using historical data to gain insights into its potential future performance. It’s an essential element in crafting investment strategies, allowing investors to quantify potential risk, optimize and backtest portfolio asset allocation, and anticipate performance based on past market conditions.

With backtesting, investors can confidently make informed decisions, reducing the probability of unwelcome surprises. Backtesting holds immense importance, actively offering an objective lens to evaluate and refine your investment strategy critically.

Diversiview lets you backtest your own asset allocation strategy for the past year (up to three years), and compare it with:

- an optimised asset allocation

- an equal asset allocation

- a major index – currently supporting XAO (All Ords) and XJO (S&P ASX200), more indexes will be available for benchmarking soon, including US indexes.

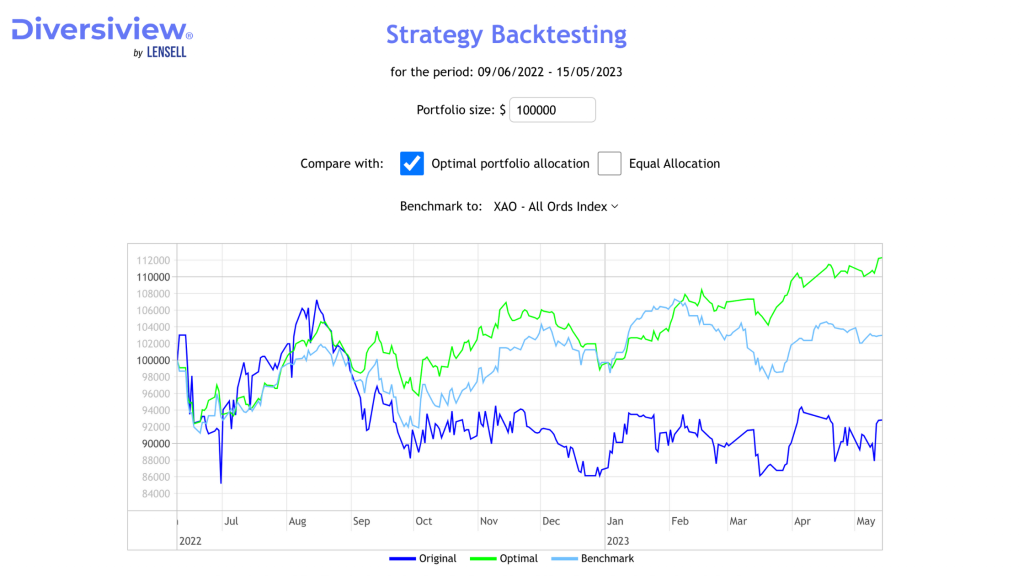

See an example below where a portfolio of stocks and ETFs with equal allocation (list below) shows compared benchmarked performance between original (equal)allocation, optimal allocation and XAO (All Ords Australian Index).

- ACDC – Global X Battery Tech & Lithium ETF

- LIT – Lithium Australia Ltd

- QUAL – Vaneck MSCI International Quality ETF

- VGS – Vanguard MSCI INDEX International Shares ETF

- BAT – Battery Minerals Ltd

(Stocks are for exemplification purposes only; this is not an endorsement or recommendation)

As it can be seen, if applied at 9/06/2022, the equal allocation strategy between these 5 securities would have been worse off by 15/05/023 compared with the All Ords index and compared with an optimised asset allocation. The equal allocation produced better results for some time (approx mid-Aug 2022), then the roles changed dramatically.

Have you backtested your asset allocation strategy?

Give it a try now – it’s free to analyse portfolios with Diversiview!

If you have any questions please contact the team at hello@diversiview.online and we will be happy to help.