Portfolio rebalancing is the art and science of periodically adjusting the proportions of different assets in an investment portfolio. As the financial markets move, individual assets within a portfolio will either gain or lose value, causing shifts in their original allocations. Over time, these shifts can diverge significantly from an investor’s intended strategy and risk appetite. This is where rebalancing steps in, and how Diversiview can help ensure that a portfolio remains in tune with its predetermined goals and does not unwittingly stray into riskier territories.

By keeping a portfolio aligned with its original objectives, investors can maintain a consistent risk exposure, capture potential gains, and mitigate possible losses. We’ll explore why rebalancing isn’t just a task—it’s a crucial step in successful wealth management.

Why Rebalancing Matters

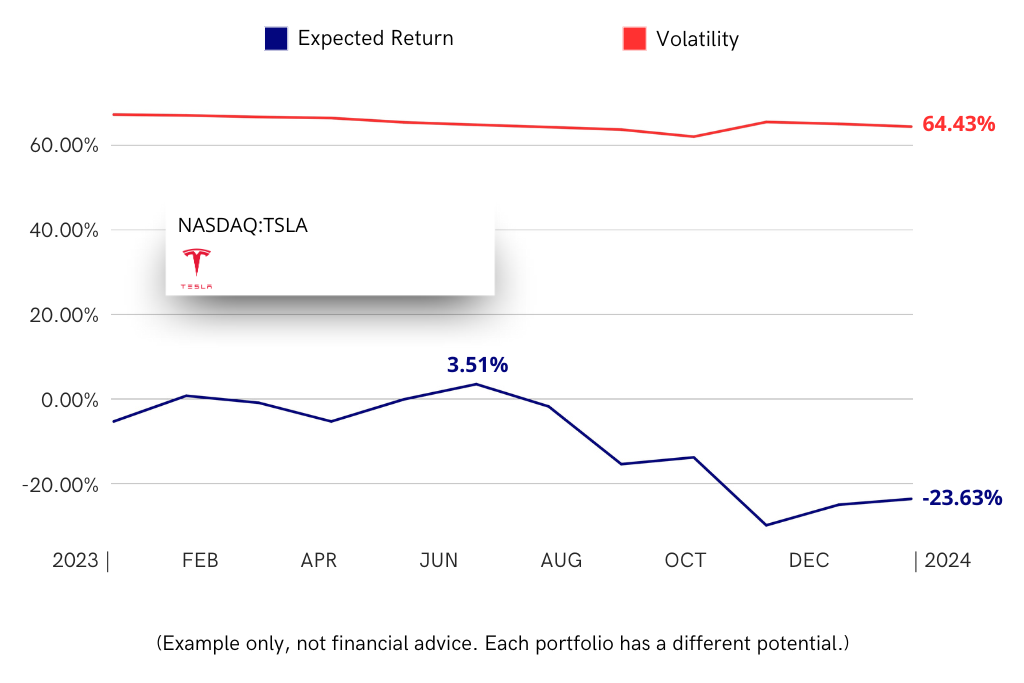

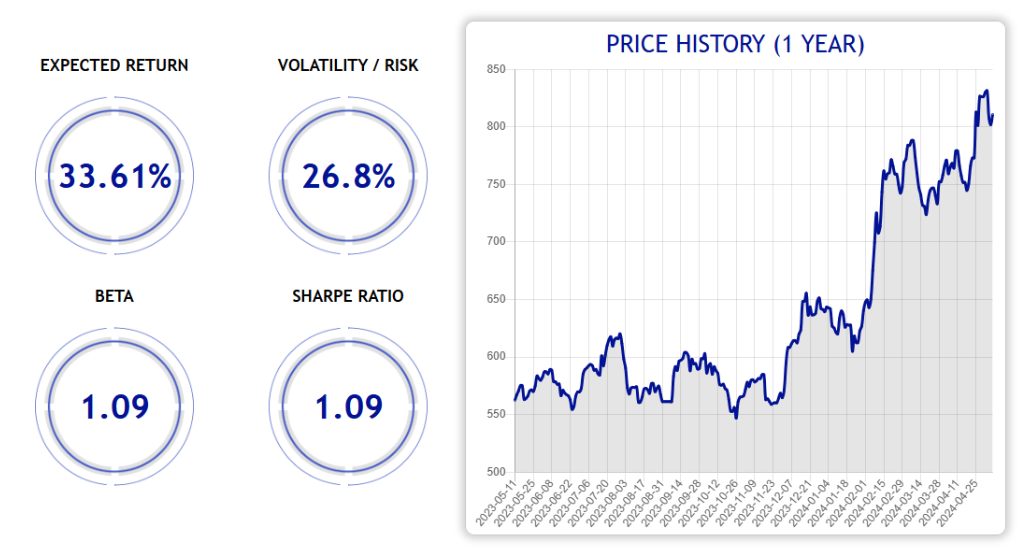

At the core of investment management lies the preservation of an investor’s desired returns and personal risk profile. This ensures that the portfolio remains within acceptable levels of volatility and potential for returns. Rebalancing plays a pivotal role in this preservation. The portfolio may drift from its intended risk-return characteristics as individual assets grow or diminish in value.

