Which Moves the Needle on Risk-Adjusted Returns?

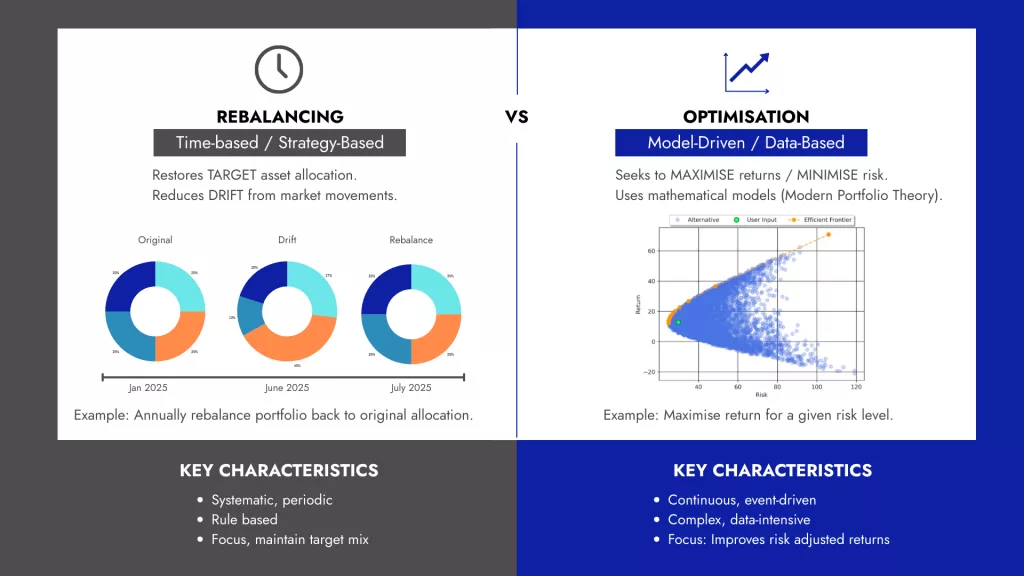

Portfolio rebalancing and optimisation both aim to improve portfolio outcomes, but they solve different problems: one maintains a chosen risk profile while the other recalculates target weights to improve the risk-return trade-off.

A practical, tool-enabled workflow can combine both, using efficient frontier analytics to set targets and disciplined rebalancing to keep allocations on course as markets shift.

Maintain vs Improve

Portfolio rebalancing restores target weights after market movements to keep risk aligned with a policy or mandate, typically via calendar or band/threshold rules that are easy to explain and implement.

Portfolio optimisation recalculates target weights using updated expectations for return, volatility, and correlations to locate positions on the efficient frontier that maximise expected return for a given risk or minimise risk for a target return.

What is Portfolio Rebalancing

Portfolio rebalancing is the periodic process of buying and selling positions to return a portfolio’s asset mix to predefined targets, thereby maintaining a chosen risk profile as markets push allocations off course.

Common approaches include calendar-based rebalancing (e.g., quarterly/annually) and threshold or band rebalancing where trades trigger only when drift exceeds set bands, balancing simplicity and costs.

The benefits are risk control, behavioural discipline, and clear governance, while limitations include ignoring structural changes in returns and correlations if the target mix never updates.

What is Portfolio Optimisation

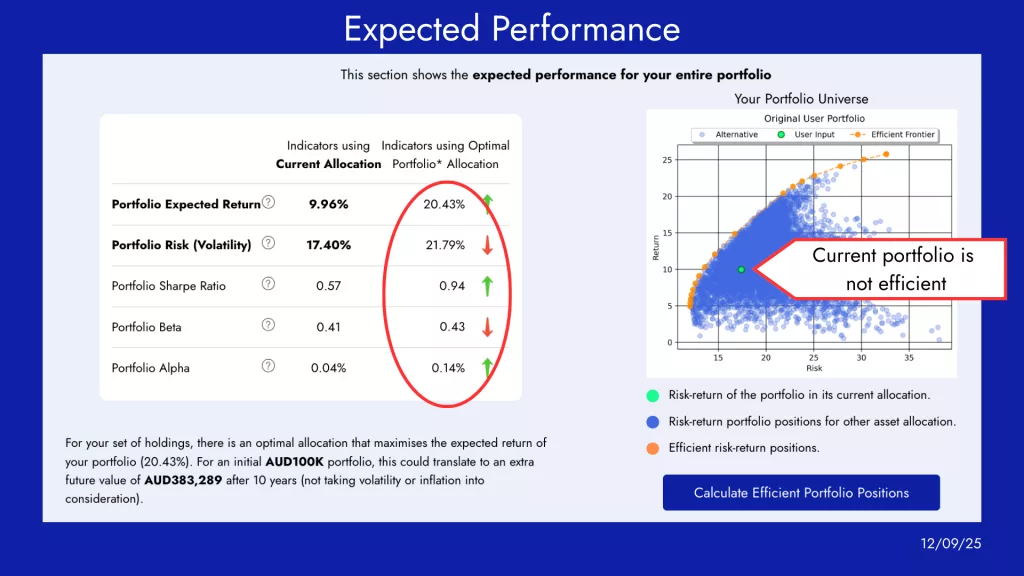

Portfolio optimisation computes new target weights that sit on the efficient frontier, portfolios that deliver the highest expected return for each level of risk or the lowest risk for a given return, based on current estimates of returns, volatilities, and correlations. Watch our short video below on the efficient frontier and portfolio optimisation, or continue reading.

Modern portfolio analysis tools, like Diversiview, allows investors to select a desired risk level and calculate the corresponding allocation, including constraints such as min/max weights, expected volatility.