Diversiview can help investors stay on top of these drifts. By analysing your portfolio holdings periodically and comparing them to your target risk-return goals, Diversiview can help you identify the optimal allocation to maximise returns. This allows you to make informed decisions about rebalancing and get your portfolio back on track, as explored in our previous blog about the benefits of regular optimisation.

Locking in gains is another valuable aspect of rebalancing. When certain assets in the portfolio have performed exceptionally well, rebalancing allows the investor to capitalise on these gains, selling a portion of these outperforming assets. Conversely, it provides an opportunity to buy potentially undervalued assets, allowing the investor to “buy low.”

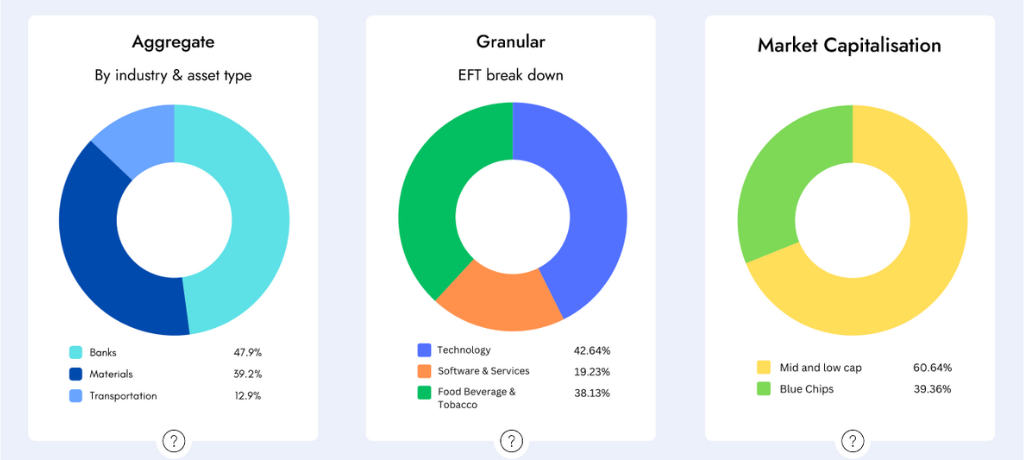

Moreover, without regular rebalancing, there’s a risk of becoming overexposed to specific sectors or asset classes. Overexposure can leave a portfolio vulnerable to sharp downturns in those particular areas. For instance, if tech stocks have had a significant run, they may make up a larger portion of a portfolio than initially intended. Rebalancing helps ensure proper diversification, reducing the impact of any potential downturn in any one sector or asset class.

Diversiview can be a valuable tool for assessing your portfolio’s diversification. It can analyse your holdings across various asset classes and identify any strong correlations between investments. This information can help you make informed rebalancing decisions to achieve a more diversified portfolio.

In essence, rebalancing is a tool for maintenance and proactive, strategic portfolio management.

Methods of Rebalancing

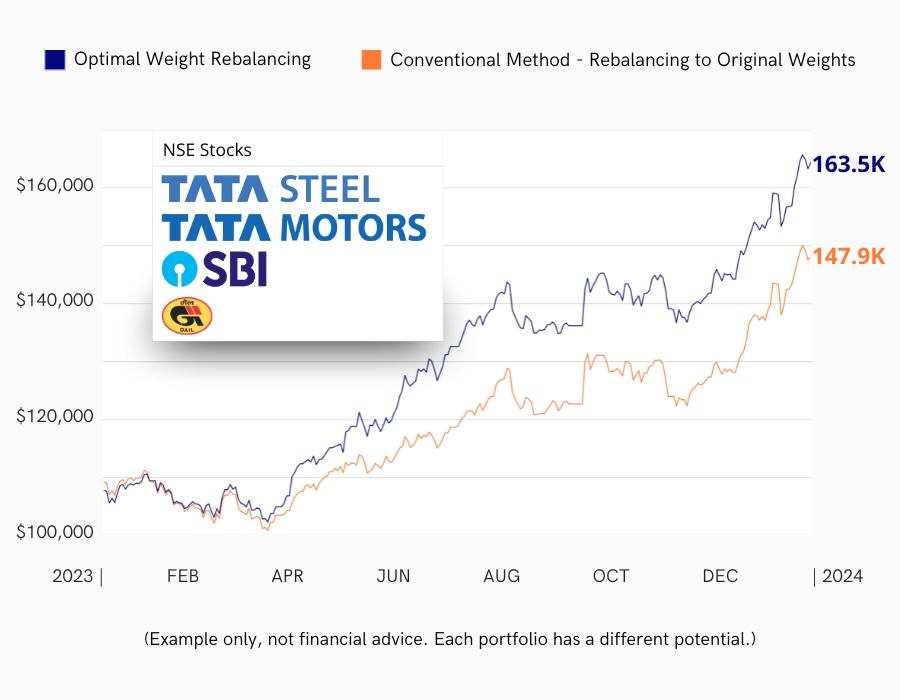

In portfolio management, there have traditionally been two dominant approaches to rebalancing: the conventional method and the more dynamic approach.

- The Conventional Method: Hinges on rebalancing to the original weights. For example, if a portfolio was initially set up with a 60% allocation to equities and a 40% allocation to bonds, the investor would periodically rebalance the portfolio to maintain these exact proportions, irrespective of market conditions or shifts in the investor’s financial goals or risk appetite.