Because inputs and market regimes evolve, periodic optimisation can adapt allocations to new information, though estimation error and model assumptions make guardrails and backtesting essential.

Rebalancing vs Optimisation: Quick View

- Rebalancing maintains a chosen risk profile at existing targets, while optimisation seeks a better risk–return combination at that same risk level by refreshing the targets themselves.

- Rebalancing enhances discipline and reduces drift, whereas optimisation may increase expected return or reduce volatility for a comparable return, subject to the quality of inputs and constraints.

- Optimisation can introduce more turnover and cost without careful bands and constraints, making cadence and tax-aware thresholds central to governance.

Rebalancing vs Optimisation: Detailed Comparison

Rebalancing vs Optimisation: A Comparison

Case Snapshot: from below the efficient frontier to targeted efficiency

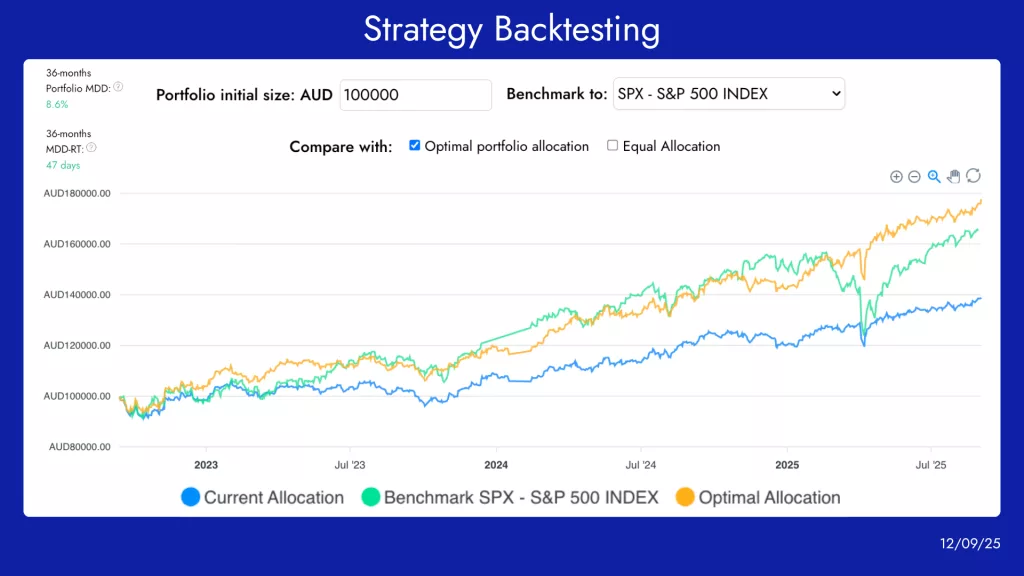

The current allocation sits below the efficient frontier; optimise the portfolio in Diversiview to compute the optimal asset allocation, then backtest it to show performance versus current and benchmark (blue=current, green=benchmark, orange=optimal).

Result: the optimal allocation illustrates the trade‑off chosen at the target risk and how re‑weighting changes drawdowns and trajectory relative to the current mix and SPX benchmark.

The original allocations maximum drawdown (MDD) and maximum drawdown recovery time (MDD-RT) improved from 8.6% to 6.34% and 42 days to 27 days respectively.

Portfolio Holdings used in the Case Snapshot.

| Ticker | Name | Allocation |

| VNQ | Vanguard Real Estate ETF | 25.00% |

| SPY | SPDR S&P 500 ETF | 13.00% |

| EFA | iShares MSCI EAFE ETF | 8.00% |

| VWO | Vanguard FTSE Emerging Markets ETF | 4.00% |

| BND | Vanguard Total Bond Market ETF | 25.00% |

| GLD | SPDR Gold Shares | 25.00% |

| These holdings were selected for illustrative purposes only. Not financial advice. | ||

When to use each

Rebalancing is generally preferred when the policy mandate is stable, cost and tax constraints are tight, and governance emphasises simplicity and repeatability over frequent target revisions.

Optimisation fits when updated inputs and correlation structures materially change the efficient set and constraints can be applied prudently to manage turnover and concentration risk.

A hybrid approach is often practical: optimise quarterly or annually to set targets, then use band or threshold rebalancing intra-period to control turnover while holding risk on course.

Diversiview: Portfolio Analysis and Optimisation

Backtesting provides an evidence-led baseline by comparing current versus optimised allocations against a relevant index over a 36‑month lookback (or available data range), with both cumulative performance and drawdown context.

Diversiview’s articles and help content show how to visualise efficient frontier positions, evaluate portfolio universes, and test strategy variants to quantify potential benefits before implementation.

How Diversiview operationalises the workflow

- Efficient frontier analytics: visualise current versus efficient positions and select a target risk point to compute a corresponding allocation using constraints that reflect policy and practical limits.

- Backtesting: compare current, equal-weighted, and optimised allocations against a benchmark over the past 36 months to understand volatility, drawdowns, and risk-adjusted performance implications.

- Monitoring Diversification: Displays concentration by security, sector, and market, highlighting overweight exposures and underrepresented area with Diversiview Correlation Matrix.

Try Diversiview for FREE today! Run an efficient frontier analysis, calculate an optimal allocation, and backtest against a benchmark to validate the trade-offs before making allocation changes in production.

Note: Diversiview does not provide financial advice or recommendations. Investment Portfolio Analyses are intended to provide investors with data driven insights and information. You should do your own further research, or speak with a licenced professional before making changes to your investment portfolio.