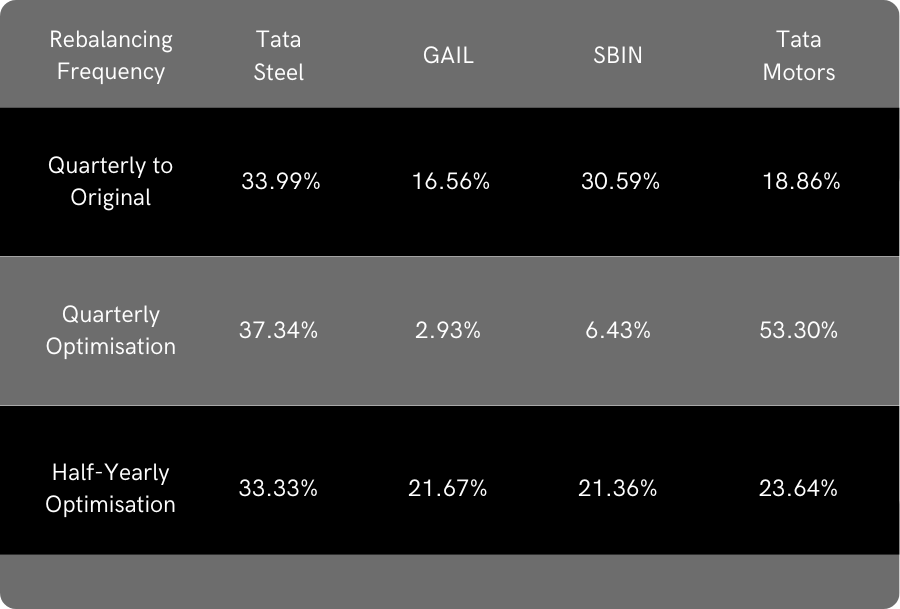

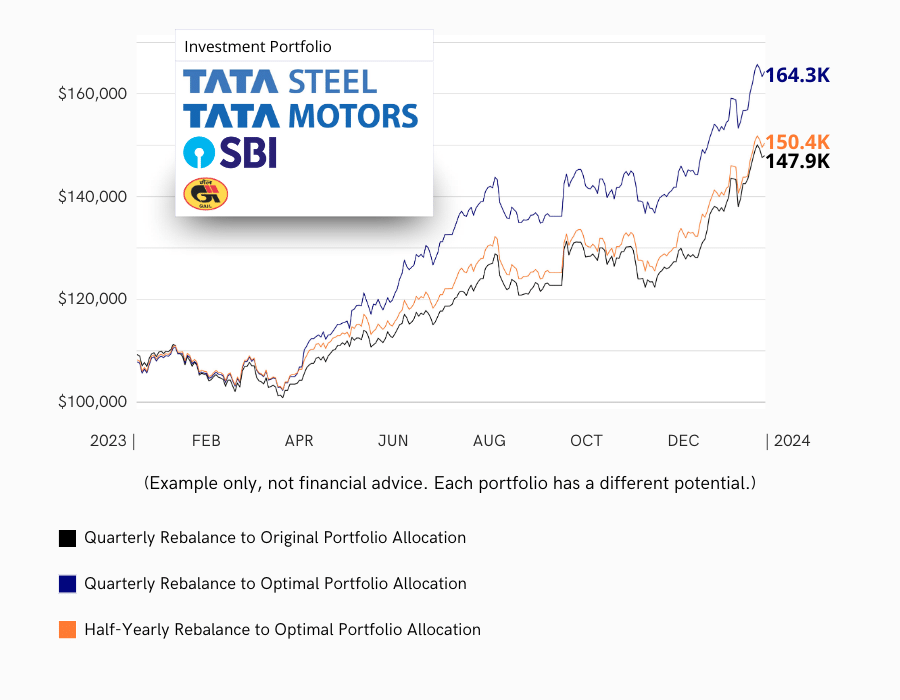

- Optimal Weight Rebalancing (explored in-depth here): Considers the ever-evolving nature of financial markets and the investor’s personal circumstances. Instead of mechanically returning to the original weights, this method assesses the current market environment, recognises new investment opportunities, and factors any changes to the investor’s financial situation or objectives.

Diversiview can assist with both traditional and optimal weight rebalancing strategies. For traditional rebalancing, Diversiview can help you compare your current asset allocation with that of the original weights, helping you identify the changes in performance. For optimal weight rebalancing, Diversiview can provide insights into potential opportunities based on current market conditions and strategy backtesting, helping you make informed decisions about adjusting your portfolio weights.

Sticking to the original weights can be seen as a somewhat rigid approach. Financial markets, economic conditions, and individual circumstances change; what was optimal a few years ago might not be so today. By sticking strictly to old weights, investors might miss out on new growth opportunities or inadvertently expose themselves to risks that were not previously present.

While traditional rebalancing offers simplicity and ease, the dynamic rebalancing to current optimal weights provides a more adaptive and potentially more profitable strategy. It encourages investors to stay attuned to market changes and proactively seek out the best opportunities for their portfolio.

Frequency of Rebalancing

There are a few methods to be aware of that are more commonly used:

- Calendar-Based Rebalancing: This is the most straightforward (and also the most basic) method, where an investor decides to rebalance their portfolio at regular intervals, whether quarterly, bi-annually, or annually. This systematic approach ensures discipline, but it might not always align with significant market shifts between the set intervals.

- Threshold-Based Rebalancing: In this method, investors adjust their portfolios when a particular asset class’s weight deviates from its target allocation by a predetermined percentage, say 5% or 10%. This strategy allows for flexibility and can be more responsive to market movements.

- Formula-Based Rebalancing: Here, investors apply specific formulas or algorithms to determine when and how much to rebalance. Such methods might consider volatility, momentum, or other market factors. They often require more sophisticated tools or software and can be ideal for those looking for a more hands-on, quantitative approach.

Rebalancing According to Personal Changes

Life is in a constant state of flux. Change is inevitable, from significant milestones like marriage, having children, or approaching retirement to subtle personal aspirations and goal shifts. Just as one would adapt to these life changes in various ways – perhaps by relocating to a bigger house or revising one’s retirement plans – so should investment portfolios evolve to remain aligned with these transitions.

Marriage might necessitate a joint financial strategy, considering both partners’ goals and risk tolerances. The arrival of children could mean prioritising future educational expenses, which might entail allocating more funds toward safer, long-term investment vehicles. As one nears retirement, the risk appetite often lowers, prompting a pivot towards more conservative assets to preserve wealth and ensure a steady income stream in the post-working years.

Moreover, an individual’s financial objectives aren’t static. A person may initially be driven by wealth accumulation but later find more value in wealth preservation or generating passive income. Thus, it’s essential to periodically assess and modify the investment strategy based on any altered risk appetite or evolving financial goals.

In essence, rebalancing is not just about market dynamics; it’s deeply personal. Ensuring that your portfolio resonates with your life’s journey can make the difference between merely investing and investing wisely.

Do all methods give you the same result?

Each rebalancing method comes with its advantages and challenges. The best approach often depends on an investor’s time availability, market knowledge, and risk appetite. It’s important to remember that information provided here, including on Diversiview, is intended to be educational and shouldn’t be construed as financial advice. Consulting with a qualified financial professional is recommended before making any investment decisions.

Costs and Tax Considerations

Rebalancing does come with its costs. Transaction fees can add up, especially if rebalancing frequently. Moreover, selling assets might trigger capital gains taxes, which can impact the net returns. Investors must be mindful of these implications and possibly seek tax-efficient ways to rebalance, such as in tax-advantaged accounts.

Conclusion

Portfolio rebalancing is more than a routine task; it’s an essential strategy for risk management and optimising returns. Rather than a static, once-done affair, it’s a dynamic process. Diversiview can be a valuable asset for several rebalancing methods. While it can’t replace the need for an investor’s or a financial professional’s judgment, it can provide the data and insights needed to make informed rebalancing decisions, regardless of the chosen method.

Ready to achieve the optimal portfolio balance with Diversiview? Create a free account and analyse your first portfolio for free!

About the author:

Matthew Levy, CFA, is a dedicated finance professional with a proven track record of creating successful, risk-adjusted portfolios that empower clients to achieve financial freedom. As a University of Victoria graduate with a Bachelor of Science in Economics, Matthew has built a strong foundation of knowledge and expertise in the financial sector.

He has a wealth of experience managing and co-managing over $600 million in assets for private households and institutions, demonstrating his commitment to client satisfaction and financial growth. In 2015, Matthew earned his CFA® charter, solidifying his dedication to maintaining the highest standards of education, ethics, and professional excellence in the investment profession.

Currently, Matthew shares his insights and knowledge through his work as a financial writer, contributing valuable financial commentary and articles that help others navigate the complex world of finance.